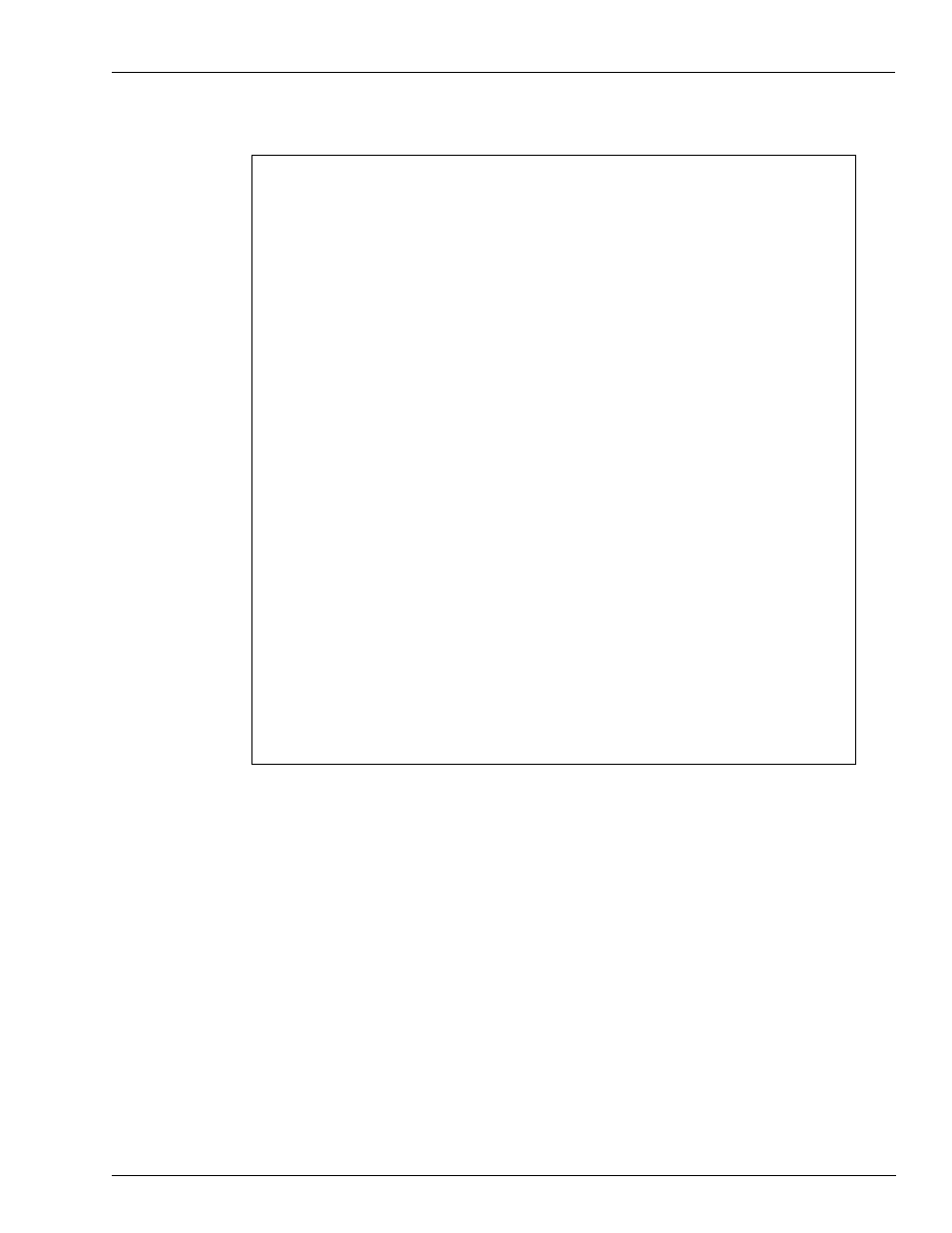

Figure 10-1: sample tax table – Gasboy CFN III Manager Manual V3.6 User Manual

Page 93

MDE-4871 CFN III Manager’s Manual for Windows® XP Embedded - Version 3.6 · August 2010

