Nominal, 129 nominal – Apple iWork '09 User Manual

Page 129

Chapter 6

Financial Functions

129

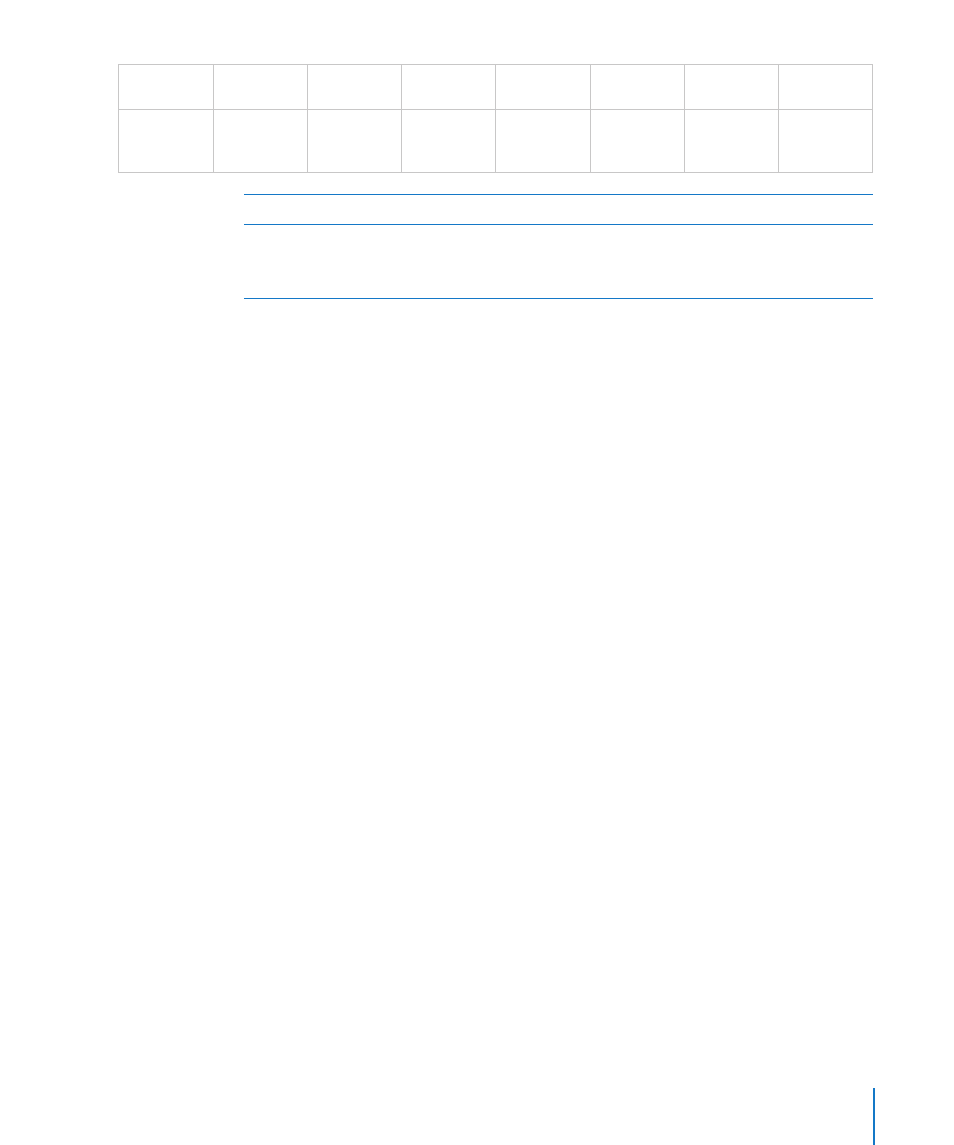

Initial

Deposit

Year 1

Year 2

Year 3

Year 4

Year 5

Sales

proceeds

=MIRR

(B2:H2, 0.09,

0.0425)

-50000

-25000

-10000

0

10000

30000

100000

Example 2

Assume the same information as in Example 1, but rather than placing the cash flows in individual

cells, you specify the cash flows as an array constant. The MIRR function would then be as follows:

=MIRR({-50000, -25000, -10000, 0, 10000, 30000, 100000}, 0.09, 0.0425) returns approximately 9.75%.

Related Topics

For related functions and additional information, see:

“Choosing Which Time Value of Money Function to Use” on page 348

“Common Arguments Used in Financial Functions” on page 341

“Listing of Financial Functions” on page 96

“Value Types” on page 36

“The Elements of Formulas” on page 15

“Using the Keyboard and Mouse to Create and Edit Formulas” on page 26

“Pasting from Examples in Help” on page 41

NOMINAL

The NOMINAL function returns the nominal annual interest rate from the effective

annual interest rate based on the number of compounding periods per year.

NOMINAL(effective-int-rate, num-periods-year)

Â

effective-int-rate: The effective interest rate of a security. effective-int-rate is a

number value and is either entered as a decimal (for example, 0.08) or with a

percent sign (for example, 8%).

Â

num-periods-year: The number of compounding periods per year. num-periods-

year is a number value and must be greater than 0.