Compound interest cash flow – Casio ClassPad II fx-CP400 User Manual

Page 183

Chapter 11

: Financial Application 183

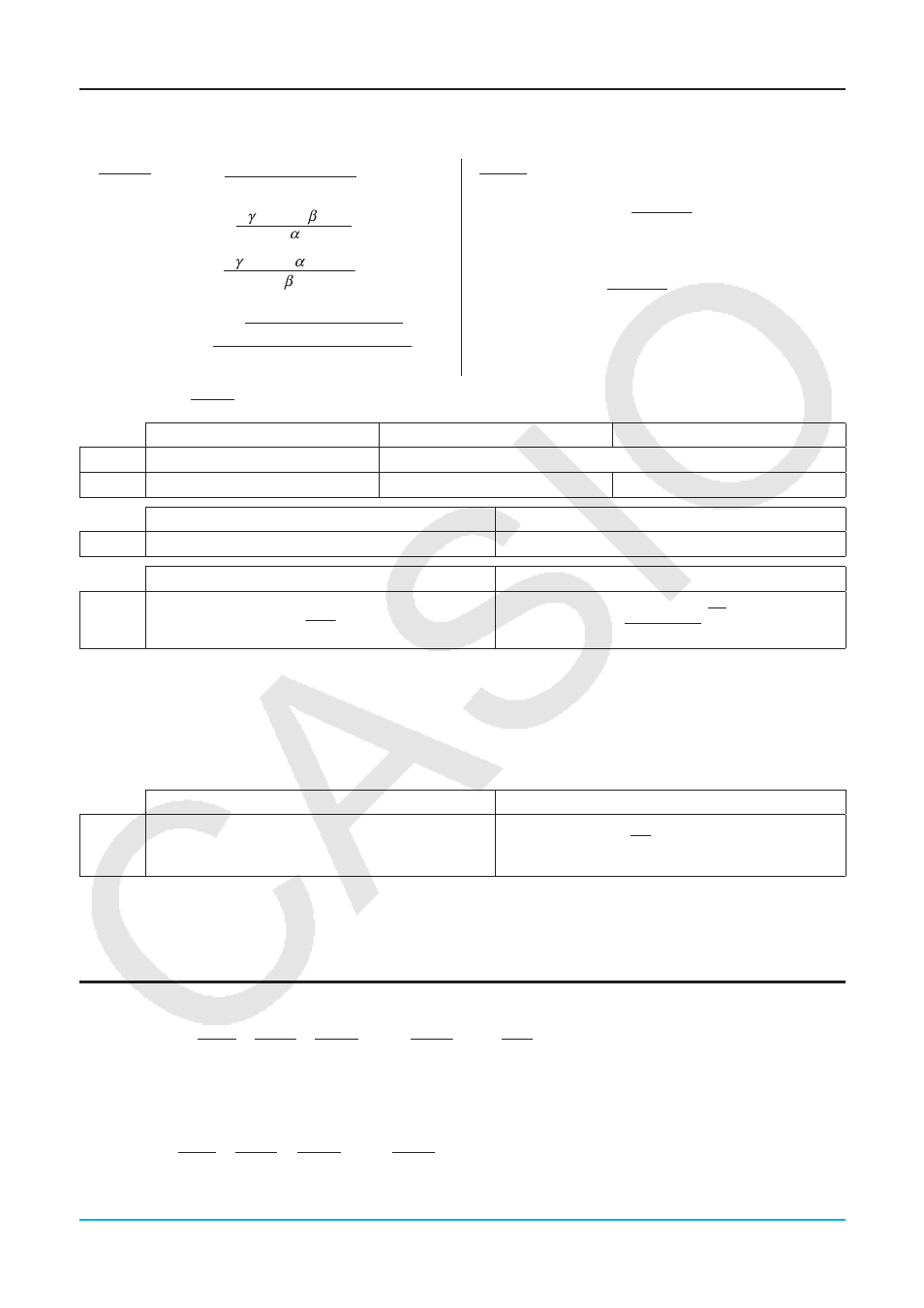

Compound Interest

u When calculating PV, PMT, FV,

n

I

%

0

PV

=

–

× PMT – × FV

β

γ

α

PMT

=

–

ϫPV – ϫFV

FV

=

–

ϫ PV – ϫ PMT

n

=

log

(1 +

iS ) × PMT – FV × i

(1 +

iS ) × PMT + PV × i

{

}

log (1 +

i)

I

%

=

0

PV

= – (PMT

×

n

+ FV )

PMT

= –

n

PV

+

FV

FV

= – (PMT

×

n

+ PV )

n

=

PMT

PV

+

FV

–

= (1 +

i × S) ×

i

1

– β

α

When “Odd Period” is “Off”

When “Odd Period” is “CI”

When “Odd Period” is “SI”

ơ

=

(1 +

i

)

–n

(1 +

i

)

–Intg (n)

Ƣ

=

1

(1 +

i

)

Frac (n)

1 +

i

×

Frac (n)

When “Payment Date” is “End”

When “Payment Date” is “Begin”

S

=

0

1

When

P/Y

=

C/Y

= 1

When

P/Y

1 and/or

C/Y

1

i

=

u When calculating

I

%

i

(effective interest rate) is calculated using Newton’s Method.

Ƣ

×

PV

+

Ơ

×

PMT

+

ơ

×

FV

= 0

I

% is calculated from

i

using the formulas below:

When

P/Y

=

C/Y

= 1

When

P/Y

1 and/or

C/Y

1

I

% =

Interest (

I

%) calculations are performed using Newton’s Method, which produces approximate values whose

precision can be affected by various calculation conditions. Interest calculation results produced by this

application should be used keeping the above in mind, or results should be confirmed separately.

Cash Flow

NPV

= CF

0

+ + + + … +

(1+ i)

CF

1

(1+ i)

2

CF

2

(1+ i)

3

CF

3

(1+ i)

n

CF

n

( L =

100

,

%

,

n

: natural number up to 80)

NFV = NPV

× (1 + i )

n

IRR

is calculated using Newton’s Method.

0 = CF

0

+ + + + … +

(1+ i)

CF

1

(1+ i)

2

CF

2

(1+ i)

3

CF

3

(1+ i)

n

CF

n

100

I

%

I

%

(1 +

)

– 1

C/Y

P/Y

100

× [C/Y ]

i

× 100

( )

×

C

/Y

×

100

(1 + i )

–1

P

/Y

C

/Y