Apple iWork '09 User Manual

Page 351

Chapter 13

Additional Examples and Topics

351

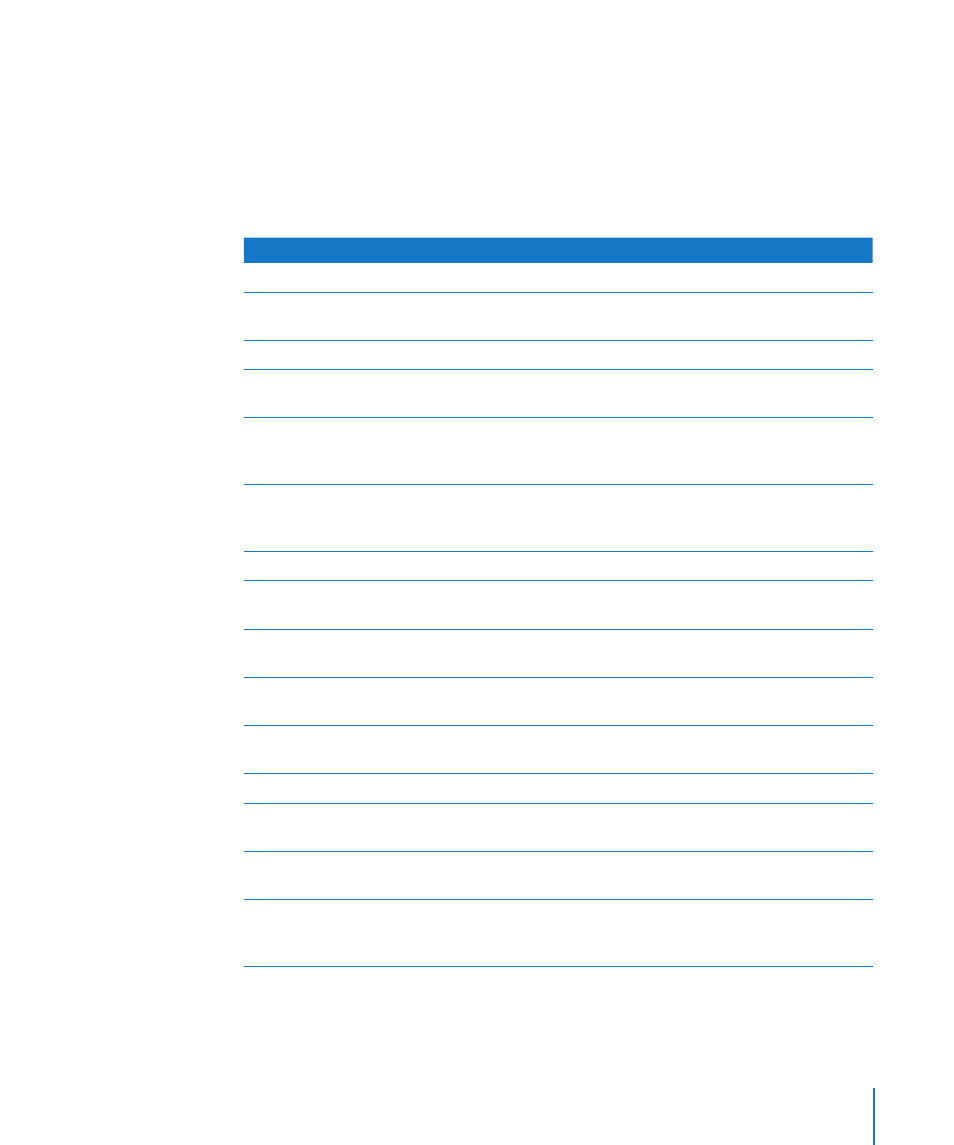

Which Function Should You Use to Solve Common Financial

Questions?

This section describes some common questions you might want to address and lists

the financial function that might be helpful. The questions help with everyday financial

questions. More complex uses of the financial functions are described in “Regular Cash

Flows and Time Intervals” on page 348, “Irregular Cash Flows and Time Intervals” on

page 350, and “Example of a Loan Amortization Table” on page 353.

If you would like to know

This function may be helpful

Savings

The effective interest rate on an investment or

savings account that pays interest periodically

How much a CD will be worth at maturity

“FV” (page 120). Note that payment will be 0.

The nominal rate of interest on a CD where the

issuer has advertised the “effective rate”

How many years it will take to save a specific

amount, given monthly deposits to a savings

account

“NPER” (page 130). Note that present-value will

be the amount deposited at the beginning and

could be 0.

How much to save each month to reach a savings

goal in a given number of years

“PMT” (page 134). Note that present-value will

be the amount deposited at the beginning and

could be 0.

Loans

The amount of interest paid on a loan during the

third year

The amount of principal paid on a loan during

the third year

The amount of interest included in the 36th loan

payment

The amount of principal included in the 36th

loan payment

Bond Investments

The amount of interest that will need to be

added to a bond’s purchase price

“ACCRINT” (page 99) or “ACCRINTM” (page 101)

The number of coupon payments between the

time a bond is purchased and its maturity

The annual discount rate for a bond that is sold

at a discount to its redemption value and pays no

interest (often known as a “zero coupon bond”)