2 performing financial calculations, 3 calculation formulas, Performing financial calculations – Casio ClassPad II fx-CP400 User Manual

Page 182: Calculation formulas, Simple interest

Chapter 11

: Financial Application 182

11-2

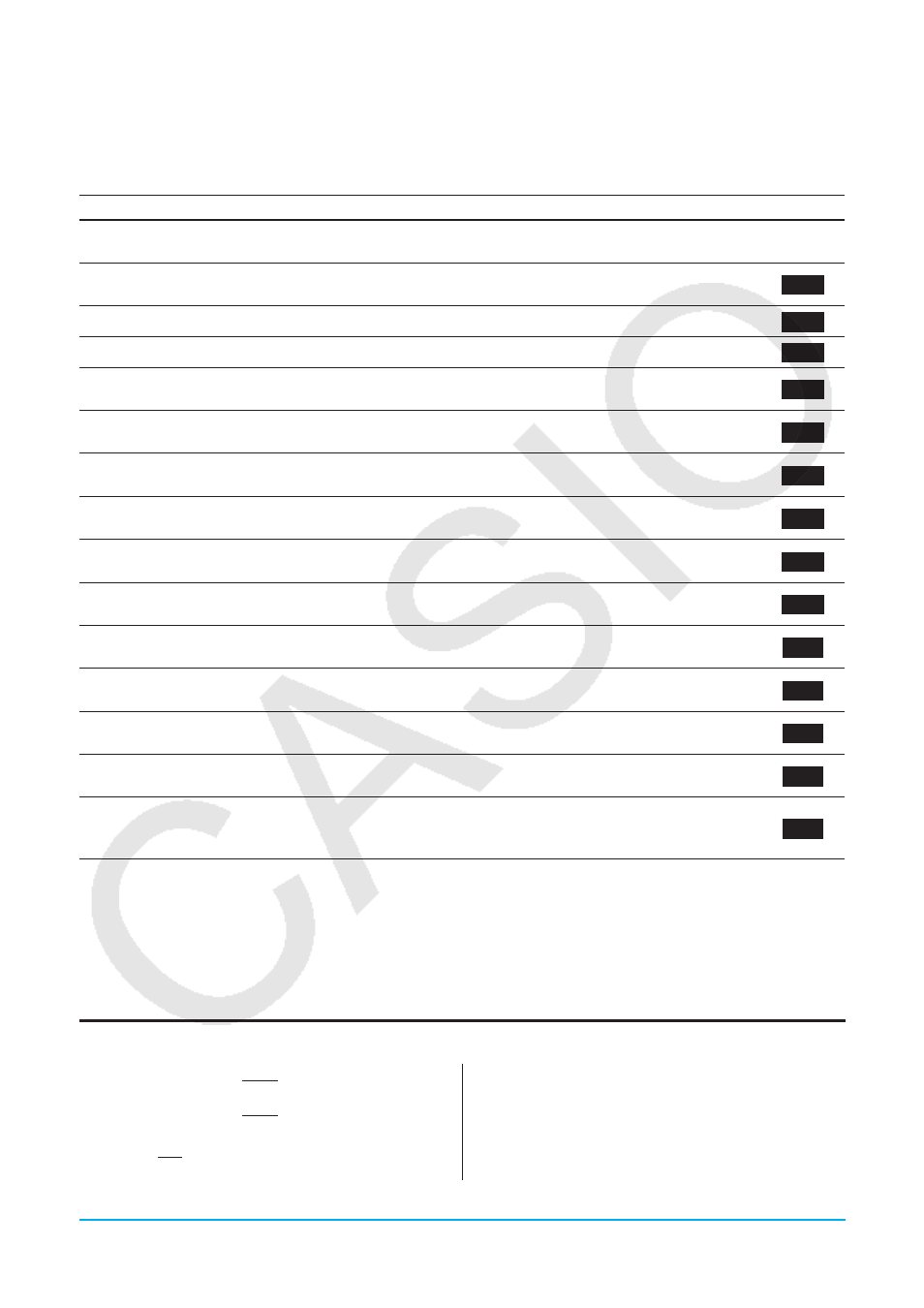

Performing Financial Calculations

The calculations in the table below can be performed with the Financial application. For actual calculation

examples, refer to the sections of this manual or the separate “Examples” booklet shown in the “Example”

column.

To perform this type of calculation:

Select this menu item:

Example

Interest without compounding based on the number of days money is

invested

Calc(1) - Simple

Interest

Page 179

Interest based on compounding parameters specified by you

Calc(1) - Compound

Interest

1101

Value of money paid out or received in varying amounts over time

Calc(1) - Cash Flow

1102

Interest and principal portions of a payment or payments

Calc(1) - Amortization

1103

Effective or nominal interest rate for interest compounded multiple

times during a year

Calc(1) - Interest

Conversion

1104

Cost, selling price, or margin of profit on an item given the other two

values

Calc(1) - Cost/Sell/

Margin

1105

Number of days between two dates, or the date that is a specified

number of days from another date

Calc(1) - Day Count

1106

Amount that a business expense can be offset by income

(depreciated) over a given year

Calc(1) - Depreciation

1107

Purchase price or annual yield of a bond

Calc(1) - Bond

Calculation

1108

Amount you must sell to break even or to obtain a specified profit, as

well as amount of profit or loss on particular sales

Calc(2) - Break-Even

Point

1109

How much sales can be reduced before incurring losses

Calc(2) - Margin of

Safety

1110

Degree of change in net earnings arising from a change in sales

amount

Calc(2) - Operating

Leverage

1111

Degree of change in net earning arising from a change in interest paid

Calc(2) - Financial

Leverage

1112

Combined effects of operating and financial leverages

Calc(2) - Combined

Leverage

1113

Number of items sold, selling price, or sales amount given other two

values; number of items manufactured, unit variable cost, or total

variable cost given other two values

Calc(2) - Quantity

Conversion

1114

11-3

Calculation Formulas

For information about terms used in formulas that are not explained in detail below, refer to “11-5 Input and

Output Field Names”.

Simple Interest

365-day Mode:

360-day Mode:

i

=

I

%

100

SI' =

Days

365 ×

PV

× i

SI' =

Days

360 ×

PV

× i

SI

= –SI'

SFV

= –(PV + SI')