Casio ClassPad II fx-CP400 User Manual

Page 186

Chapter 11

: Financial Application 186

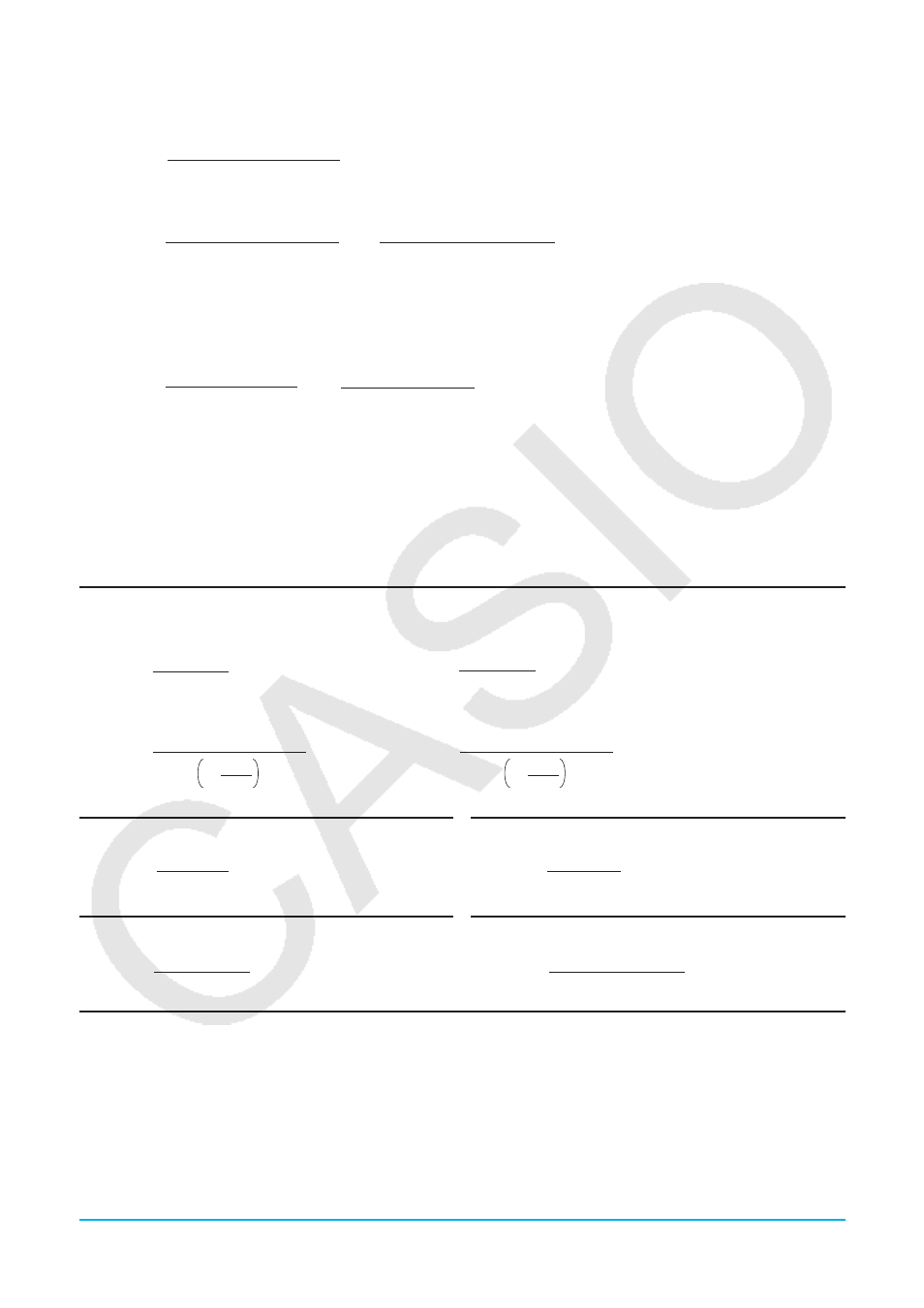

u

PRC

when “Date” is specified for “Bond Interval”

For one or fewer coupon period to redemption:

PRC

= −

+

RDV

+ CPN / M

1 + (B / D

× (YLD/100)/M)

A / D

× CPN/M

For more than one coupon period to redemption:

INT

= −A / D

× CPN/M

CST

= PRC

× INT

PRC

= −

–

RDV

Σ

N

k

=1

(1 + (YLD/100)/M)

(N–1+B/D )

(1 + (YLD / 100) / M)

(k–1+B/D )

+

CPN / M

(

)

A / D

× CPN/M

u

PRC

when “Term” is specified for “Bond Interval”

PRC

= −

INT

= 0

CST

= PRC

–

RDV

Σ

n

k

=1

n

k

CPN / M

(1 + (YLD/100)/M)

(1 + (YLD/100)/M)

(

)

u

YLD

The Financial application performs annual yield (

YLD

) calculations using Newton’s Method, which produces

approximate values whose precision can be affected by various calculation conditions. Because of this, annual

yield calculation results produced by this application should be used keeping the above in mind, or results

should be confirmed separately.

Break-Even Point

u Profit (Profit Amount/Ratio Setting: Amount (PRF))

PRC

–

VCU

FC

+

PRF

QBE

=

PRC

–

VCU

FC

+

PRF

SBE

=

×

PRC

u Profit Ratio (Profit Amount/Ratio Setting: Ratio (

r

%))

PRC

×

–

VCU

QBE

=

FC

100

r

%

1–

×

PRC

PRC

×

–

VCU

SBE

=

FC

100

r

%

1–

Margin of Safety

SAL

MOS

=

SAL

–

SBE

Financial Leverage

EBIT

–

ITR

DFL

=

EBIT

Operating Leverage

SAL

–

VC

–

FC

DOL

=

SAL

–

VC

Combined Leverage

SAL

–

VC

–

FC

–

ITR

DCL

=

SAL

–

VC

Quantity Conversion

SAL

=

PRC

×

QTY VC

=

VCU

×

QTY