Preset and delivery, Screen 19b: preset and delivery (2/7) – Liquid Controls DMS Setup User Manual

Page 55

55

Preset and Delivery

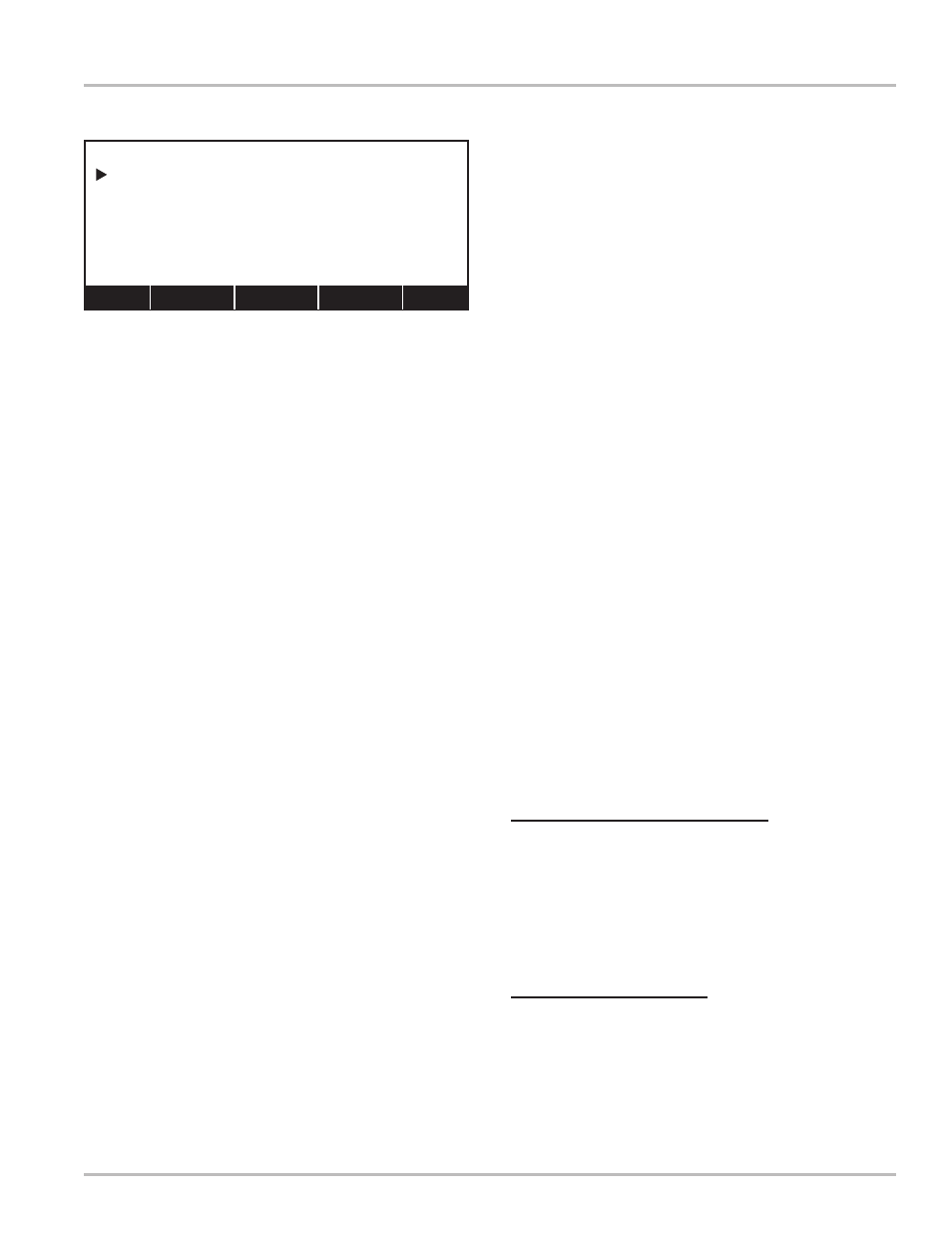

Screen 19b: Preset and Delivery (2/7)

The second Preset and Delivery screen continues with

defining the parameters of a delivery. The

Product # will

be carried forward from the previous screen, but it can be

changed again in this screen.

Product Code will display the current product code

associated with the product number as set up in the

calibration screens.

Name will also reflect the name

associated with the product number.

Price/Unit is used to set the price per unit volume as

defined by

Units. For instance, if Units is Gallons then

this represents price per gallon. If

Units is changed to

Litres then the price represents price per litre. Move the

pointer to

Price/Unit and press ENTER to open a field

edit window. Enter a value in the range

-9999.9999 to

9999.9999.

Tax/Unit is used to set the tax per unit volume as defined

by

Units. Move the pointer to Tax/Unit and press ENTER

to open a field edit window. Enter a value in the range

-9999.9999 to 9999.9999. For instance, if the Tax/Unit

is

.034 and the total delivery volume is 300 units, then

the total Tax/Unit is $.034 x 300 = $10.20. This is added

to the sale.

Percent Tax is used to set the percent tax rate. Move

the pointer to

Percent Tax and press ENTER to open a

field edit window. Enter a value in the range

-1000.0000

to

1000.000. This value is determined by the sale price

multiplied by a percentage. For instance, if the delivery

results in a charge of $200.00, and the

Percent Tax

entered is

6.5, then percent tax charged is 200.00 x .065 =

13.00. This value will be added to $200.00 to get $213.00.

The total sale for the delivery is then calculated as:

Price/Unit total

+ Tax/Unit total

+ Percent Tax X Price/Unit total

$Total Sale

So, if

Price/Unit = 1.10, Tax/Unit = 0.25, and Percent

Tax = 6.5 and 100 units was delivered, the total charge

for the delivery would be:

$1.10 x 100 = $110.00

$0.25 x 100 = $ 25.00

0.065 x $110 = $ 7.15

Total

$142.15

Press

Next (F1) to advance to Screen 19c on page 56.

Press

Prev (F2) to return to Screen 19a on page 54.

(2/7) 1

Units: Gallons

0.0000

0.0000

0.0000

PRESET AND DELIVERY

Product#: 1

Product Code:

Name:

Price/Unit:

Tax/Unit:

Percent Tax:

Next Prev Status LCR# Main