Kofax Getting Started with Ascent Xtrata Pro User Manual

Page 399

Chapter 6

380

Ascent Xtrata Pro User's Guide

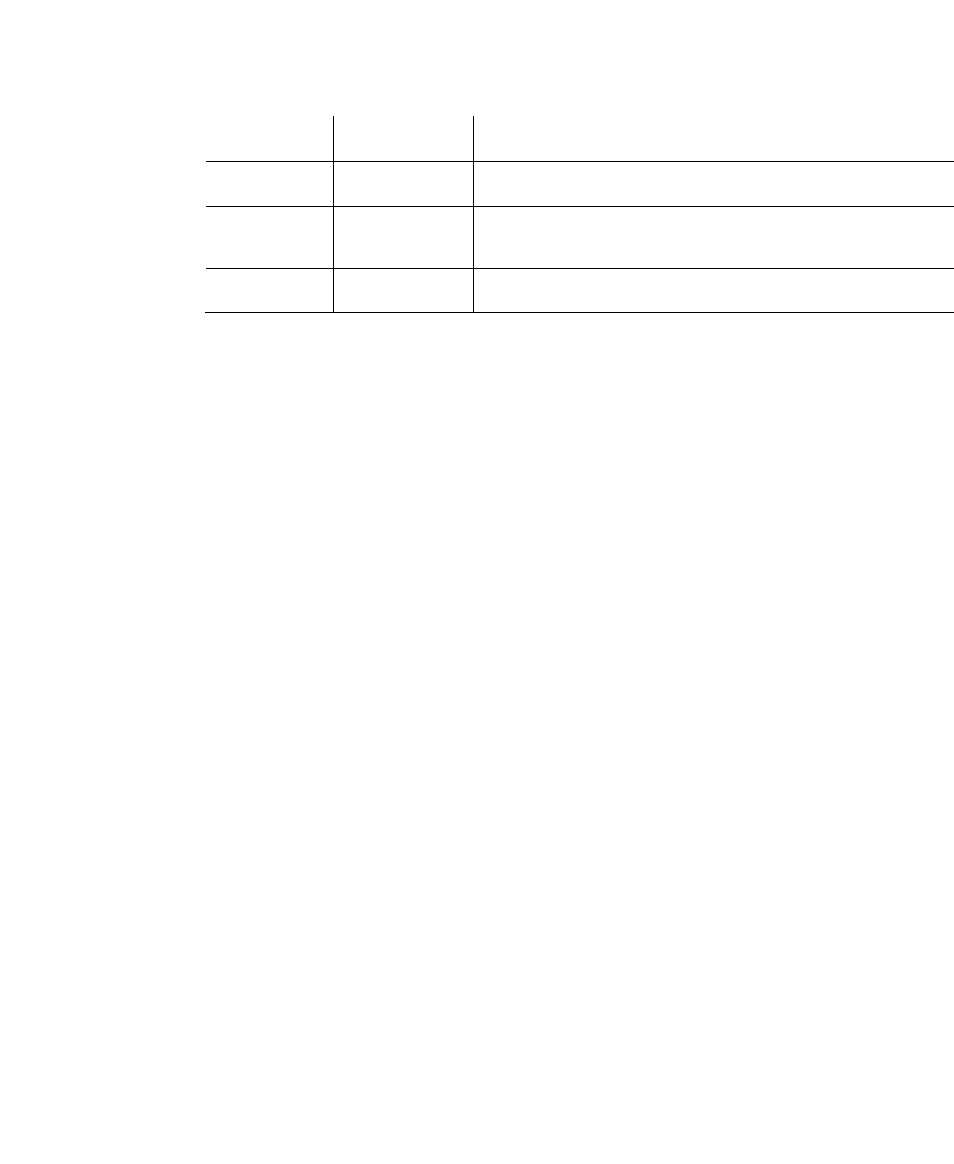

NetAmount3 + NetAmount4 – Postage - Packaging +

Discount

NetAmount0 No

= Total (if no tax amount are present)

NetAmount1 No

= Subtotal + Postage + Packaging - Discount

(Tax block 2-4 are not present)

TaxRate 1-4

Yes

= TaxAmount / NetAmount

• Fill empty fields with 0.00 - Select this option to assign 0.00 to empty fields.

• Consider Total-only invoices as valid – Select this option to allow an invoice

to be valid if it contains only the total amount.

Discount Rates

Enter a discount rate and click Add to insert the value to the list of already

defined discount rates.

You may select “Allow tax calculation on reduced net amounts” since the tax

amount may be calculated using a net amount that has been discounted due to

early payment, for example for Belgium and the UK.

The normal invoice validation for VAT invoices does not apply in such cases.

Therefore if this option is selected, the tax amount is calculated as:

(NetAmount1 – Discount) * TaxRate1 = TaxAmount1, where (NetAmount1 –

Discount) * TaxRate1 = TaxAmount1

The reduced net amount is usually not present on the document, just the

discount or the discount rate. The early payment discount is not the same as the

discount field inside the Invoice Fields list. See Tax Validation for a short

description of the tax validation calculation.

If the option is checked, the user has to enter the set of possible discount rates.

Rounding Mode

In some cases it is necessary to apply a special rounding algorithm to all

mathematical operations. For examples in Switzerland all amounts can be

rounded to the nearest amount which is a multiple of 0.05. In Sweden amounts

will be rounded to multiples of 0.50.

Select a rounding value from the list and define the maximum allowed rounding

error by placing a value in the corresponding field. By default the rounding error

is set to 0.02.