Calculation formulas -9-3, Calculation formulas – Casio CLASSPAD 330 3.04 User Manual

Page 861

20060301

I Example 2

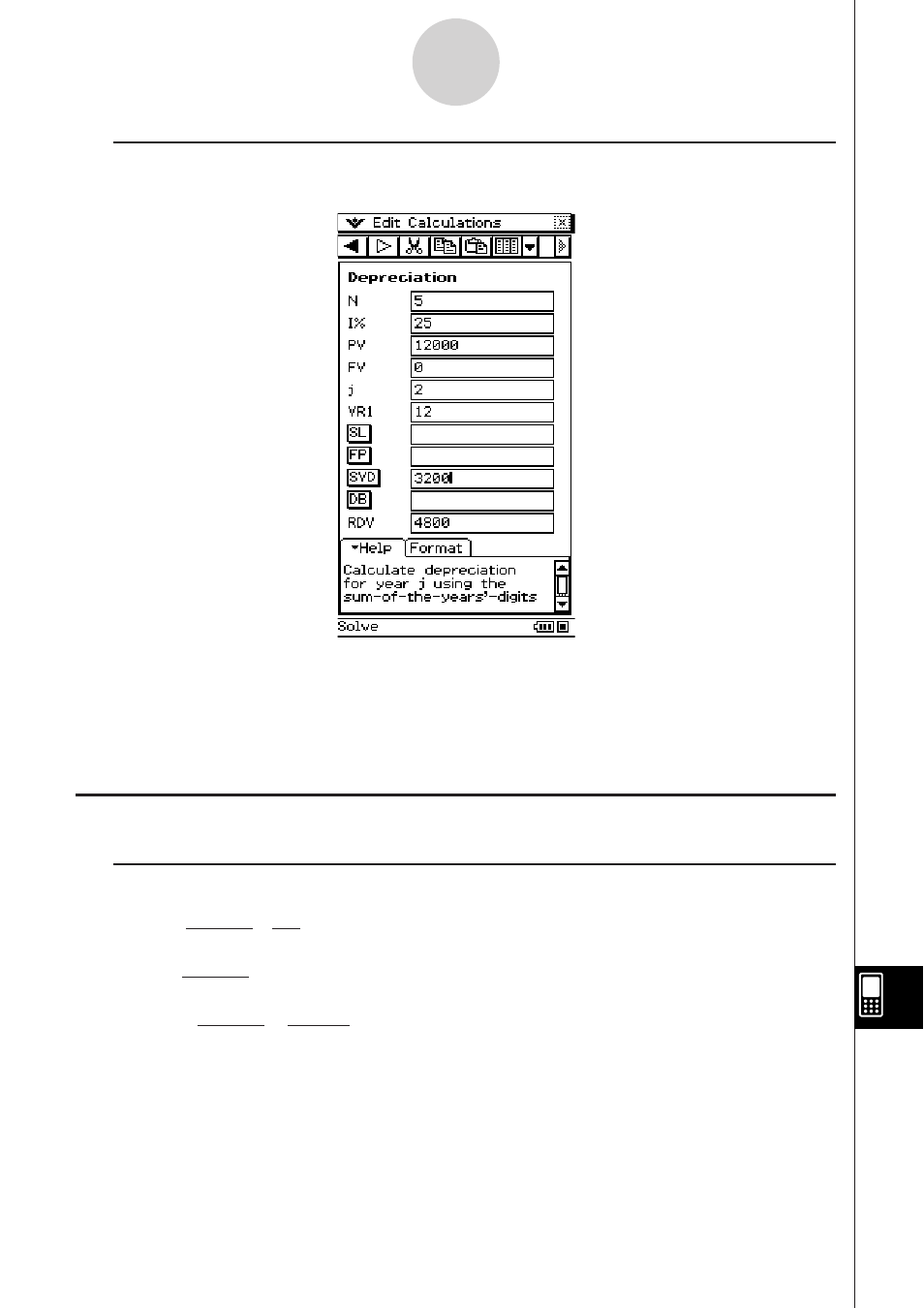

Now calculate the depreciation amount ([SYD]) for the second year (j = 2).

Note

• You can also tap [SL] to calculate depreciation using straight-line method, [FP] using fixed-

percentage method, or [DB] using declining-balance method.

• Each depreciation method will produce a different residual value after depreciation (RDV)

for the applicable year (j).

Calculation Formulas

I Straight-Line Method

YR

1

(PV–FV )

SL

1

=

n

12

×

(PV–FV )

SL

j

=

n

12– YR1

(YR1

G12)

(PV–FV )

n

12

×

SL

n

+1

=

15-9-3

Depreciation

This manual is related to the following products: