Intrate, 122 intrate – Apple iWork '09 User Manual

Page 122

INTRATE

The INTRATE function returns the effective annual interest rate for a security that pays

interest only at maturity.

INTRATE(settle, maturity, invest-amount, redemption, days-basis)

Â

settle: The trade settlement date. settle is a date/time value. The trade settlement

date is usually one or more days after the trade date.

Â

maturity: The date when the security matures. maturity is a date/time value. It must

be after settle.

Â

invest-amount: The amount invested in the security. invest-amount is a number

value and must be greater than or equal to 0.

Â

redemption: The redemption value per $100 of par value. redemption is a number

value that must be greater than 0. redemption is the amount that will be received

per $100 of face value. Often, it is 100, meaning that the security’s redemption value

is equal to its face value.

Â

days-basis: An optional argument specifying the number of days per month and

days per year used in the calculations.

30/360 (0 or omitted): 30 days in a month, 360 days in a year, using the NASD

method for dates falling on the 31st of a month.

actual/actual (1): Actual days in each month, actual days in each year.

actual/360 (2): Actual days in each month, 360 days in a year.

actual/365 (3): Actual days in each month, 365 days in a year.

30E/360 (4): 30 days in a month, 360 days in a year, using the European method for

dates falling on the 31st of a month (European 30/360).

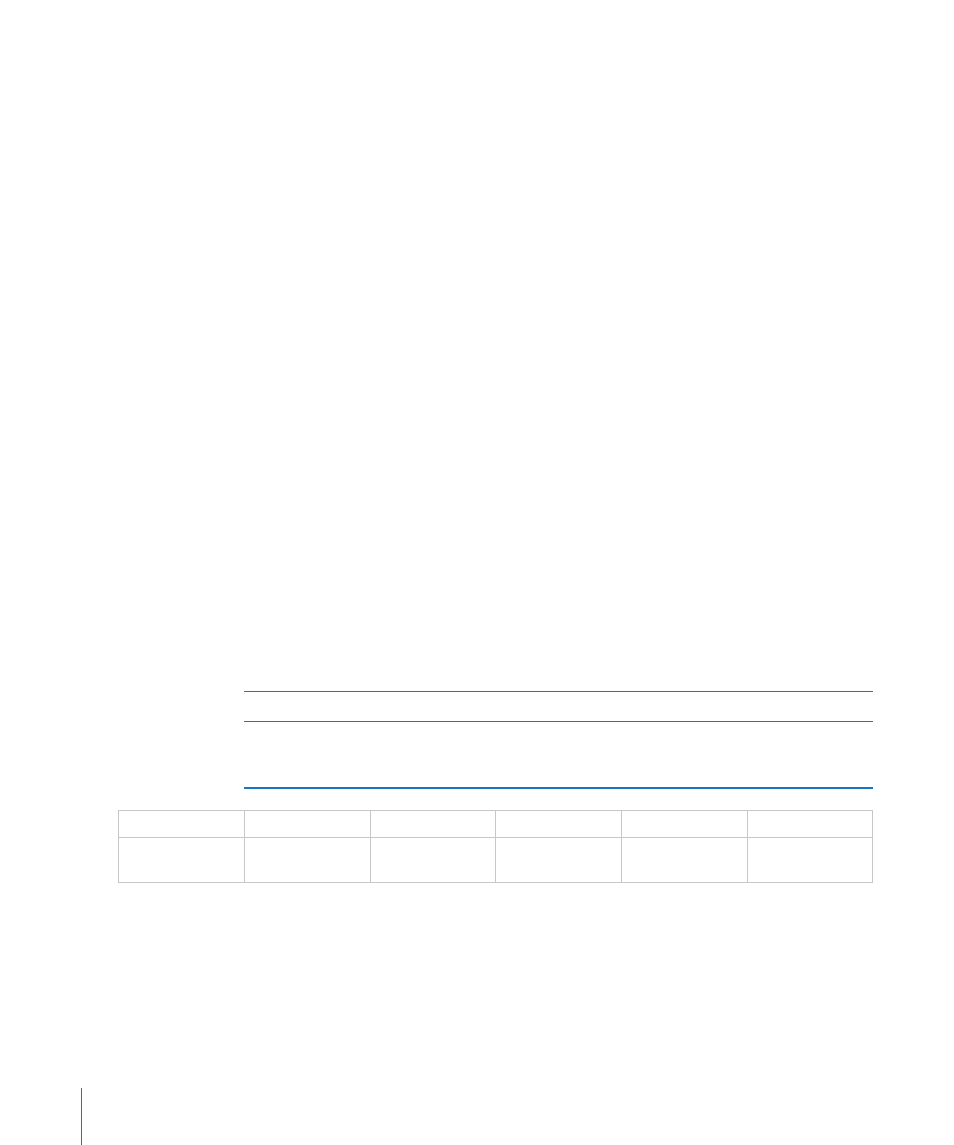

Example

In this example, the INTRATE function is used to determine the effective annual interest rate of the

hypothetical security described by the values listed. The security pays interest only at maturity. The

function evaluates to approximately 10.85%.

settle

maturity

invest-amount

par

days-basis

=INTRATE(B2, C2,

D2, E2, F2)

05/01/2009

06/30/2015

990.02

1651.83

0

122

Chapter 6

Financial Functions