Ipmt – Apple Numbers '08 User Manual

Page 239

Chapter 12

Dictionary of Functions

239

IPMT

The IPMT function calculates the interest portion of a payment for a loan or investment

at a specified period based on fixed, periodic payments and a fixed interest rate.

IPMT(rate, period, num-periods, present-value, [future-value], [when-due])

rate: The interest rate for each period.

period: The period for which you want to find the interest.

num-periods: The number of periods in the life of the investment.

present-value: The present value of the loan or investment.

future-value: Optional; the target future value, if this in an investment. If omitted,

assumed to be 0.

when-due: Optional; specifies whether payments are made at the beginning or end

of each period:

0 (or omitted) means payments are at the end of each period.

1 means payments are at the beginning of each period.

Notes

Be sure that the interest rate is expressed as the rate per period. For example, if the

interest rate is 10% per year and the payment period is monthly, the rate used in the

function should be 0.1/12 (approximately 0.00833 per month).

Examples

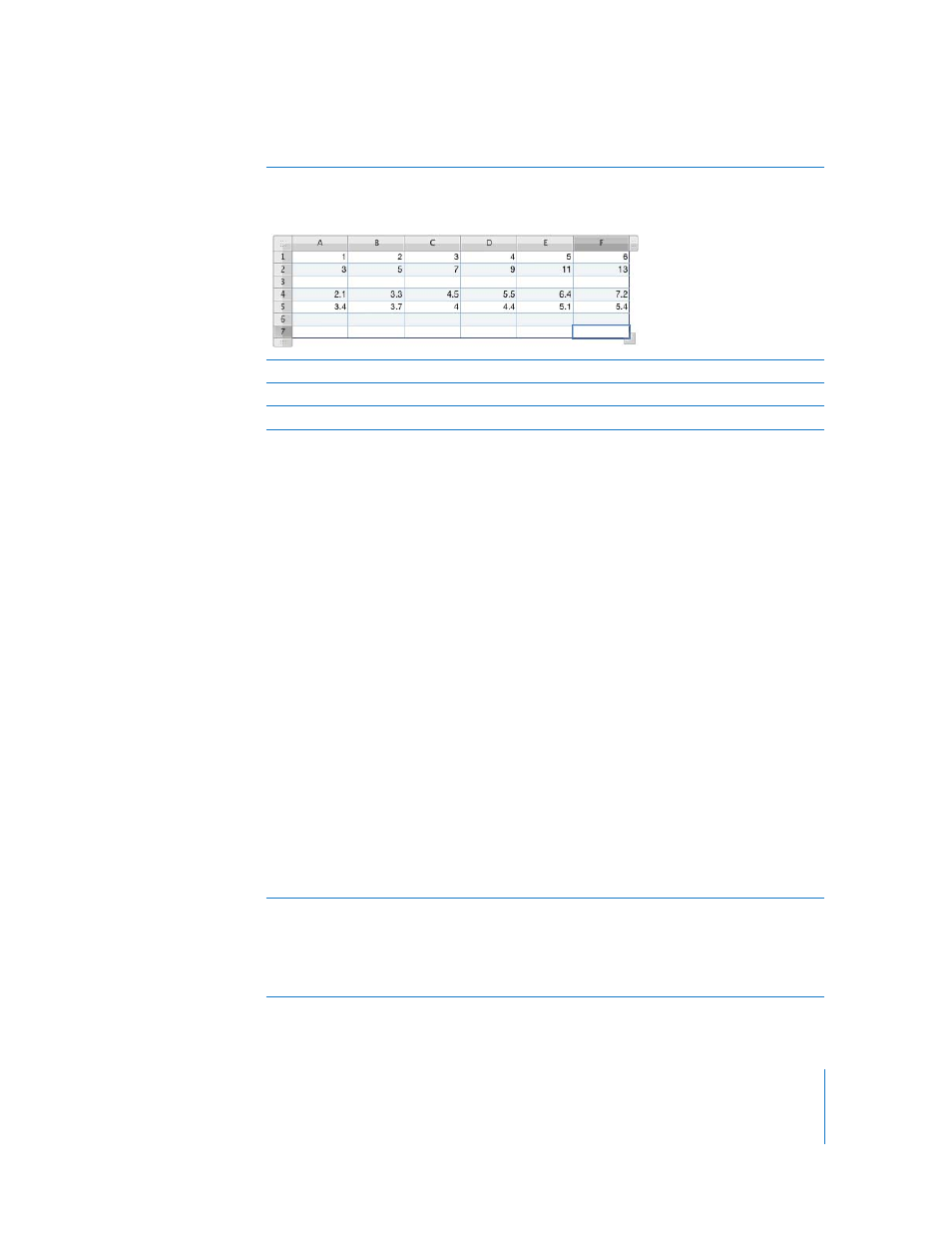

Given the following table:

INTERCEPT(A2:F2, A1:F1) returns 1.

SLOPE(A2:F2, A1:F1) returns 2.

INTERCEPT(A5:F5, A4:F4) returns 2.392.

Examples

To find the interest portion of the first payment on a $1000 loan at 12% annual interest with payments

due at the end of each month:

IPMT(0.12/12, 1, 12, 1000) returns -$10.