Ispmt, 126 ispmt – Apple iWork '09 User Manual

Page 126

Example 2

Assume you are presented with the opportunity to invest in a partnership. The initial investment

required is $50,000. Because the partnership is still developing its product, an additional $25,000 and

$10,000 must be invested at the end of the first and second years, respectively. In the third year the

partnership expects to be self-funding but not return any cash to investors. In the fourth and fifth

years, investors are projected to receive $10,000 and $30,000, respectively. At the end of the sixth

year, the company expects to sell and investors are projected to receive $100,000.

Using the IRR function, you can determine the expected rate of return on this investment. Based on

the assumptions given, the rate would be 10.24%.

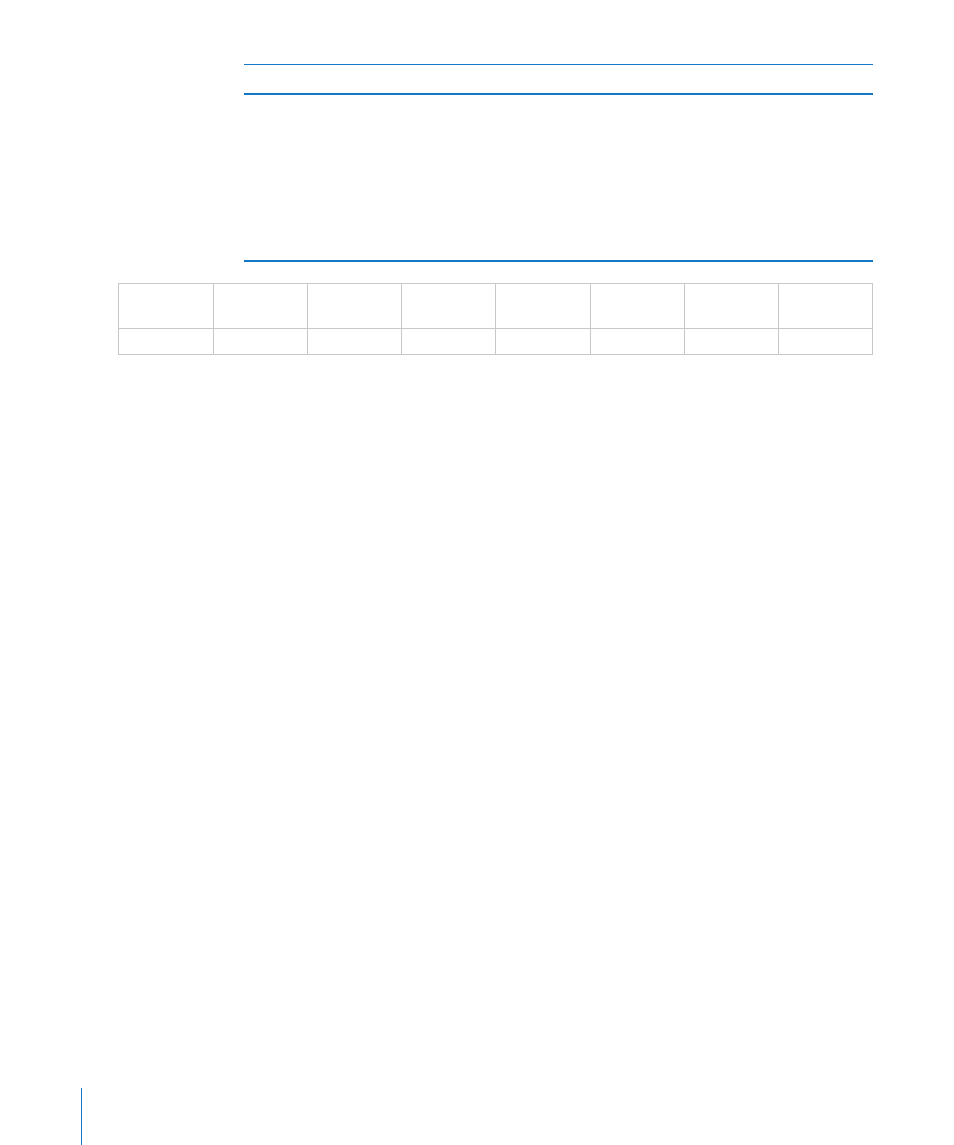

Initial

Deposit

Year 1

Year 2

Year 3

Year 4

Year 5

Sales

proceeds

=IRR(B2:H2)

-50000

-25000

-10000

0

10000

30000

100000

Related Topics

For related functions and additional information, see:

“Choosing Which Time Value of Money Function to Use” on page 348

“Common Arguments Used in Financial Functions” on page 341

“Listing of Financial Functions” on page 96

“Value Types” on page 36

“The Elements of Formulas” on page 15

“Using the Keyboard and Mouse to Create and Edit Formulas” on page 26

“Pasting from Examples in Help” on page 41

ISPMT

The ISPMT function returns the interest portion of a specified loan or annuity payment

based on fixed, periodic payments and a fixed interest rate. This function is provided

for compatibility with tables imported from other spreadsheet applications.

126

Chapter 6

Financial Functions