134 pmt – Apple iWork '09 User Manual

Page 134

PMT

The PMT function returns the fixed periodic payment for a loan or annuity based on

a series of regular periodic cash flows (payments of a constant amount and all cash

flows at constant intervals) and a fixed interest rate.

PMT(periodic-rate, num-periods, present-value, future-value, when-due)

Â

periodic-rate: The interest rate per period. periodic-rate is a number value and is

either entered as a decimal (for example, 0.08) or with a percent sign (for example, 8%).

Â

num-periods: The number of periods. num-periods is a number value and must be

greater than or equal to 0.

Â

present-value: The value of the initial investment, or the amount of the loan or

annuity. present-value is a number value. At time 0, an amount received is a positive

amount and an amount invested is a negative amount. For example, it could be an

amount borrowed (positive) or the initial payment made on an annuity contract

(negative).

Â

future-value: An optional argument that represents the value of the investment

or remaining cash value of the annuity (positive amount), or the remaining loan

balance (negative amount), after the final payment. future-value is a number value.

At the end of the investment period, an amount received is a positive amount and

an amount invested is a negative amount. For example, It could be the balloon

payment due on a loan (negative) or the remaining value of an annuity contract

(positive). If omitted, it is assumed to be 0.

Â

when-due: An optional argument that specifies whether payments are due at the

beginning or end of each period. Most mortgage and other loans require the first

payment at the end of the first period (0), which is the default. Most lease and rent

payments, and some other types of payments, are due at the beginning of each

period (1).

end (0 or omitted): Payments are due at the end of each period.

beginning (1): Payments are due at the beginning of each period.

Example

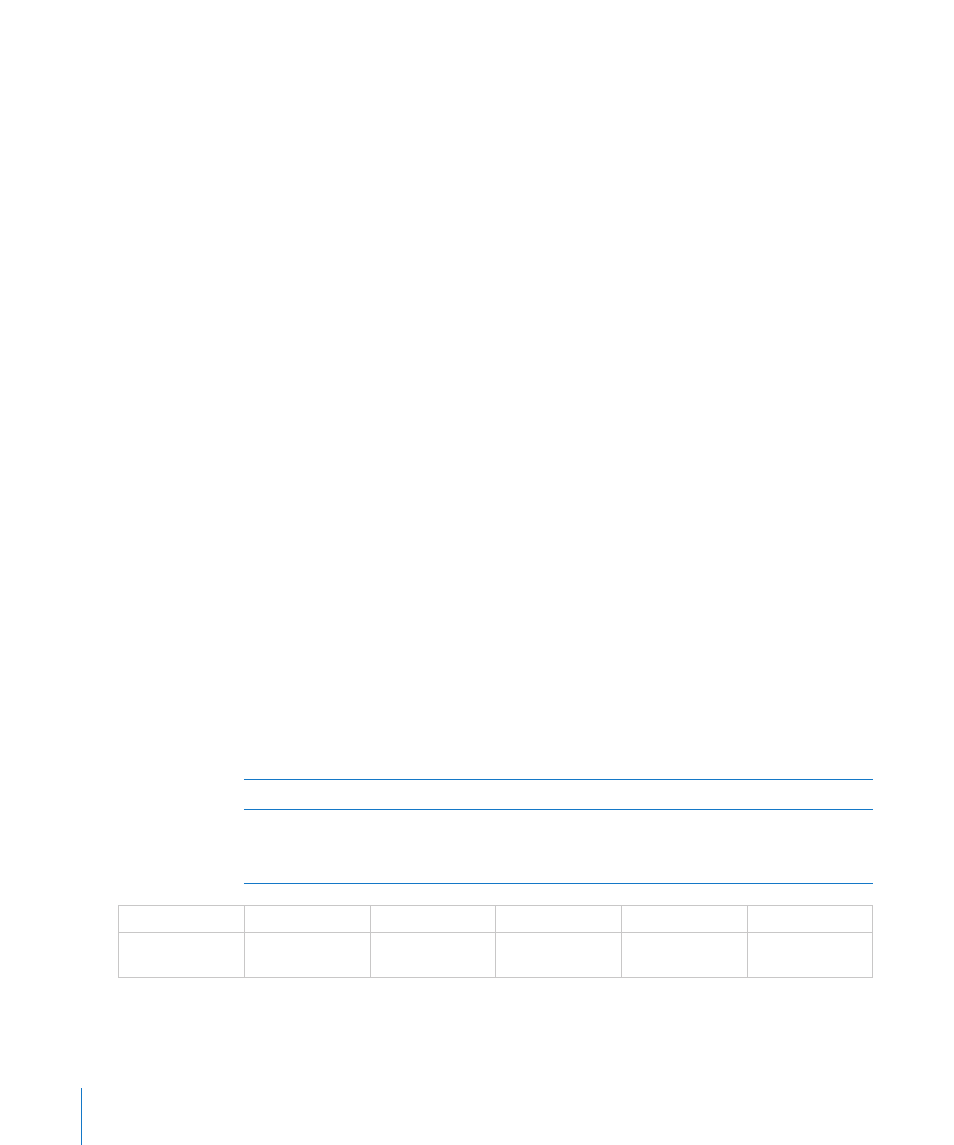

In this example, PMT is used to determine the fixed payment given the loan facts presented.

The function evaluates to –$1,610.21, which represents the fixed payment you would make (negative

because it is a cash outflow) for this loan.

periodic-rate

num-periods

present-value

future-value

when-due

=PMT(B2, C2, D2,

E2, F2)

=0.06/12

=10*12

200000

-100000

0

134

Chapter 6

Financial Functions