Konica Minolta Digital StoreFront User Manual

Page 364

Digital StoreFront 5.2 Administration Reference

364

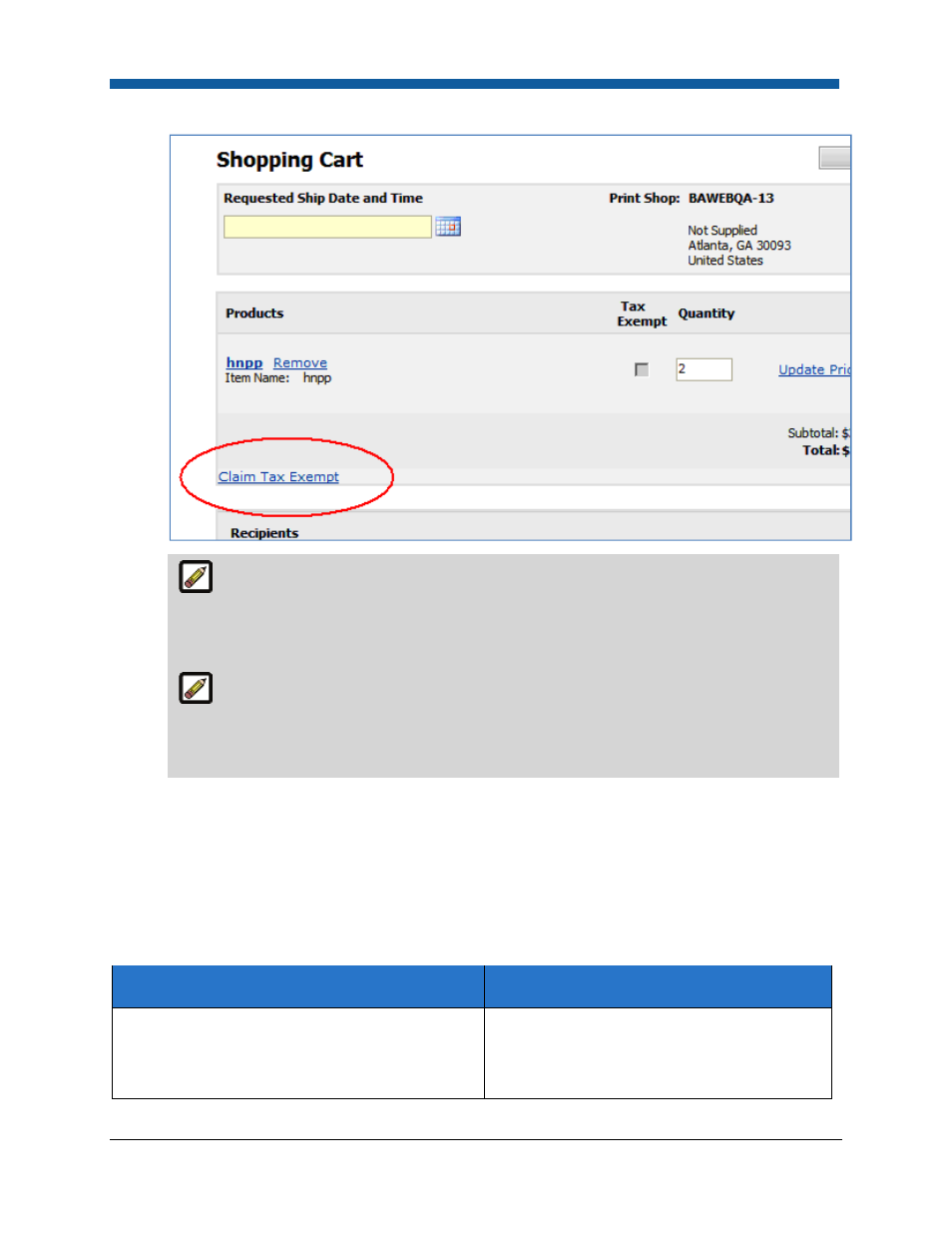

default this setting is unchecked.

During order checkout, the anonymous user will be required to login. Once logged in,

the tax exemption status of the anonymous user (based on whether s/he clicked and

provided details in the Claim Tax Exempt link) will be transferred to the logged in user. The

logged in user then gets the same tax exemption status for all orders placed.

When anonymous user claims tax exempt and the order becomes tax free, the operator

can override this in the Quote Editor by changing the tax exempt status of the order. The

Order Summary Page lets operators view an anonymous user’s tax exemption claim and view

the uploaded certificate (PDF).

•

Show item level tax in Shopping Cart: Check to show buyers taxes for each item in an order (in

an “Item Tax” column) rather than only for the total order. This setting applies both to Digital

StoreFront's internal taxation system and to external tax integrations.

External Tax System Integration

Digital StoreFront enables integration with an external system for calculating taxes on orders. The

external system will calculate the tax based on the details of the order, such as order gross amount,

products, and the local tax governing authorities for the shipping origin and destination.

What is external tax system integration for?

When should you use it?

Using a third-party taxation engine rather than

Digital StoreFront’s built-in tax engine.

To connect to a third-party tax engine that

might better suit your organization’s taxation

needs (e.g., for accounting and reporting

purposes).