Casio FX-CG10 User Manual

Page 269

7-5

u I %

i

(effective interest rate)

i

(effective interest rate) is calculated using Newton’s Method.

PV

+

α ×

PMT

+

β ×

FV

= 0

To

I

% from

i

(effective interest rate)

n

............ number of compound periods

FV

......... future value

I

% ......... annual interest rate

P/Y

........ installment periods per year

PV

......... present value

C/Y

........ compounding periods per year

PMT

...... payment

• A deposit is indicated by a plus sign (+), while a withdrawal is indicated by a minus sign (–).

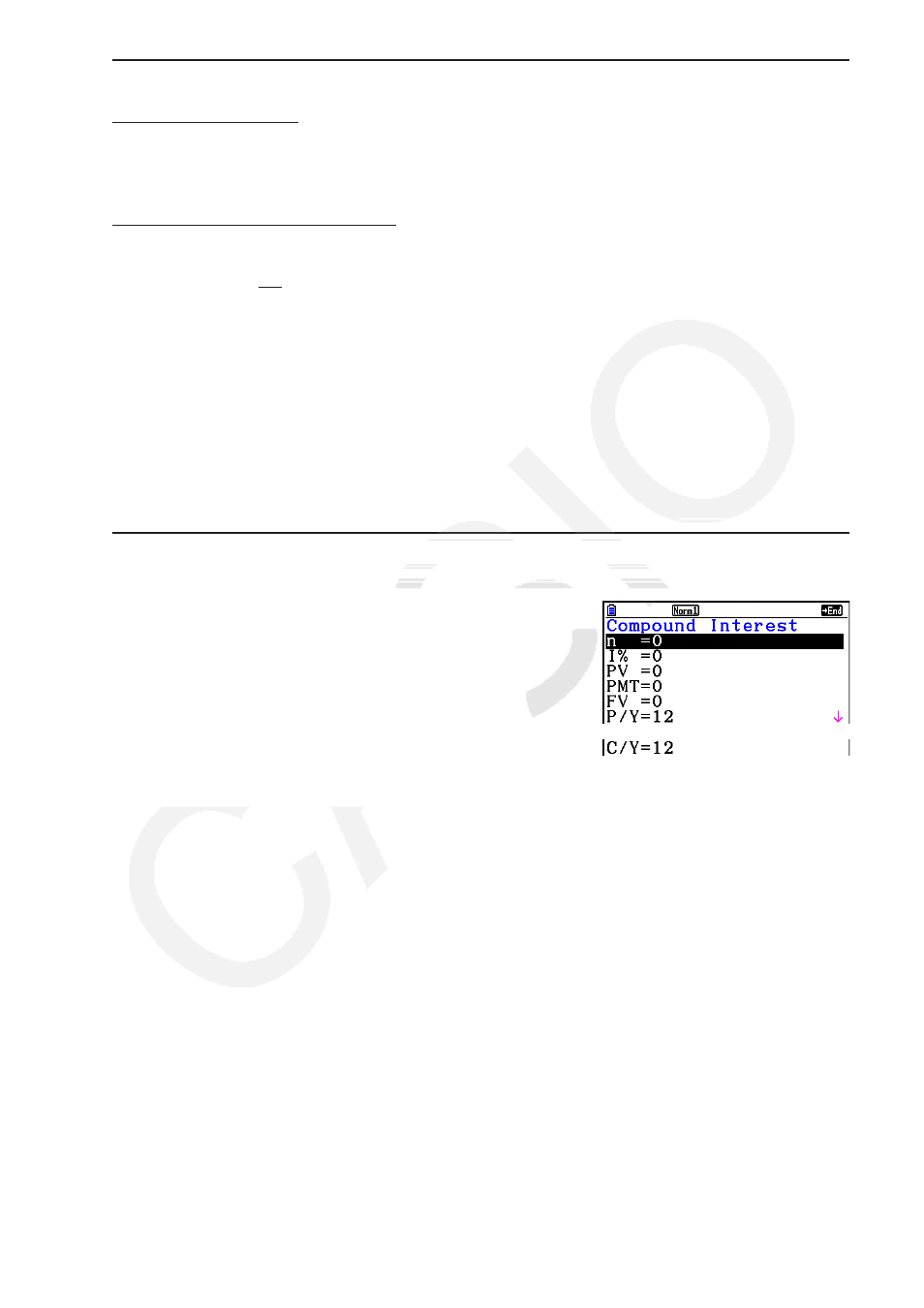

Press

2(COMPND) from the Financial 1 screen to display the following input screen for

compound interest.

2(COMPND)

n

........... number of compound periods

I

% ........ annual interest rate

PV

........ present value (loan amount in case of loan; principal in case of savings)

PMT

..... payment for each installment (payment in case of loan; deposit in case of savings)

FV

........ future value (unpaid balance in case of loan; principal plus interest in case of

savings)

P

/

Y

....... installment periods per year

C

/

Y

....... compounding periods per year

{ }

×

C

/Y

×

100...

I

% =

(1+ i )

–1

P

/Y

C

/Y

(Other than those above)

i

× 100 ................................. (P/Y = C/Y = 1)

{

{ }

×

C

/Y

×

100...

I

% =

(1+ i )

–1

P

/Y

C

/Y

(Other than those above)

i

× 100 ................................. (P/Y = C/Y = 1)

{