Calculation formulas -10-4, Calculation formulas – Casio CLASSPAD 330 3.04 User Manual

Page 866

20060301

PRC : price per $100 of face value

CPN : coupon rate (%)

YLD : annual yield (%)

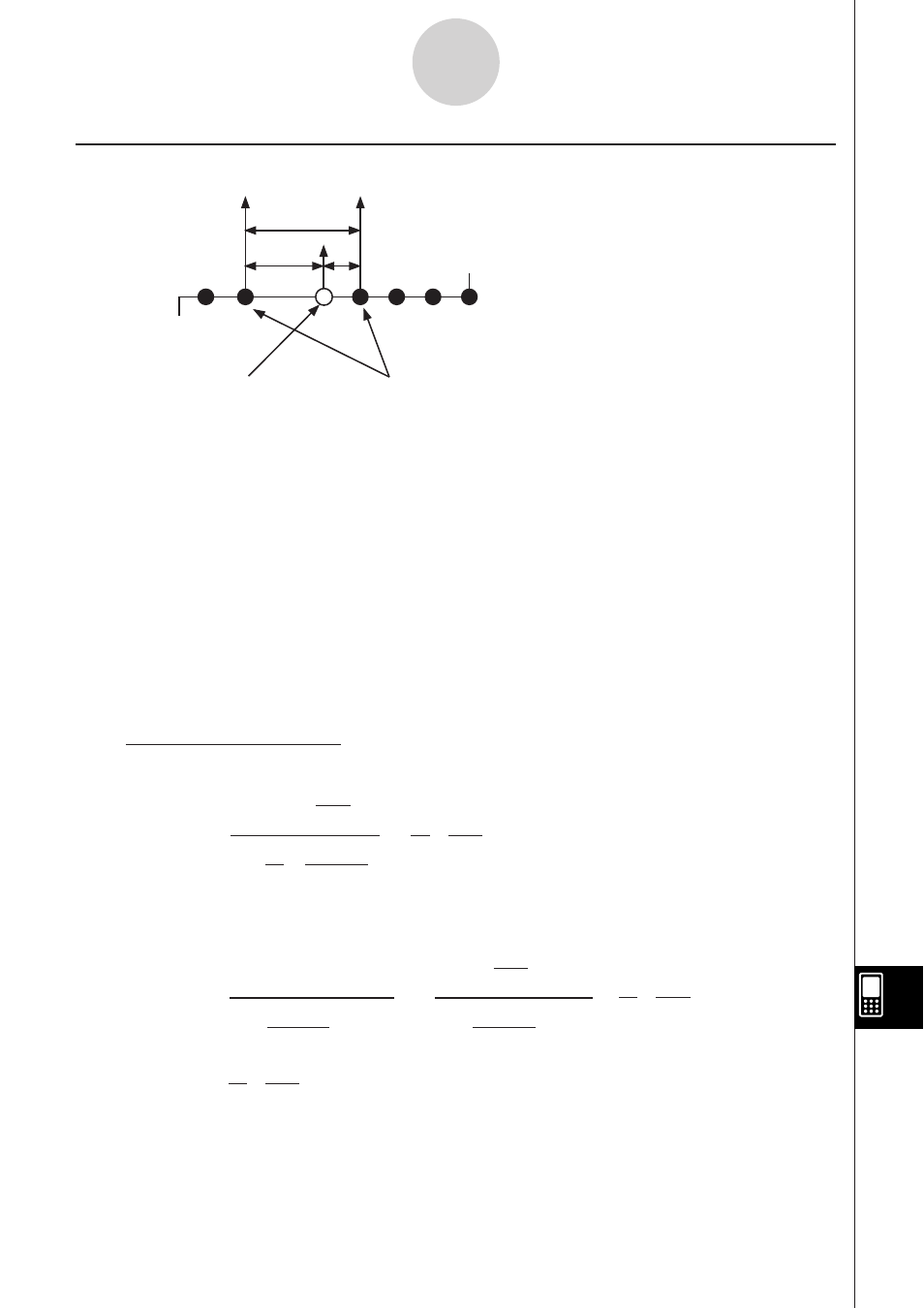

A :

accrued

days

M

: number of coupon payments per year (1 = Annual, 2 = Semi-annual)

N

: number of coupon payments until maturity

(n is used when “Term” is specified for [Bond Interval] in the [Format] tab.)

RDV : redemption price per $100 of face value

D

: number of days in coupon period where settlement occurs

B

: number of days from purchase date until next coupon payment date = D – A

INT : accrued

interest

CST : price including interest

S Price per $100 of face value (PRC)

Bond Interval Setting: Date

• For one or fewer coupon period to redemption

• For more than one coupon period to redemption

15-10-4

Bond Calculation

PRC =

–

+ (

)

RDV

+

M

CPN

1+ (

)

D

B

M

YLD/

100

D

A

M

CPN

+

D

A

CPN

PRC =

–

INT =

–

–

RDV

(1+

)

M

YLD/

100

(1+

)

M

YLD/

100

M

CPN

N

k

=1

(N–1+B/D)

(k–1+B/D)

CST = PRC + INT

D

A

M

CPN

M

Calculation Formulas

D

Issue date

Redemption date (d2)

Purchase date (d1)

Coupon Payment dates

A B