Apple iWork '09 User Manual

Page 121

Chapter 6

Financial Functions

121

Example 2

Assume you are presented with an investment opportunity. The opportunity requires that you invest

$50,000 in a discount security today and then nothing further. The discount security matures in 14

years and has a redemption value of $100,000. Your alternative is to leave your money in your money

market savings account where it is expected to earn an annual yield of 5.25%.

One way to evaluate this opportunity would be to consider how much the $50,000 would be worth

at the end of the investment period and compare that to the redemption value of the security.

Using the FV function, you can determine the expected future value of the money market account.

Based on the assumptions given, it would be $102,348.03. Therefore, if all assumptions happen as

expected, it would be better to keep the money in the money market account since its value after 14

years ($102,348.03) exceeds the redemption value of the security ($100,000).

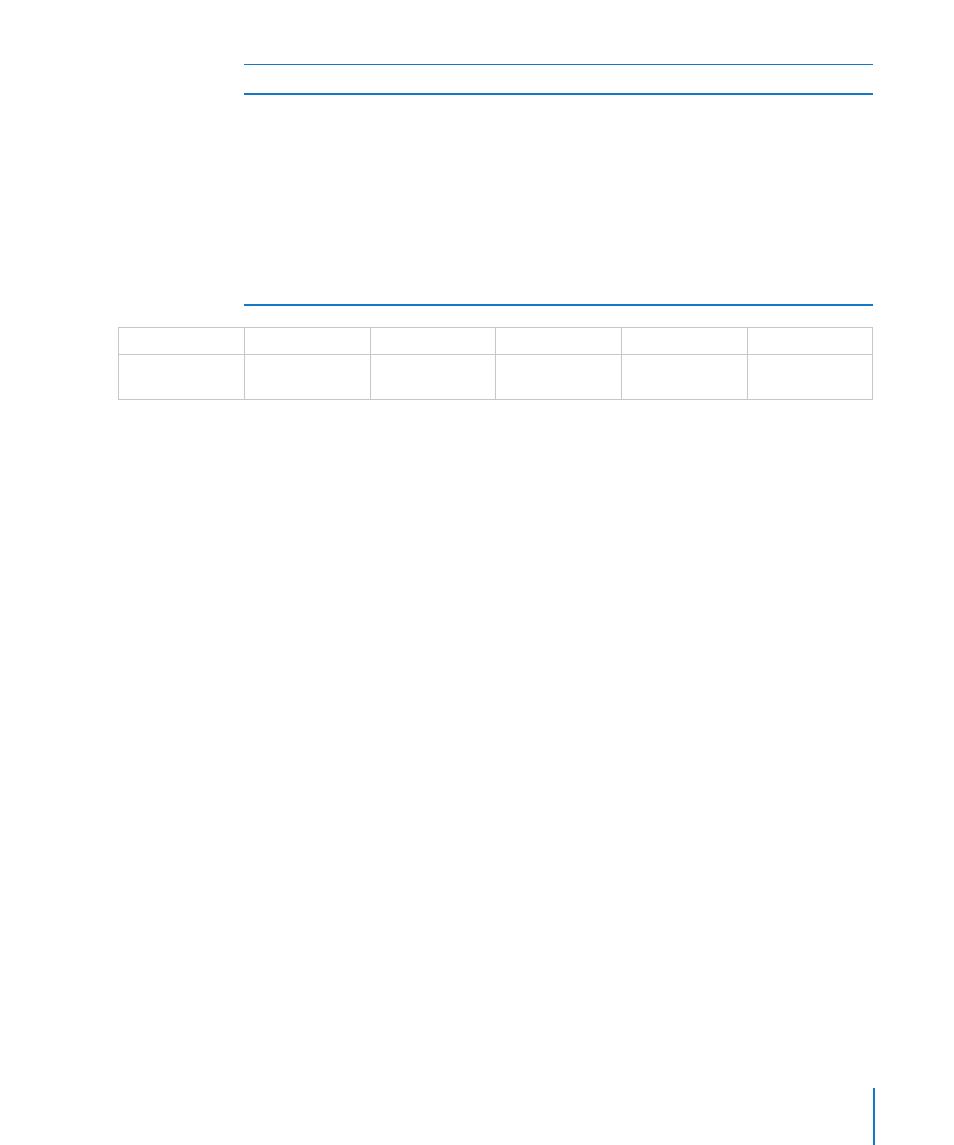

periodic-rate

num-periods

payment

present-value

when-due

=FV(B2, C2, D2,

E2, F2)

0.0525

14

0

-50000

1

Related Topics

For related functions and additional information, see:

“Choosing Which Time Value of Money Function to Use” on page 348

“Common Arguments Used in Financial Functions” on page 341

“Listing of Financial Functions” on page 96

“Value Types” on page 36

“The Elements of Formulas” on page 15

“Using the Keyboard and Mouse to Create and Edit Formulas” on page 26

“Pasting from Examples in Help” on page 41