Casio CLASSPAD 330 3.04 User Manual

Page 865

20060301

15-10-3

Bond Calculation

I Example 2

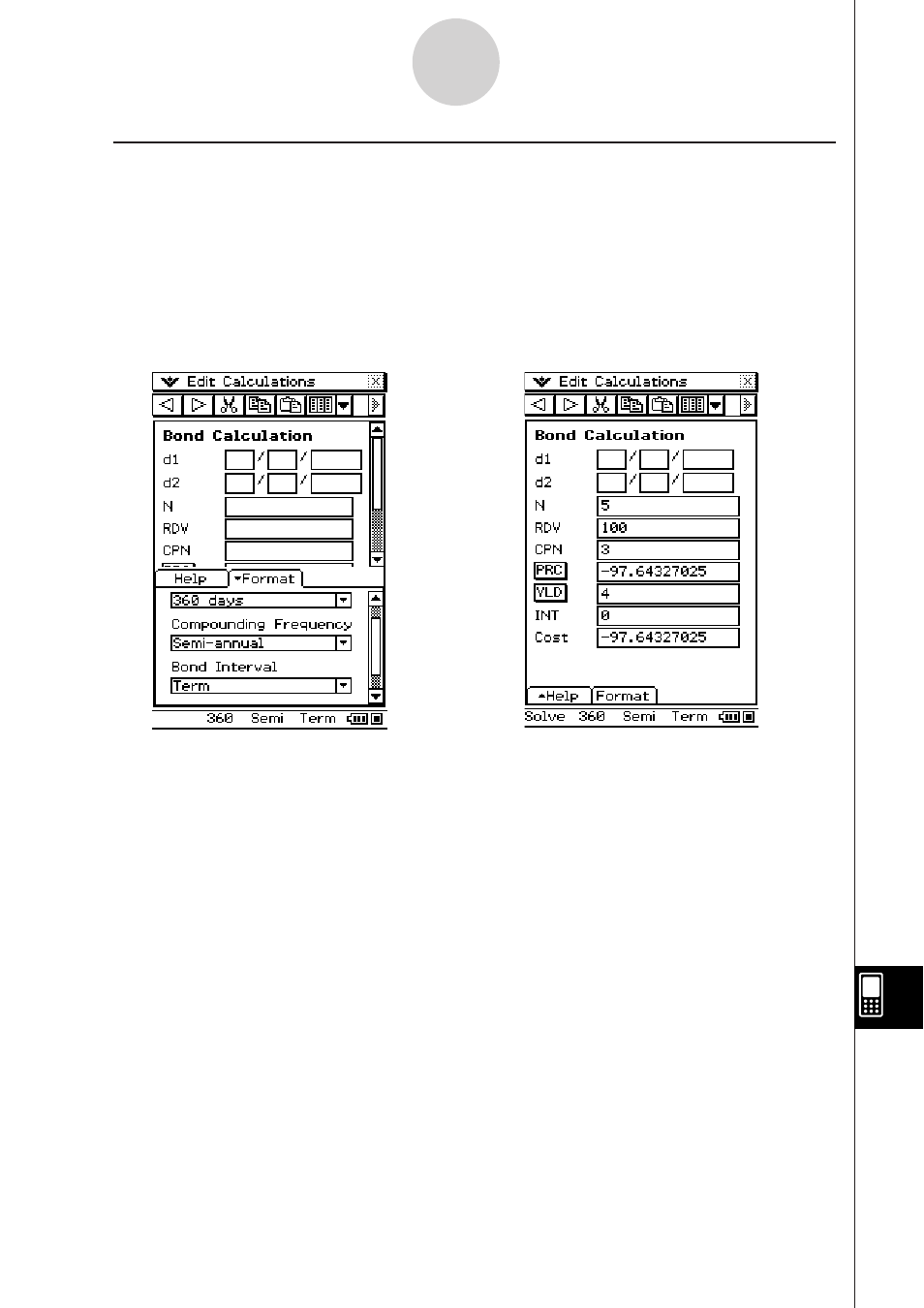

For the same type of bond described in Example 1, calculate the price on the bond (PRC)

based on a specific number of coupon payments (Term).

•

Before performing the calculation, you should use the [Format] tab to change the [Bond

Interval] setting to “Term”, or tap “Date” in the status bar.

The bond is based on the 30/360 day-count method (Days in Year = 360 days) with a coupon

rate (CPN) of 3%. The bond will be redeemed at 100% of its par value (RDV) after 3 periods

(N). For 4% yield to maturity (YLD), calculate the bond’s price ([PRC]).

This manual is related to the following products: