9 depreciation, Depreciation, Depreciation fields -9-1 – Casio CLASSPAD 330 3.04 User Manual

Page 859: Depreciation fields

20060301

15-9-1

Depreciation

15-9 Depreciation

Depreciation lets you calculate the amount that a business expense can be offset by income

(depreciated) over a given year.

You can use a Depreciation page to calculate depreciation using one of four methods:

straight-line, fixed-percentage, sum-of-the-years’-digits, or declining-balance.

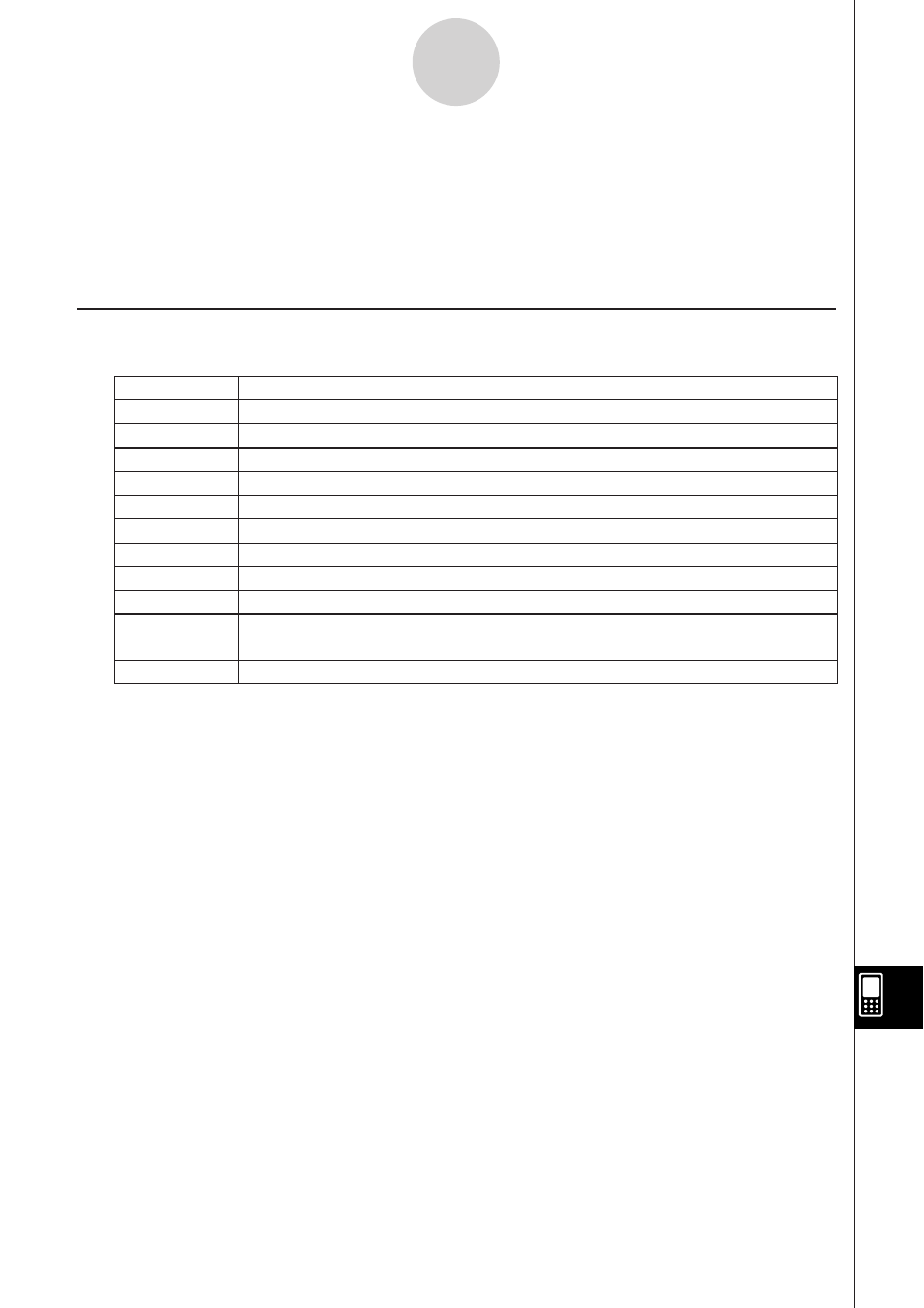

Depreciation Fields

The following fields appear on the Depreciation calculation page.

Field

Description

N

Number of years over which depreciation occurs

I%

Annual interest rate (as a percent)

PV

Present value (initial investment)

FV

Future value

j

Year for which depreciation is being calculated

YR1

Number of depreciable months in first year

SL

Calculate depreciation for year j using the straight-line method

FP

Calculate depreciation for year j using the fixed-percentage method

SYD

Calculate depreciation for year j using the sum-of-the-years’-digits method

DB

Calculate depreciation for year j calculated using the declining-balance

method

RDV

Residual value after depreciation for year j