Page 10-5

How to Set Up a Tax Table

Setting Up Tax Tables

Figure 10-1: Sample Tax Table

Amt

Tax

Amt

Tax

From

To

Tax

diff

diff

From

To

Tax

Diff

Diff

0.00

0.09

0.00

-

-

8.10

8.27

0.45

0.19

0.01

0.10

0.27

0.01

-

-

8.28

8.45

0.46

0.18

0.01

0.28

0.45

0.02

0.18

0.01

8.46

8.63

0.47

0.18

0.01

0.46

0.63

0.03

0.18

0.01

8.64

8.81

0.48

0.18

0.01

0.64

0.81

0.04

0.18

0.01

8.82

8.99

0.49

0.18

0.01

0.82

0.99

0.05

0.18

0.01

9.00

9.18

0.50

0.18

0.01

1.00

1.18

0.06

0.18

0.01

9.19

9.36

0.51

0.19

0.01

1.19

1.36

0.07

0.19

0.01

9.37

9.54

0.52

0.18

0.01

1.37

1.54

0.08

0.18

0.01

9.55

9.72

0.53

0.18

0.01

1.55

1.72

0.09

0.18

0.01

9.73

9.90

0.54

0.18

0.01

1.73

1.90

0.10

0.18

0.01

9.91

10.09

0.55

0.18

0.01

1.91

2.09

0.11

0.18

0.01

10.10

10.27

0.56

0.19

0.01

2.10

2.27

0.12

0.19

0.01

10.28

10.45

0.57

0.18

0.01

2.28

2.45

0.13

0.18

0.01

10.46

10.63

0.58

0.18

0.01

2.46

2.63

0.14

0.18

0.01

10.64

10.81

0.59

0.18

0.01

2.64

2.81

0.15

0.18

0.01

10.82

10.99

0.60 0.18

0.01

2.82

2.99

0.16

0.18

0.01

11.00

11.18

0.61

0.18

0.01

3.00

3.18

0.17

0.18

0.01

11.19

11.36

0.62

0.19

0.01

3.19

3.36

0.18

0.19

0.01

11.37

11.54

0.63

0.18

0.01

3.37

3.54

0.19

0.18

0.01

11.55

11.72

0.64

0.18

0.01

3.55

3.72

0.20

0.18

0.01

11.73

11.90

0.65

0.18

0.01

3.73

3.90

0.21

0.18

0.01

11.91

12.09

0.66

0.18

0.01

3.91

4.09

0.22

0.18

0.01

12.10

12.27

0.67

0.19

0.01

4.10

4.27

0.23

0.19

0.01

12.28

12.45

0.68

0.18

0.01

4.28

4.45

0.24

0.18

0.01

12.46

12.63

0.69

0.18

0.01

4.46

4.63

0.25

0.18

0.01

12.64

12.81

0.71

0.18

0.01

4.64

4.81

0.27

0.18

0.01

12.82

12.99

0.72

0.18

0.01

4.82

4.99

0.27

0.18

0.01

13.00

13.18

0.72

0.18

0.01

5.00

5.18

0.28

0.18

0.01

13.19

13.36

0.73

0.19

0.01

5.19

5.36

0.29

0.19

0.01

13.37

13.54

0.74

0.18

0.01

5.37

5.54

0.30

0.18

0.01

13.55

13.72

0.75

0.18

0.01

5.55

5.72

0.31

0.18

0.01

13.73

13.90

0.76

0.18

0.01

5.73

5.90

0.32

0.18

0.01

13.91

14.09

0.77

0.18

0.01

5.91

6.09

0.33

0.18

0.01

14.10

14.27

0.78

0.19

0.01

6.10

6.27

0.34

0.19

0.01

14.28

14.45

0.79

0.18

0.01

6.28

6.45

0.35

0.18

0.01

14.46

14.63

0.80

0.18

0.01

6.46

6.63

0.36

0.18

0.01

14.64

14.81

0.81

0.18

0.01

6.64

6.81

0.37

0.18

0.01

14.82

14.99

0.82

0.18

0.01

6.82

6.99

0.38

0.18

0.01

15.00

15.18

0.83

0.18

0.01

7.00

7.18

0.39

0.18

0.01

15.19

15.36

0.84

0.19

0.01

7.19

7.36

0.40

0.19

0.01

15.37

15.54

0.85

0.18

0.01

7.37

7.54

0.41

0.18

0.01

15.55

15.72

0.86

0.18

0.01

7.55

7.72

0.42

0.18

0.01

15.73

15.90

0.87

0.18

0.01

7.73

7.90

0.43

0.18

0.01

15.91

16.09

0.88

0.18

0.01

7.91

8.09

0.44

0.18

0.01

16.10

16.27

0.89

0.19

0.01

4

Complete your worksheet, indicating the amount differences and the tax differences for each

range of taxable amounts.

5

Examine the Amt Diff column on the sample worksheet. Note that there is a regular pattern.

Five $0.18 taxable amount increments are followed by one $0.19 increment, then there are

four $0.18 increments, and one $0.19 increment. This pattern repeats-or loops-itself eight

times. Now examine the Amt Diff column of your worksheet. Try to find a repeating pattern in

the tax amount increments.

6

Find a repeating pattern to the increments in the Tax Diff column (it may be that they are

always the same, as in the sample).

7

Then find a single repeating pattern that accounts for the increments in both Diff columns. If

the increments in the Tax Diff column are not all the same, this may be more difficult, and the

pattern will almost certainly repeat itself less often. You will use the repeating patterns you

find to build the tax table through the TAX program.