Apple iWork '09 User Manual

Page 118

Â

days-basis: An optional argument specifying the number of days per month and

days per year used in the calculations.

30/360 (0 or omitted): 30 days in a month, 360 days in a year, using the NASD

method for dates falling on the 31st of a month.

actual/actual (1): Actual days in each month, actual days in each year.

actual/360 (2): Actual days in each month, 360 days in a year.

actual/365 (3): Actual days in each month, 365 days in a year.

30E/360 (4): 30 days in a month, 360 days in a year, using the European method for

dates falling on the 31st of a month (European 30/360).

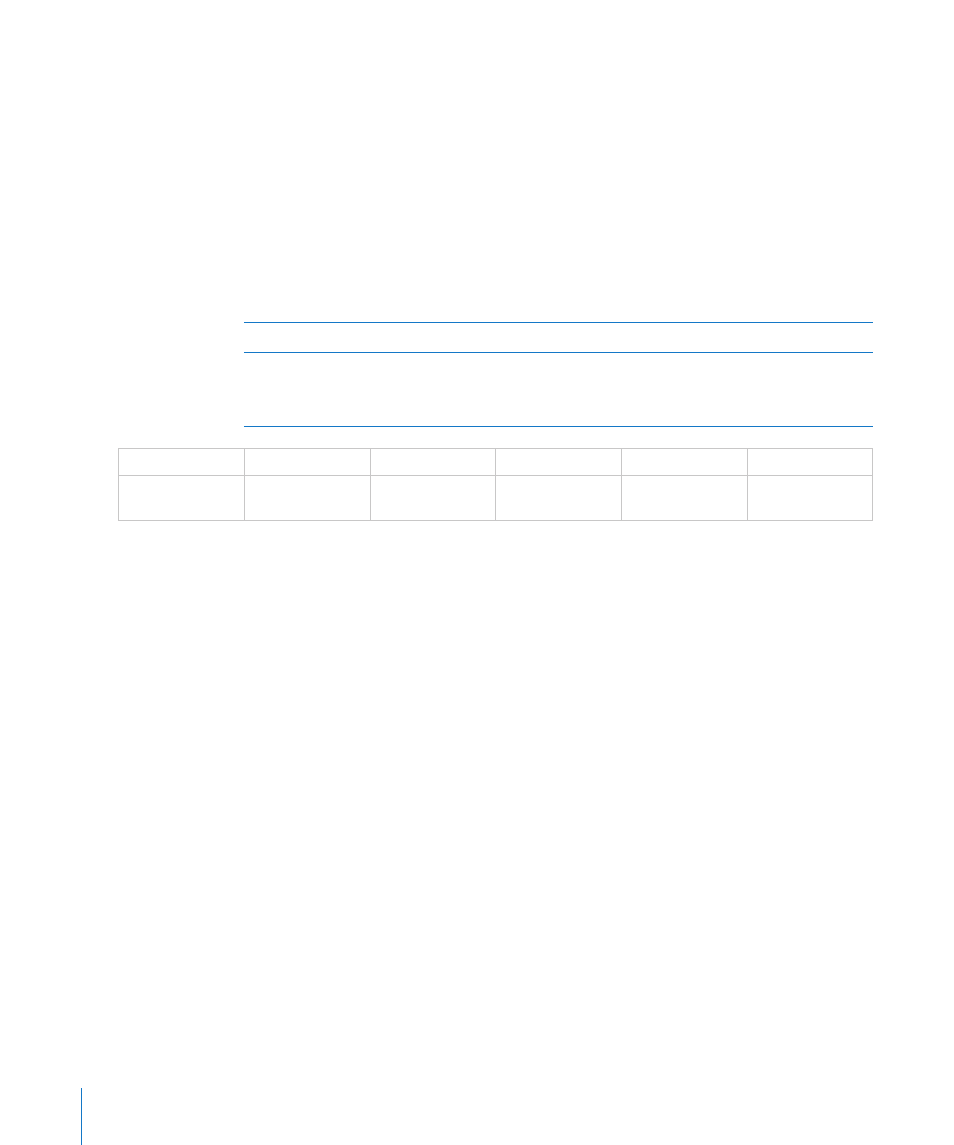

Example

In this example, the DISC function is used to determine the annual discount rate of the hypothetical

security described by the values listed.

The function evaluates to 5.25%, the annual discount rate.

settle

maturity

price

redemption

days-basis

=DISC(B2, C2, D2,

E2, F2)

05/01/2009

06/30/2015

67.64

100

0

Related Topics

For related functions and additional information, see:

“PRICEDISC” on page 138

“YIELDDISC” on page 152

“Common Arguments Used in Financial Functions” on page 341

“Listing of Financial Functions” on page 96

“Value Types” on page 36

“The Elements of Formulas” on page 15

“Using the Keyboard and Mouse to Create and Edit Formulas” on page 26

“Pasting from Examples in Help” on page 41

118

Chapter 6

Financial Functions