Calculation formulas -5-4, Calculation formulas – Casio CLASSPAD 330 3.04 User Manual

Page 853

20060301

15-5-4

Amortization

I%' =

I%

(1+

)

–1

[C / Y ]

[P / Y ]

100

× [C / Y ]

{ }

×100

i = I%'

÷100

Calculation Formulas

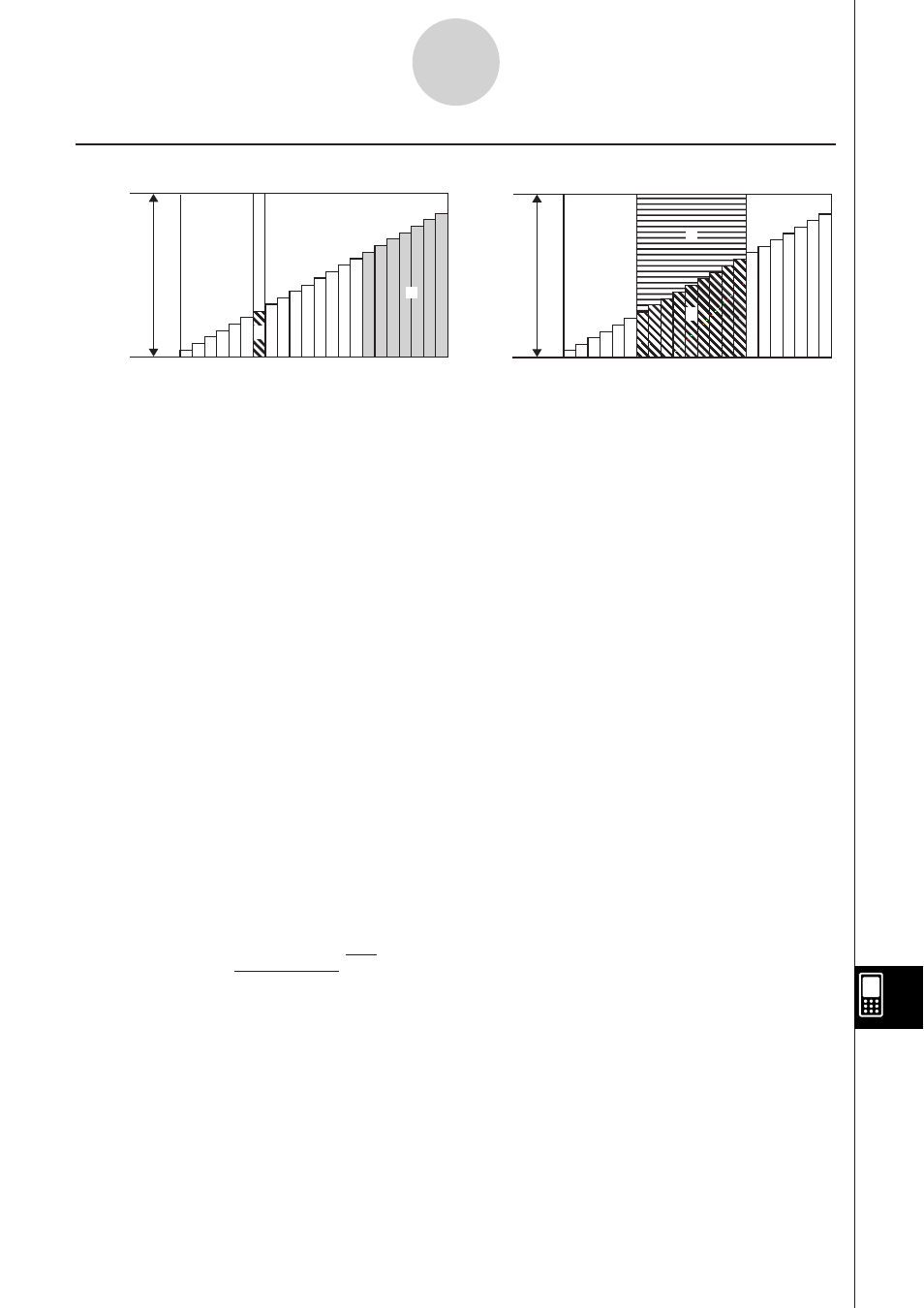

a: Interest portion of payment PM1 (INT)

b: Principal portion of payment PM1 (PRN)

c: Principal balance upon completion of payment PM2 (BAL)

d: Total principal paid from payment PM1 to payment PM2 (3PRN)

e: Total interest paid from payment PM1 to payment PM2 (3INT)

• a + b = one repayment (PMT)

Converting between the Nominal Interest Rate and Effective Interest Rate

The nominal interest rate (I % value input by user) is converted to an effective interest rate

(I %') for installment loans where the number of annual payments is different from the number

of annual compoundings calculation periods.

The following calculation is performed after conversion from the nominal interest rate to the

effective interest rate, and the result is used for all subsequent calculations.

1 payment

Number of Payments

1

PM1

PM2

Last

...............

..................

...............

d

e

INT

PM1

= I BAL

PM1–1

s i I s (PMT sign)

PRN

PM1

= PMT + BAL

PM1–1

s i

BAL

PM2

= BAL

PM2–1

+ PRN

PM2

3

PM1

+ PRN

PM1+1

+

....

+ PRN

PM2

PM2

PM1

INT = INT

PM1

+ INT

PM1+1

+

....

+ INT

PM2

PM2

PM1

BAL

0

= PV

.......................

Payment: End (Format tab)

INT

1

= 0

,

PRN

1

= PMT

...

Payment: Begin (Format tab)

c

a

b

1 payment

Number of Payments

1

PM1

PM2

Last

..............

.....................

............