Konica Minolta Digital StoreFront User Manual

Page 368

Digital StoreFront 5.2 Administration Reference

368

3.

Enable VAT based integration: Check this box to have Digital StoreFront identify whether a tax

request is “normal” or “VAT.” This enables support for external systems, which typically support

different transactions for tax calculations based on VAT.

4.

Use External Plugin: Click this button if you are integrating your site with CCH and have established

a merchant account as described in the section above.

•

Use CCH Plugin:

•

Click the Click Here link: On the CCH Account Details page:

o

Type your CCH merchant account serial number in the text entry box to establish a

connection with CCH.

o

To test the connection to the account, click Test.

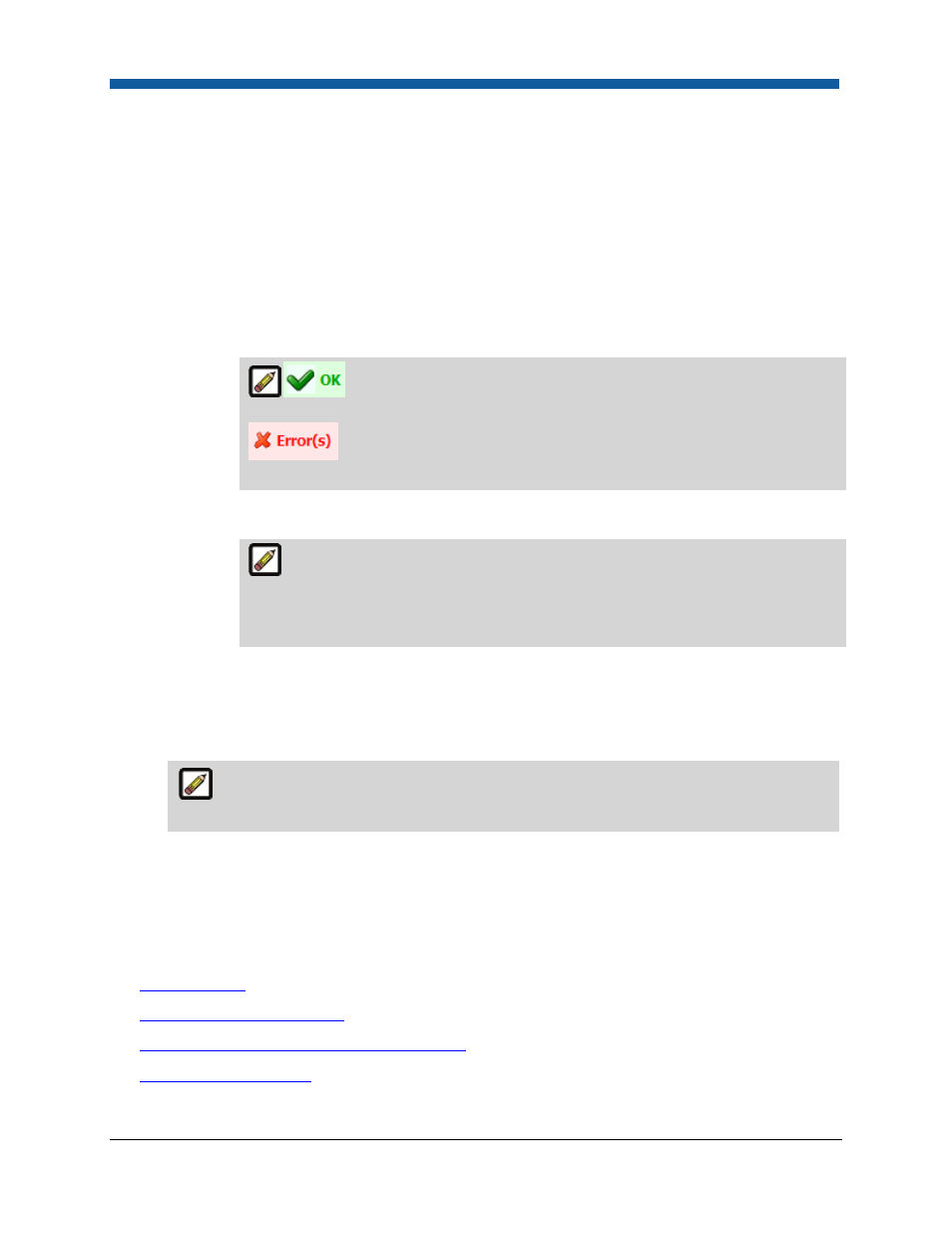

indicates that the connection is OK.

indicates a problem with the connection. Ensure that you have entered

your CCH serial number in the correct format.

o

Click Save.

Digital StoreFront does not maintain transaction data on taxation. To see the

tax information for Digital StoreFront transactions, log on to your CCH Merchant

Account to view your transaction data in the Transaction List (select status Final to

view all completed transactions).

5.

Use External Web Service: Click this button if you are integrating your site with Vertex and have

established a merchant account as described in the section above.

•

External Integration URL (Web Service): Type the URL for the web service that will be invoked

by Digital StoreFront to calculate tax for an order.

The externally-hosted web service should conform to the input/output XML schema as

defined by Digital StoreFront.

•

External System User Name: Type the user name to pass to the external tax system for

authentication. This is an optional field.

•

External System Password: Type the password to pass to the external tax system for

authentication. This is an optional field.

See Also

●

Tax Authorities

●

To create a new tax authority

●

To modify properties of existing tax authorities

●

To delete a tax authority