Apple iWork '09 User Manual

Page 111

Chapter 6

Financial Functions

111

Â

num-periods: The number of periods. num-periods is a number value and must be

greater than or equal to 0.

Â

present-value: The value of the initial investment, or the amount of the loan or

annuity. present-value is a number value. At time 0, an amount received is a positive

amount and an amount invested is a negative amount. For example, it could be an

amount borrowed (positive) or the initial payment made on an annuity contract

(negative).

Â

starting-per: First period to include in the calculation. starting-per is a number value.

Â

ending-per: Last period to include in the calculation. ending-per is a number value

and must be greater than 0 and also greater than starting-per.

Â

when-due: Specifies whether payments are due at the beginning or end of each

period.

end (0): Payments are due at the end of each period.

beginning (1): Payments are due at the beginning of each period.

Usage Notes

If

Â

settle is before first, the function returns the interest accrued since issue. If settle is

after first, the function returns the interest accrued since the coupon payment date

that most immediately precedes settle.

Use ACCRINTM for a security that pays interest only at maturity.

Â

Examples

It is generally understood that the amount of interest paid on a loan is higher in the early years, as

compared to the later years. This example demonstrates just how much higher the early years can

be. Assume a mortgage loan with an initial loan amount of $550,000, an interest rate of 6%, and a

30-year term.

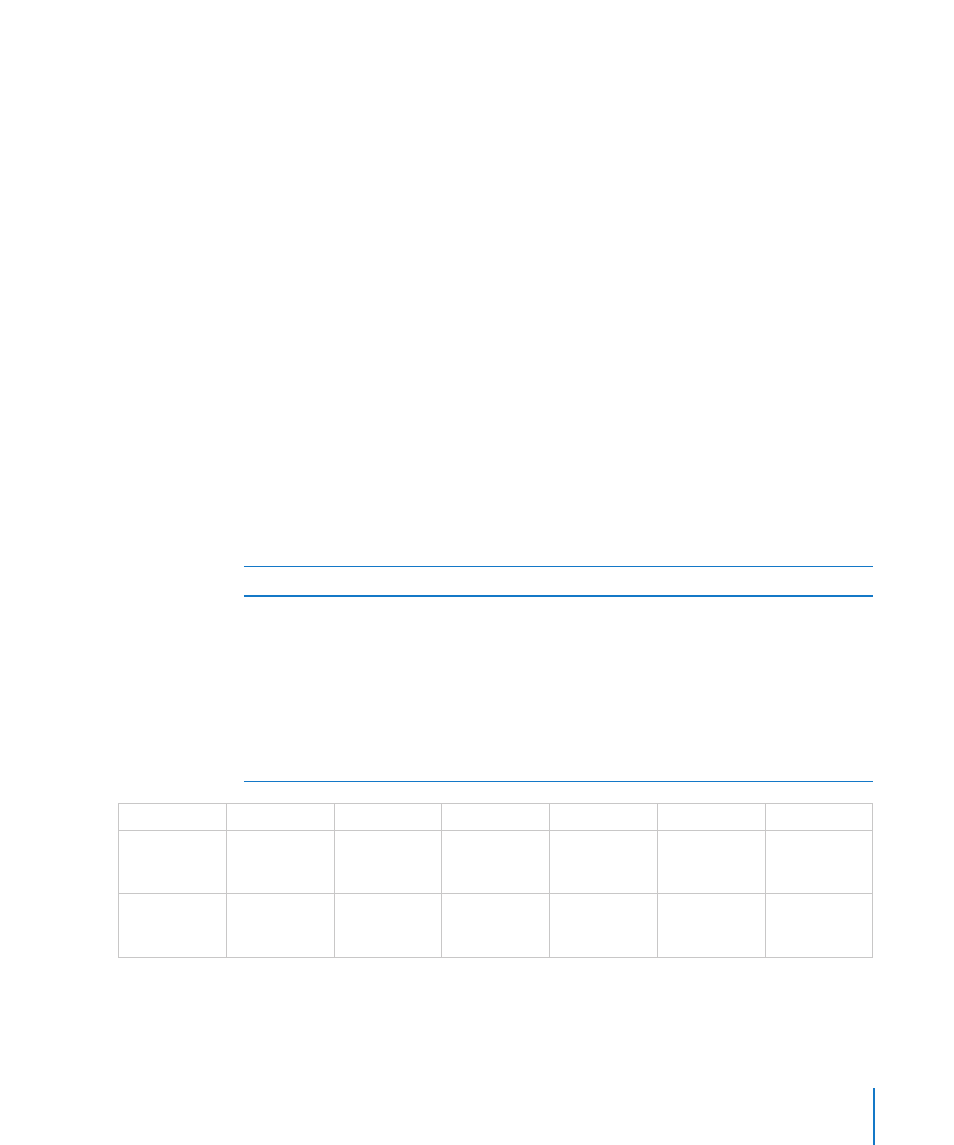

The CUMIPMT function can be used to determine the interest for any period. In the following table,

CUMIPMT has been used to determine the interest for the first year (payments 1 through 12) and for

the last year (payments 349 through 360) of the loan term. The function evaluates to $32,816.27 and

$1,256.58, respectively. The amount of interest paid in the first year is more than 26 times the amount

of interest paid in the last year.

periodic-rate

num-periods

present-value

starting-per

ending-per

when-due

=CUMIPMT (B2,

C2, D2, E2, F2,

G2)

=0.06/12

360

=550000

1

12

0

=CUMIPMT (B2,

C2, D2, E3, F3,

G2)

349

360