Financial functions – Apple Numbers '08 User Manual

Page 196

196

Chapter 12

Dictionary of Functions

Financial Functions

These functions operate on numbers and require numeric expressions as arguments.

Unless otherwise stated, these functions return numeric values.

Numbers provides these financial functions.

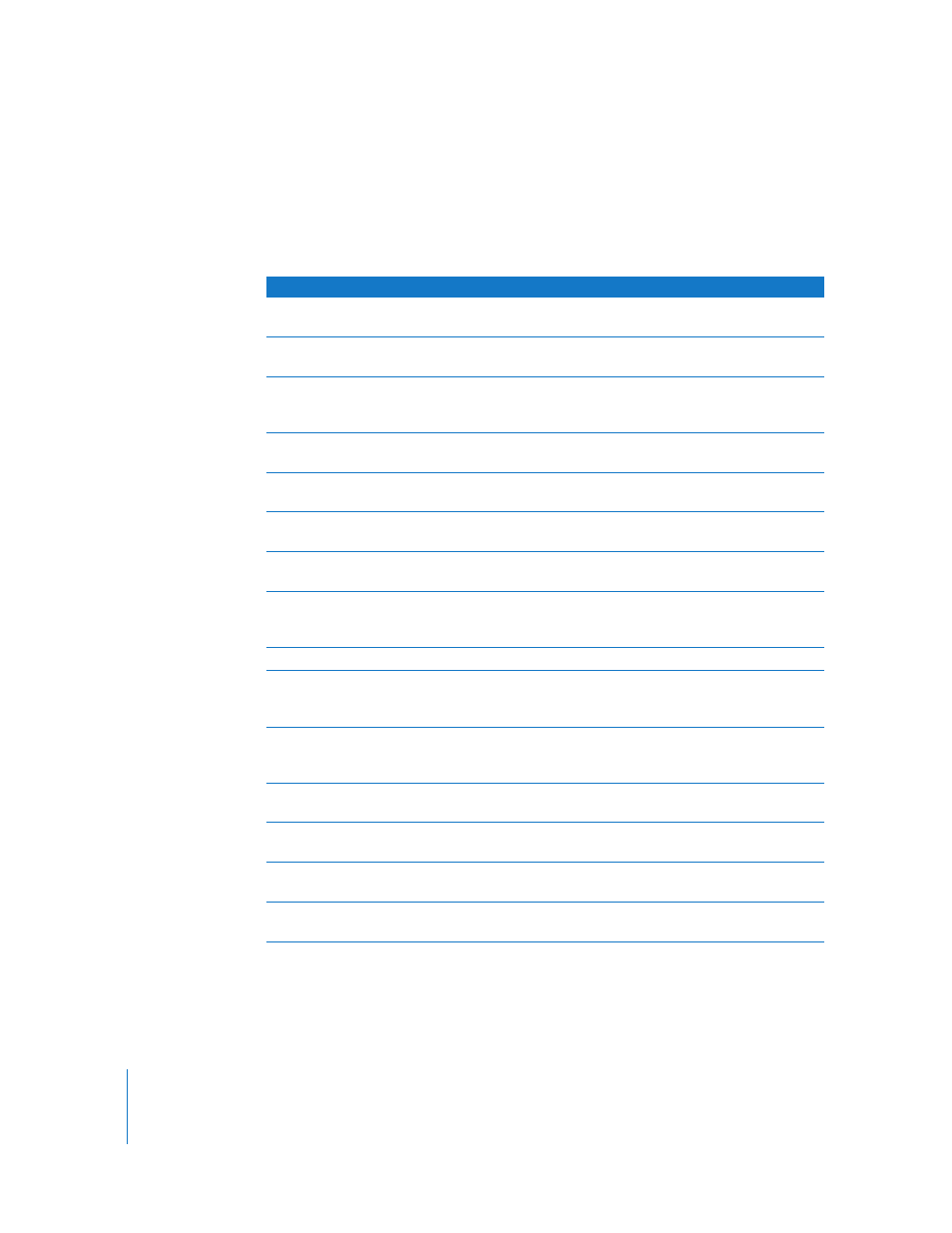

Function

Description

Calculates the total accrued interest for a security that pays

periodic interest.

Calculates the total accrued interest for a security that pays interest

at maturity.

COUPDAYBS (page 221)

Counts the number of days from the beginning of the coupon

period in which settlement of a security occurs to the settlement

date.

COUPDAYS (page 221)

Counts the number of days in the coupon period in which

settlement of a security occurs.

COUPDAYSNC (page 222)

Counts the number of days from the settlement date of a security

to the end of the coupon period in which settlement occurs.

Counts the number of coupons to be paid on a security between

the settlement date and the maturity date.

Calculates the depreciation of an asset for a specified period using

the fixed-declining balance method.

Calculates the depreciation of an asset based on a specified

depreciation rate. If you don’t specify a rate, it defaults to the

double-declining balance method.

Calculates the discount rate of a security.

Calculates the future value of an investment, given a series of fixed,

periodic added payments, the interest rate, and the number of

periods.

Calculates the interest portion of a payment for a loan or

investment based on periodic fixed payments and a fixed interest

rate.

IRR (page 240)

Calculates the internal rate of return for an investment that is based

on a series of cash flows.

Calculates the interest due for a particular payment period of an

investment.

MIRR ()page 250

Calculates the modified internal rate of return of a series of periodic

cash flows.

NPER (page 253)

Calculates the number of payment periods for a loan or investment

based on fixed payments and a fixed interest rate.