Isblank – Apple Numbers '08 User Manual

Page 240

240

Chapter 12

Dictionary of Functions

IRR

The IRR function calculates the internal rate of return for an investment that is based on

a series of potentially irregular cash flows rather than fixed-interest income. The rate

returned is the rate that makes the net present value of a series of cash flows 0.

IRR(flows-range, [estimate])

flows-range: A range of cells that contain cash flow values. Positive values represent

income. Negative values represent expenditures. All values must represent equal

time intervals.

estimate: Optional; an initial estimate for the rate of return. If omitted, 10% is used.

Try adjusting the estimate if IRR fails to return a result.

ISBLANK

The ISBLANK function returns TRUE if the specified cell is empty and FALSE otherwise.

ISBLANK(cell)

cell: A reference to a table cell.

Examples

If cells A1:F1 contain -1000, 50, 50, 50, 50, 1050:

IRR(A1:F1) returns 5%, the rate of return if you invest $1,000 and receive $50 per year for 4 years and a

final payment of $1,050 in the fifth year.

To find the rate of return if you pay $20,000 for a machine, run the machine for 5 years generating

$8,000 per year, and then sell the machine at the end of the fifth year for $2,000, enter -20000, 8000,

8000, 8000, 8000, 10000 in cells A1:A6 and use the formula IRR(A1:A6). The value 30.06% is returned.

Examples

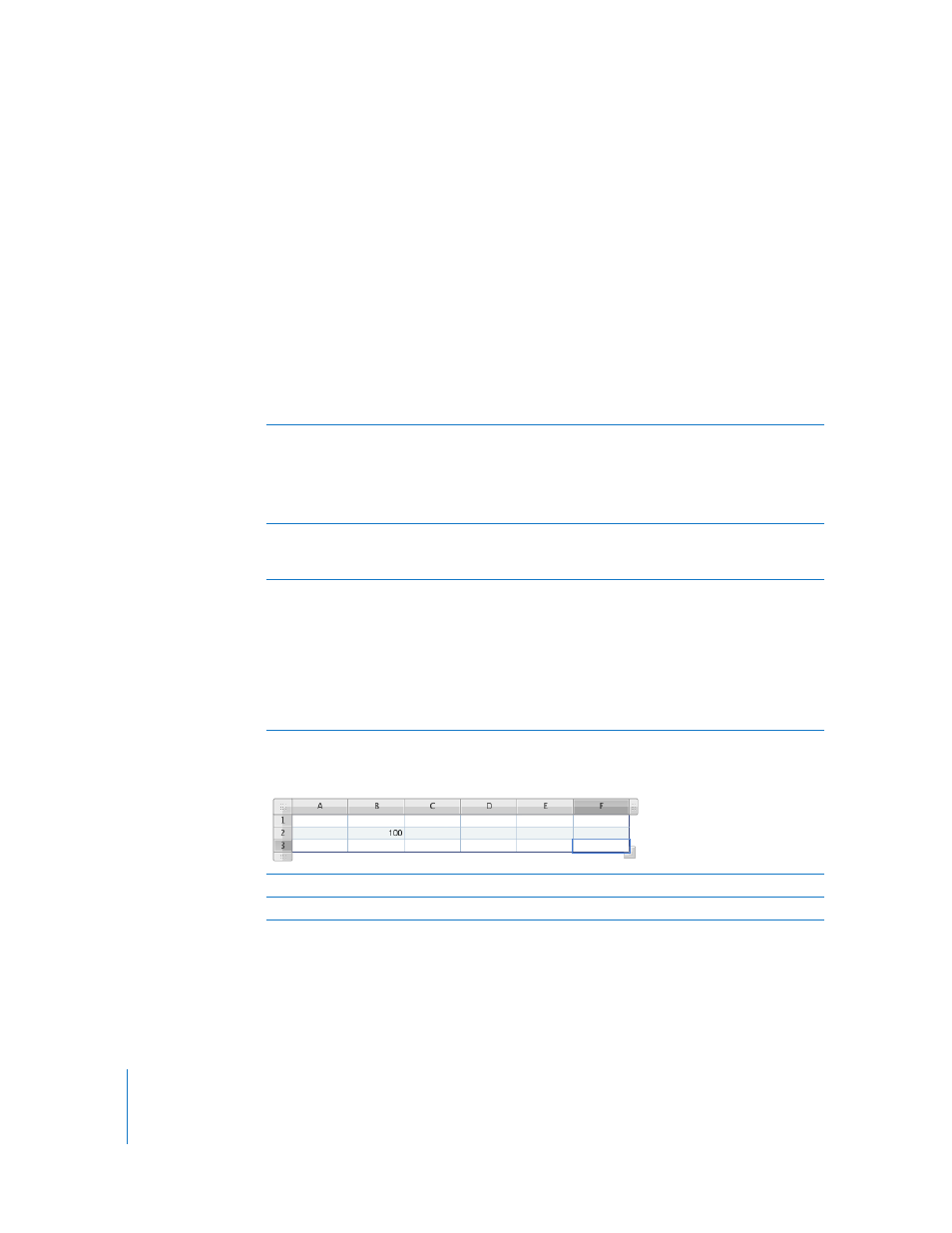

Given the following table:

ISBLANK(A1) returns TRUE.

ISBLANK(B2) returns FALSE.