Accrintm, 101 accrintm – Apple iWork '09 User Manual

Page 101

Chapter 6

Financial Functions

101

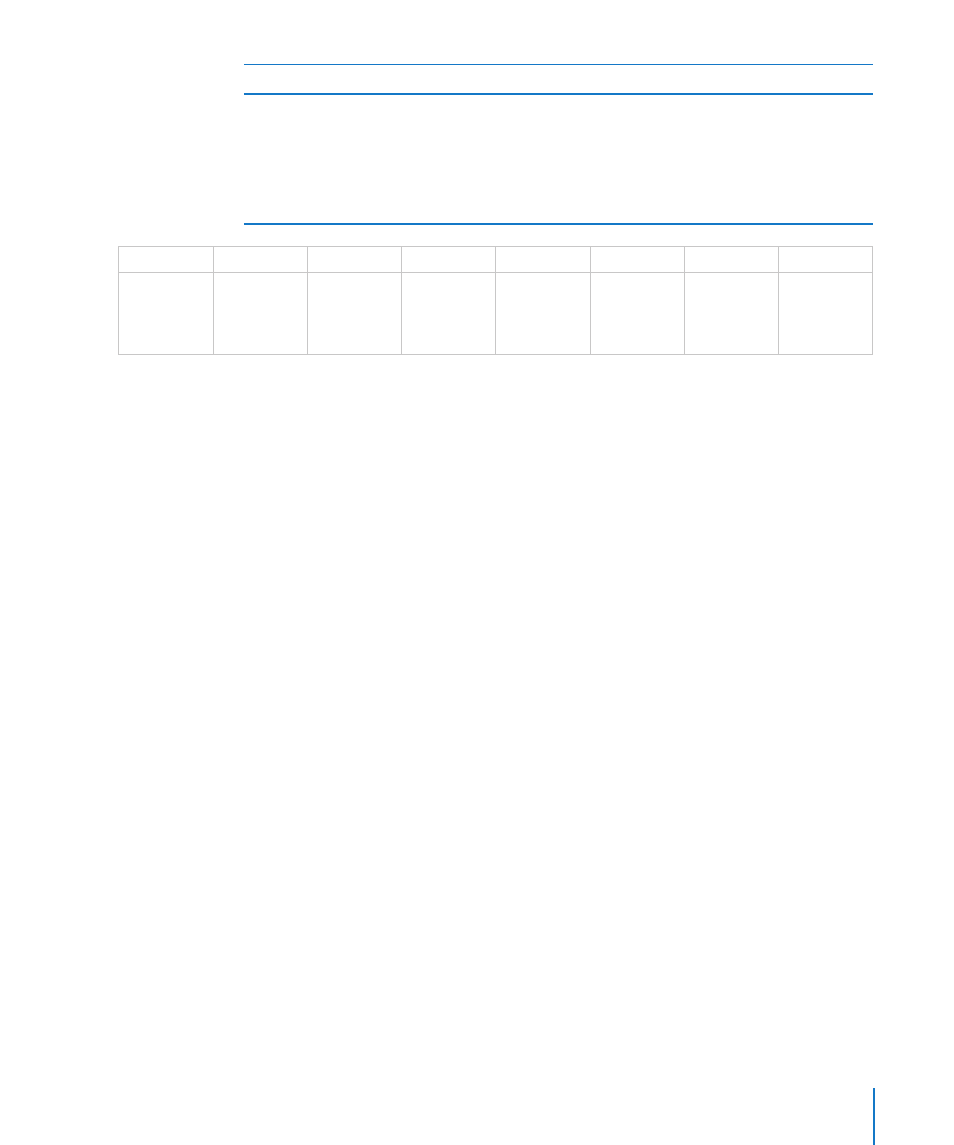

Example 2

Assume you are considering the purchase of the hypothetical security described by the values listed.

The settlement date is assumed to be after the first coupon date.

You could use the ACCRINT function to determine the amount of accrued interest that would be

added to the purchase/sale price. The function evaluates to approximately $20.56, which represents

the interest accrued between the immediately preceding coupon payment date and the settlement

date.

issue

first

settle

annual-rate

par

frequency

days-basis

=ACCRINT

(B2, C2, D2,

E2, F2, G2,

H2)

12/14/2008

07/01/2009

09/15/2009

0.10

1000

2

0

Related Topics

For related functions and additional information, see:

“ACCRINTM” on page 101

“Common Arguments Used in Financial Functions” on page 341

“Listing of Financial Functions” on page 96

“Value Types” on page 36

“The Elements of Formulas” on page 15

“Using the Keyboard and Mouse to Create and Edit Formulas” on page 26

“Pasting from Examples in Help” on page 41

ACCRINTM

The ACCRINTM function calculates the total accrued interest added to the purchase price

of a security and paid to the seller when the security pays interest only at maturity.

ACCRINTM(issue, settle, annual-rate, par, days-basis)

Â

issue: The date the security was originally issued. issue is a date/time value and

must be the earliest date given.

Â

settle: The trade settlement date. settle is a date/time value. The trade settlement

date is usually one or more days after the trade date.

Â

annual-rate: The annual coupon rate or stated annual interest rate of the security.

annual-rate is a number value and is either entered as a decimal (for example, 0.08)

or with a percent sign (for example, 8%).