Apple iWork '09 User Manual

Page 145

Chapter 6

Financial Functions

145

Example

Assume you are planning for your daughter’s college education. She has just turned 3 and you

expect she will begin college in 15 years. You think you will need to have $150,000 set aside in a

savings account by the time she reaches college. You can set aside $50,000 today and add $200 to

the account at the end of each month. Over the next 15 years, the savings account is expected to

earn an annual interest rate of 4.5%, and earns interest monthly.

Using the RATE function, you can determine the rate that must be earned on the savings account so

that it will reach $150,000 by the time your daughter begins college. Based on the assumptions given,

the rate returned by the function is approximately 0.377%, which is per month since num-periods was

monthly, or 4.52% annually.

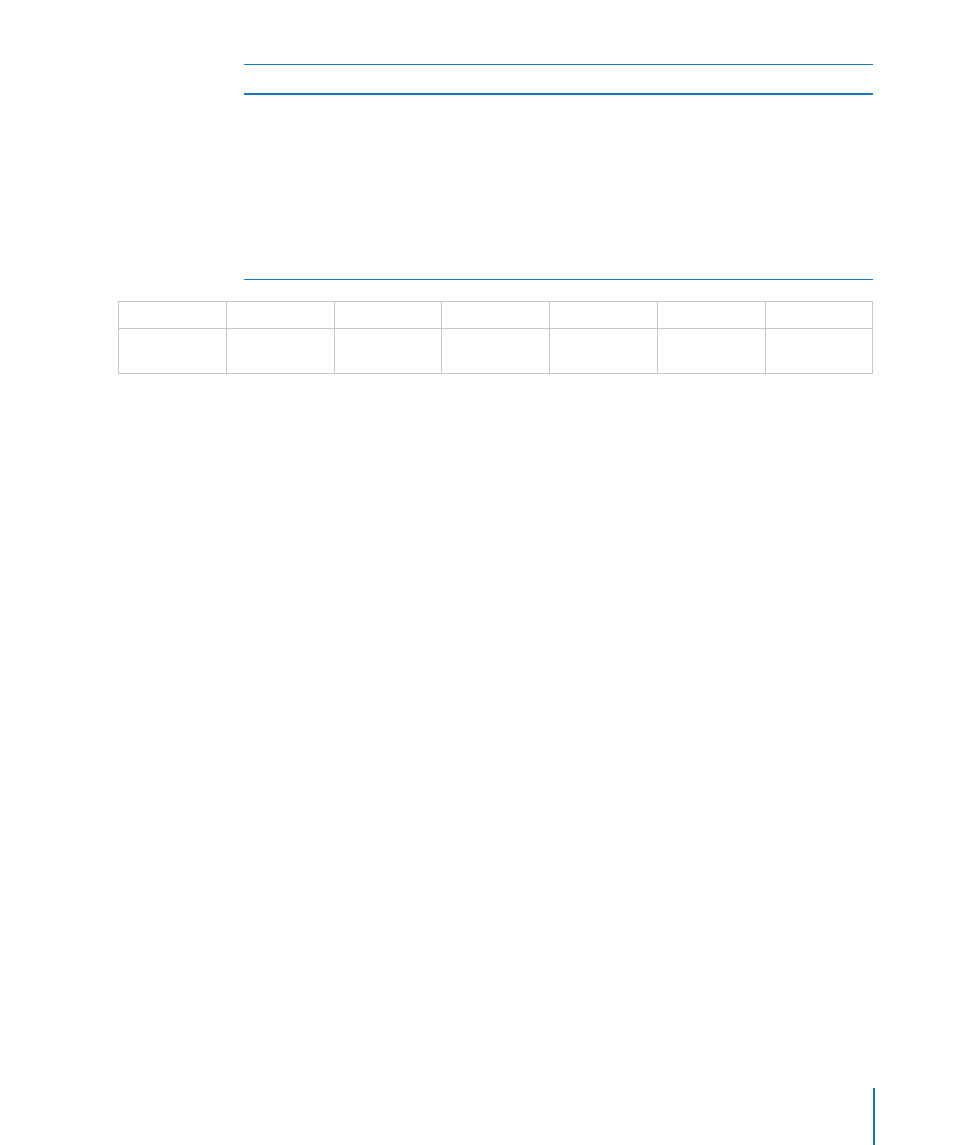

num-periods

payment

present-value

future-value

when-due

estimate

=RATE(B2, C2,

D2, E2, F2, G2)

=15*12

-200

-50000

150000

1

=0.1/12

Related Topics

For related functions and additional information, see:

“Choosing Which Time Value of Money Function to Use” on page 348

“Common Arguments Used in Financial Functions” on page 341

“Listing of Financial Functions” on page 96

“Value Types” on page 36

“The Elements of Formulas” on page 15

“Using the Keyboard and Mouse to Create and Edit Formulas” on page 26

“Pasting from Examples in Help” on page 41