Casio FX-CG10 User Manual

Page 283

7-19

d1 .......... purchase date (month, date, year)

d2 .......... redemption date (month, date, year)

RDV

...... redemption price per $100 of face value

CPN

...... coupon rate

PRC

...... price per $100 of face value

YLD

...... annual yield

• The allowable calculation range is January 1, 1902 to December 31, 2097.

After configuring the parameters, use one of the function menus noted below to perform the

corresponding calculation.

• {PRC} … {Calculate the bond’s price (PRC), accrued interest (INT), and cost of bond (CST)}

• {YLD} … {Calculate the yield to maturity}

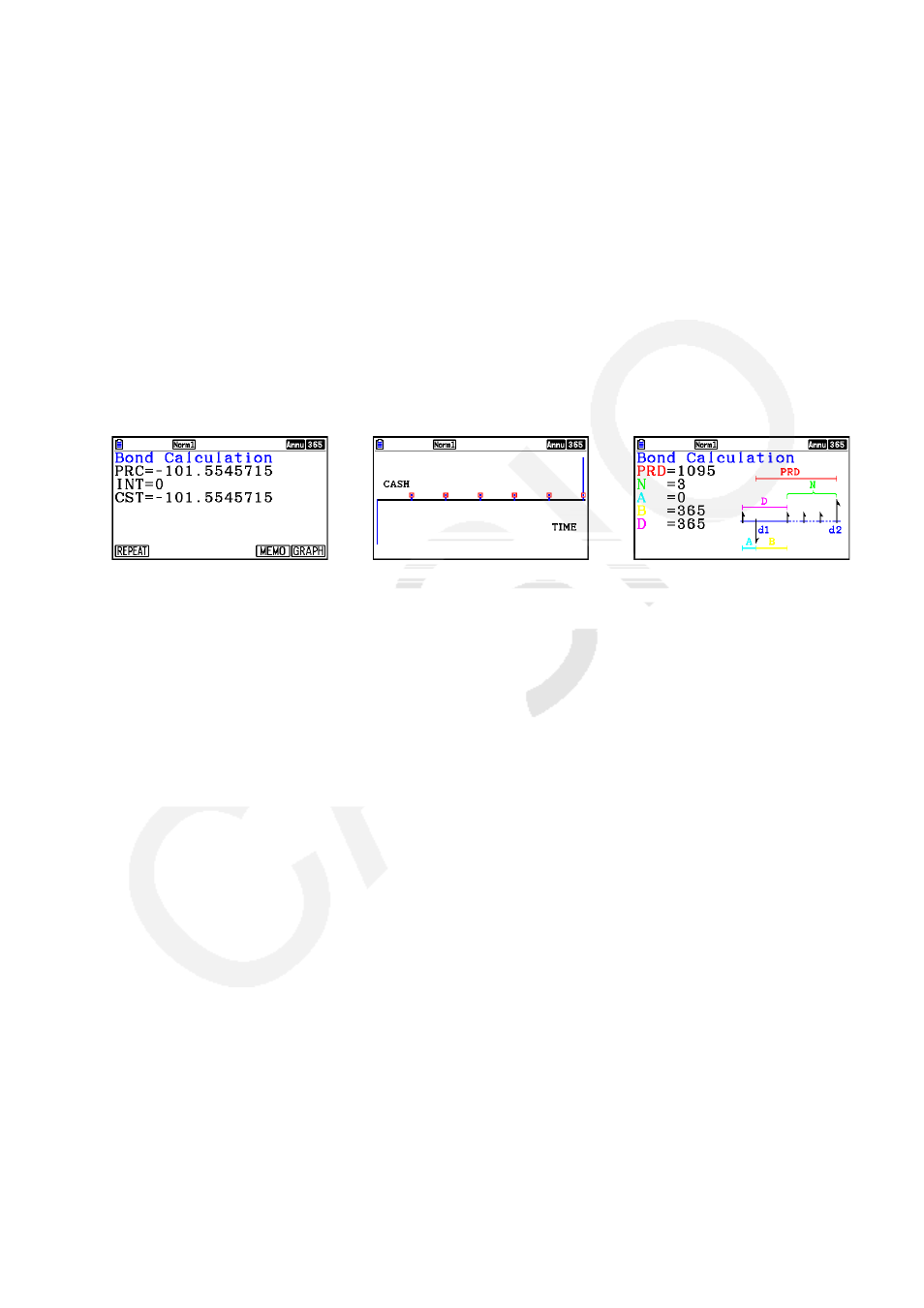

Calculation Result Output Examples

{PRC}

{PRC} − {GRAPH}

{PRC} − {MEMO}

An error occurs if parameters are not configured correctly.

Use the following function menu to maneuver between calculation result screens.

• { REPEAT } … {parameter input screen}

• { MEMO } … {displays numbers of days used in calculations}

• { GRAPH } … {draws graph}

MEMO Screen

• The following describes the meaning of the MEMO screen display items.

PRD

... number of days from d1 to d2

N

......... number of coupon payments between settlement date and maturity date

A

......... accrued days

B

......... number of days from settlement date until next coupon payment date (D−A)

D

........ number of days in coupon period where settlement occurs