132 npv – Apple iWork '09 User Manual

Page 132

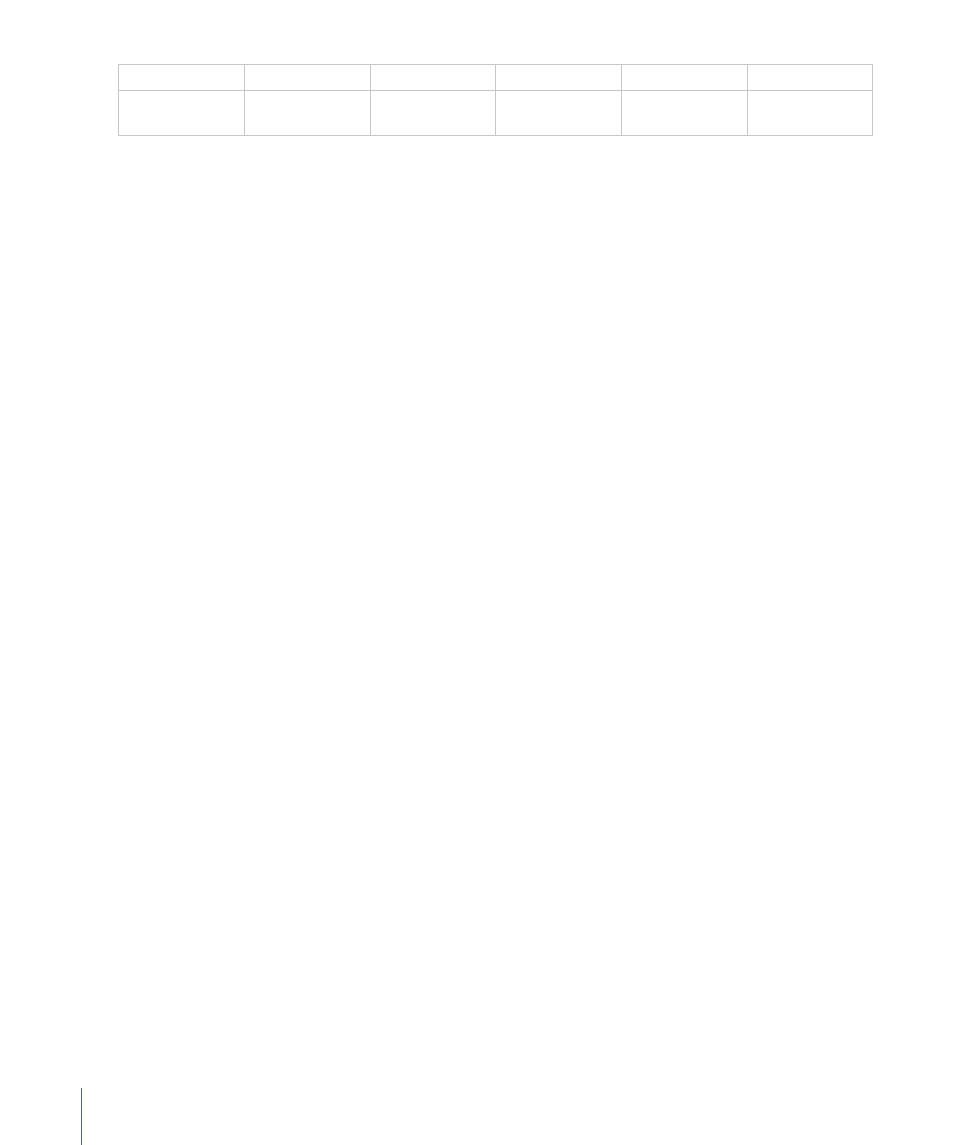

periodic-rate

payment

present-value

future-value

when-due

=NPER(B2, C2, D2,

E2, F2)

=0.07/12

-1500

170000

0

1

Related Topics

For related functions and additional information, see:

“Choosing Which Time Value of Money Function to Use” on page 348

“Common Arguments Used in Financial Functions” on page 341

“Listing of Financial Functions” on page 96

“Value Types” on page 36

“The Elements of Formulas” on page 15

“Using the Keyboard and Mouse to Create and Edit Formulas” on page 26

“Pasting from Examples in Help” on page 41

NPV

The NPV function returns the net present value of an investment based on a series of

potentially irregular cash flows that occur at regular time intervals.

NPV(periodic-discount-rate, cash-flow, cash-flow…)

Â

periodic-discount-rate: The discount rate per period. periodic-discount-rate is

a number value and is either entered as a decimal (for example, 0.08) or with a

percent sign (for example, 8%). periodic-discount-rate must be greater than or equal

to 0.

Â

cash-flow: A cash flow. cash-flow is a number value. A positive value represents

income (cash inflow). A negative value represents an expenditure (cash outflow).

Cash flows must be equally spaced in time.

Â

cash-flow…: Optionally include one or more additional cash flows.

132

Chapter 6

Financial Functions