Konica Minolta Digital StoreFront User Manual

Page 351

Pricing

351

•

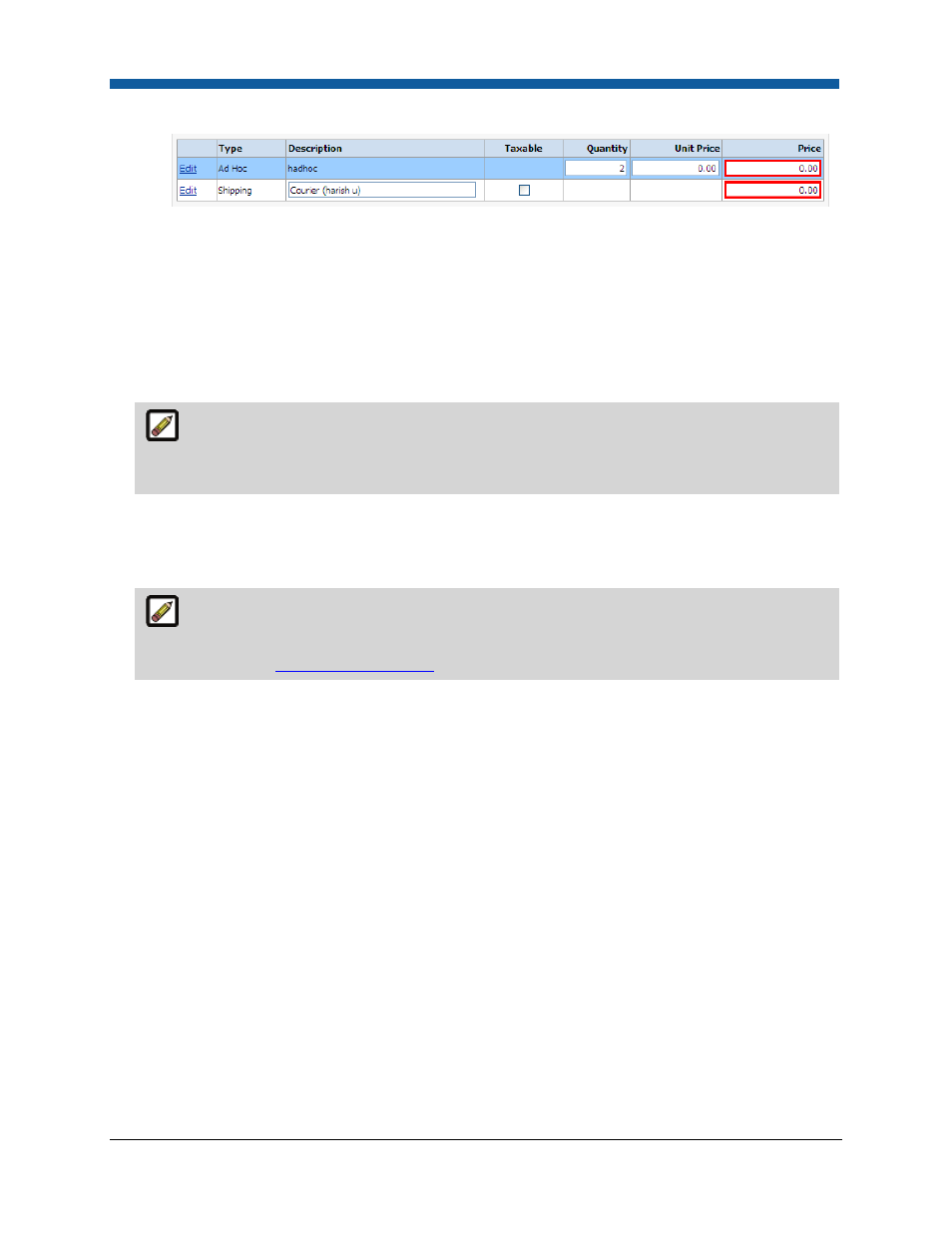

Items that require a manual quote are outlined with red boxes.

3.

To edit an item, click Edit for the line item then make changes as needed to the quantity, unit price,

and price. (If you supply a new unit price, the adjustments appear in the Item Details section as

“Adjustment to price per unit of...”.)

4.

Click Add Order Adjustment.

5.

On the row created for the new “Adjustment,” type a Description of the order adjustment, such as

“Custom binding.”

6.

Type the price in the Price column.

If the type is Adjustment, you can enter a positive or negative amount. All other types are

preset to determine whether the price adjusts upward or downward. (For example, a discount will

display as a negative amount, a fee as a positive one.)

7.

Check the Taxable box to specify that the adjustment is taxable (if the order is otherwise tax

exempt).

8.

To edit the tax applied to all taxable items, select a tax authority group from the Tax pull-down list.

The Tax Authority Group pull-down list will not be available when external tax integration is

selected for the site. For more information on external tax integration, see “External Tax System

Integration” in the

Taxation Configuration

section.

9.

Click Refresh.

10.

Click Save Changes.

To adjust pricing for an item detail in the Quote Editor

You can adjust the pricing for an item in the order in the Item Details section.

1.

Scroll down to view the Item Details and edit any of these fields:

•

Description

•

Unit—select the billing unit from the pull-down list.

•

Taxable status

•

Units Per Item—how many of the units are included in the item; a 30-sheet job three-hole

punched would contain 30 units of drilling.

•

Units Charged

•

Price Per Unit

•

Component Price—if not edited, Digital StoreFront will calculate component price as Units

Charged x Price Per Unit. However, you can adjust the component price here.

•

To adjust component price, enter a price directly in the Component Price column.

•

Click the checkbox to change the tax status; when checked, the item is taxable.

2.

To add a new charge or discount for the item, click Add Adjustment.