12 - offroad, How to set up the parameters, 12 – offroad – Gasboy CFN III Config Mnl V3.4 User Manual

Page 93

MDE-4316C CFN Series CFN III Configuration Manual for Windows NT® · April 2007

Page 87

Offroad

12 – Offroad

OFFROAD.BIN is a disk-based configuration program that calculates an offroad tax discount

for a payable fuel sale (sale must be postpay and payable) and adds a refund item to the sale in

the amount of the discount. Information for OFFROAD.BIN comes from the data or config

file OFFROAD.DTA. You will need to edit the file OFFROAD.DTA to set up the tax

parameters.

How to Set Up the Parameters

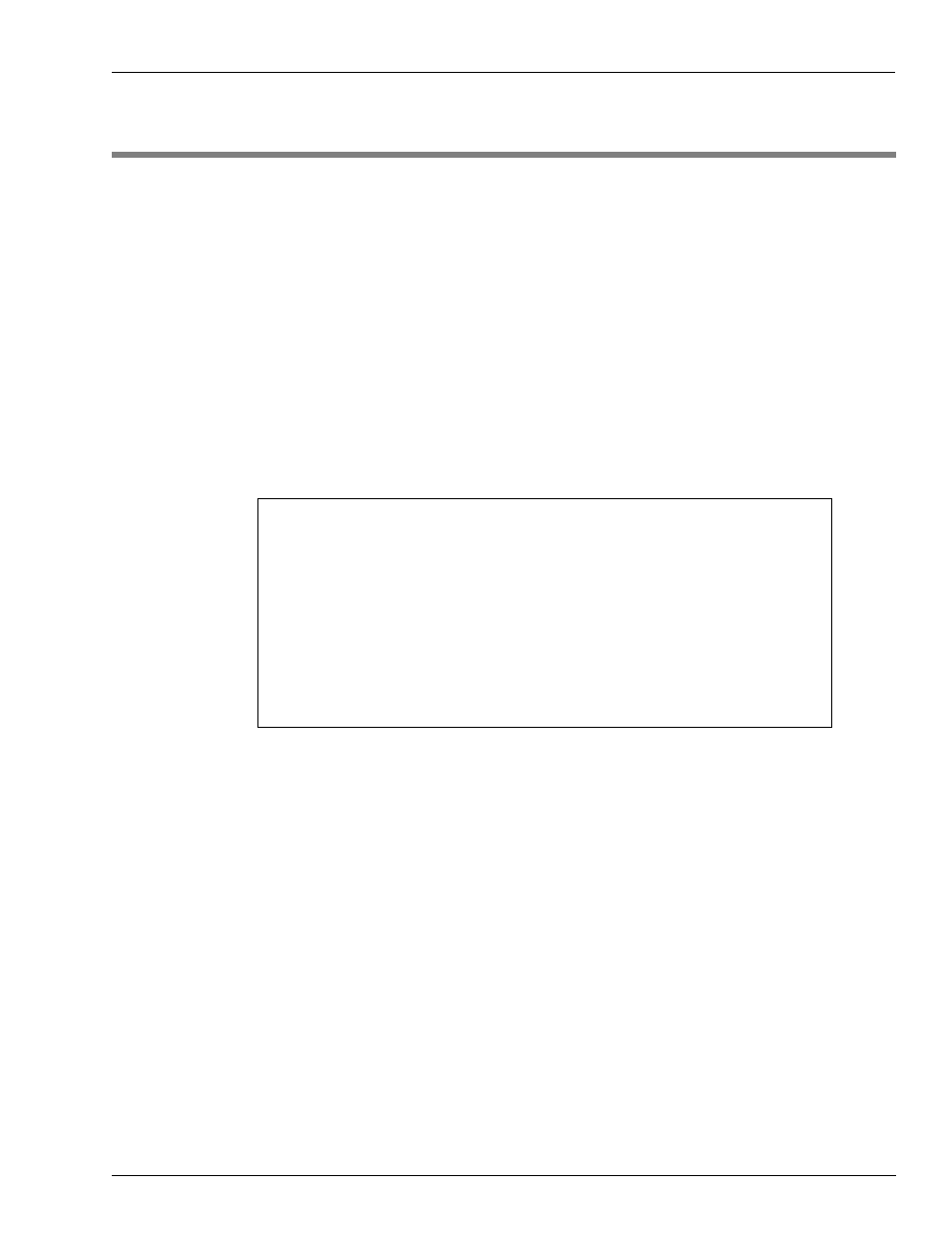

is a sample OFFROAD.DTA file.

Figure 12-1: Sample OFFROAD.DTA File

16 Offroad discount product or #,# for separate state & federal

17. Offroad sales tax product

22.0 Cents/gallon State road tax

20.1 Cents/gallon Federal road tax

8.2 State sales tax rate

Y Y = Allow operator to choose if sales tax applied

N Y = Always, Q = Ask: Add federal road tax to final total

N Y = Always, Q = Ask: Add state tax (if no sales tax) to total

Joe's Filler Up

Mail: P. O. Box 43345

Seattle, WA 98124-1991

>23404 54th St, Fife WA<

(206) 555-1212

Off Road Fuel Receipt

1

Open OFFROAD.DTA in the directory C:\SC3\ (or enter the command FRED

OFFROAD.DTA in the SC3 command window).

2

Offroad discount product or #,# for separate state & federal: Enter the product number(s)

offroad discounts are assigned to.

3

Offroad sales tax product: Enter the product number the offroad sales tax is assigned to.

4

Cents/gallon State road tax: Enter the current amount, in cents, of the state road tax per

gallon.

5

Cents/gallon Federal road tax: Enter the current amount, in cents, of the federal road tax per

gallon.

6

State sales tax rate: Enter the percentage rate for the state sales tax. This can only be a

percentage and not a table look up tax.

This tax is independent of any tax loaded in the configuration or the TAX.BIN program and

will not add to any tax totals.