Taxation, Tax authorities – Konica Minolta Digital StoreFront User Manual

Page 359

359

Taxation

Tax Authorities

A tax authority represents a single tax (local, city, county, or state) that the Print Shop must collect.

You can designate companies and departments within companies as tax exempt. For more

information, see

To add a company

and

To create a department

.

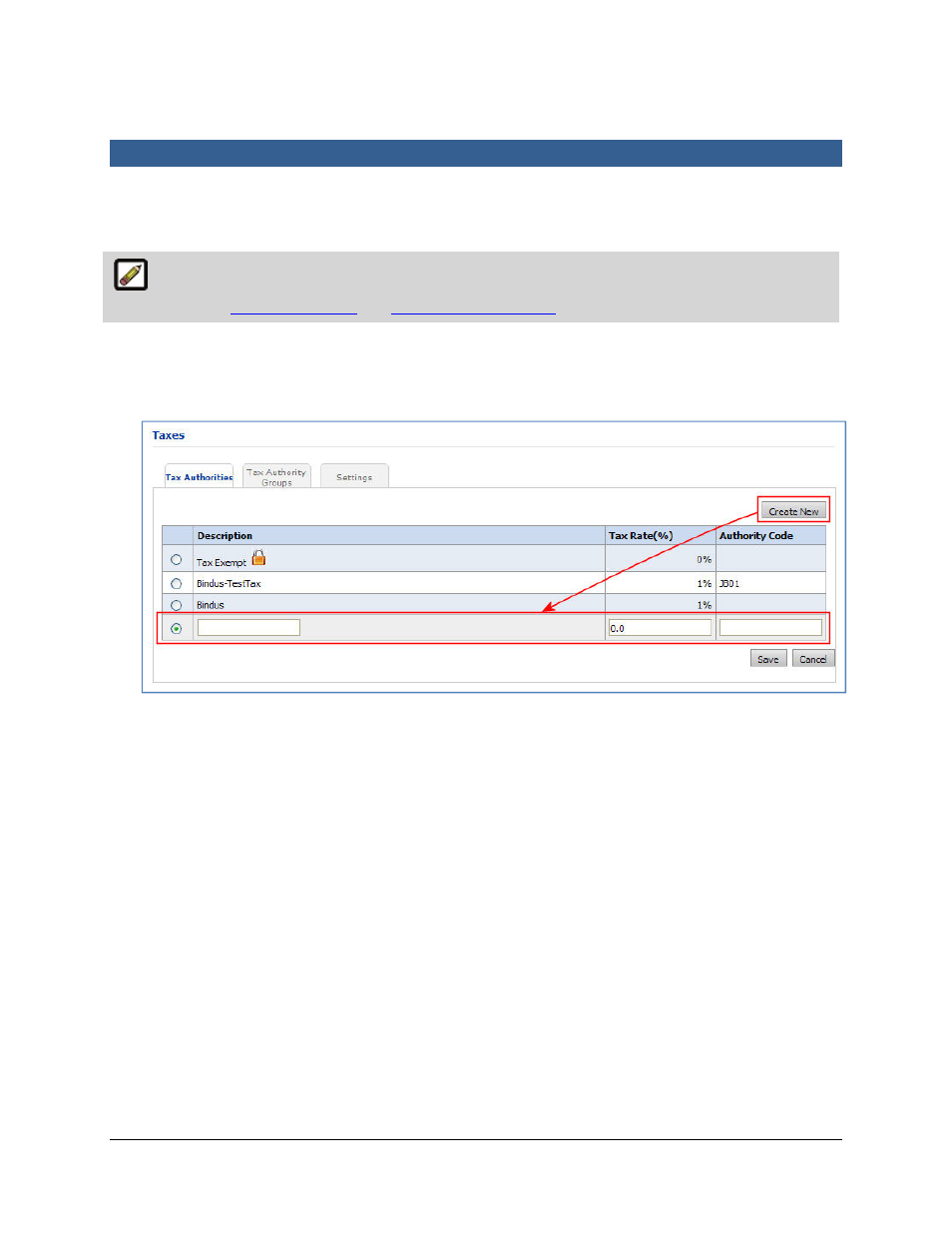

To create a new tax authority

1.

Go to Administration > Taxes.

2.

On the Tax Authorities tab, click the Create New button.

3.

On the new row for the tax authority, enter the following information for the new tax authority:

•

Description—a name that identifies this tax for reporting. This is not displayed to web site

users.

•

Tax Rate—the rate, as a percentage. Each item in the order is taxed at this rate.

•

Authority Code—Any identification number or code that facilitates the configuration or

reporting.

4.

Click OK to create the tax authority. It would appear in the form’s list view.

Tax Exempt Status

The system ships with a “Tax Exempt” tax authority that is assigned a zero tax rate. If your site requires

tracking additional taxes with either zero tax rates or tax-exempt status, you can define your own

authorities (with different names or internal codes) as needed.

To modify properties of existing tax authorities

1.

In the tax authority list view: Go to Administration > Taxes.

2.

On the Tax Authorities tab, select an existing tax authority (by clicking its radio button).

3.

Click Edit.