Coupnum, 109 coupnum – Apple iWork '09 User Manual

Page 109

Chapter 6

Financial Functions

109

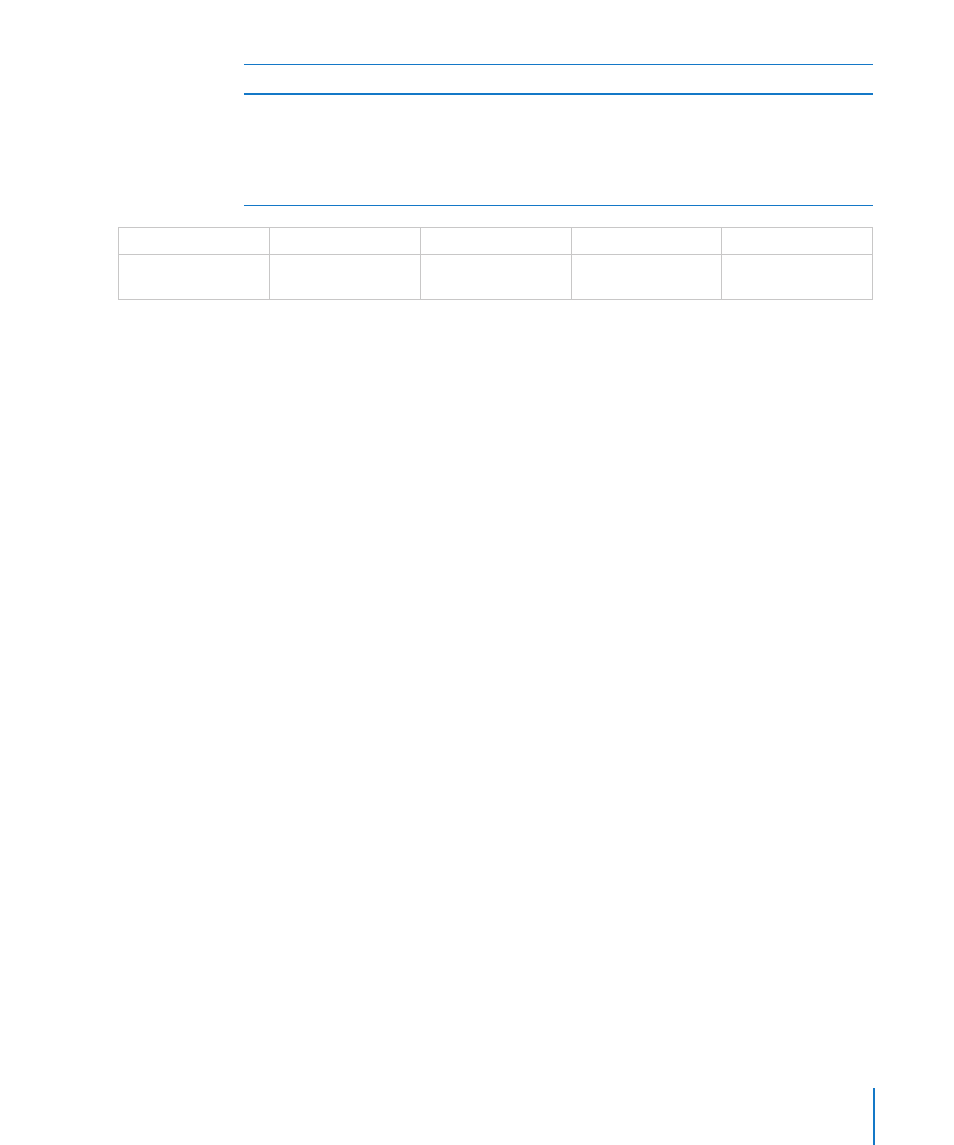

Example

Assume you are considering the purchase of the hypothetical security described by the values listed.

You could use the COUPDAYSNC function to determine the number of days until the next coupon

payment date. This would be the number of days until the first coupon payment you would receive.

The function returns 89, since there are 89 days between settlement date of April 2, 2010, and the

next coupon payment date of June 30, 2010.

settle

maturity

frequency

days-basis

=COUPDAYSNC(B2, C2,

D2, E2, F2, G2)

4/2/2010

12/31/2015

4

1

Related Topics

For related functions and additional information, see:

“COUPDAYBS” on page 105

“Common Arguments Used in Financial Functions” on page 341

“Listing of Financial Functions” on page 96

“Value Types” on page 36

“The Elements of Formulas” on page 15

“Using the Keyboard and Mouse to Create and Edit Formulas” on page 26

“Pasting from Examples in Help” on page 41

COUPNUM

The COUPNUM function returns the number of coupons remaining to be paid

between the settlement date and the maturity date.

COUPNUM(settle, maturity, frequency, days-basis)

Â

settle: The trade settlement date. settle is a date/time value. The trade settlement

date is usually one or more days after the trade date.

Â

maturity: The date when the security matures. maturity is a date/time value. It must

be after settle.

Â

frequency: The number of coupon payments each year.

annual (1): One payment per year.

semiannual (2): Two payments per year.

quarterly (4): Four payments per year.