Rice Lake TransAct 3.5 User Manual

Page 139

Rates

Accounting

140

Version 3.5

The per load charge must be entered into the field used to calculate the rate of the item. For example,

if the transaction is calculated by weight, enter the delivery charge in the weight column (

Ton

, in our

example). If the transaction is calculated by

Yard

, enter the delivery charge in the

Yard

column. If the

transaction is calculated by

Count

, enter the delivery charge in the

Count

column.

The above figure shows a delivery rate for Woodchips and Treated Soil. Enter a

‘Y’

in the

Load (Ld)

column to have the amount entered applied to the transaction. A $35.00 delivery charge will be added

to all

Outgoing Woodchips

transactions and a $40.00 delivery charge will be added to all

Outgoing

Treated Soil

transactions.

A Final Rate Example

One final example will be used to summarize the use of rates and taxes. Strupp Trucking is hauling dirt

to customer’s home. Net Weight of the transaction totals 4,220 pounds or 2.11 tons. Using the taxes

and rates from the previous examples for

Treated Dirt

, the charge is calculated as follows.

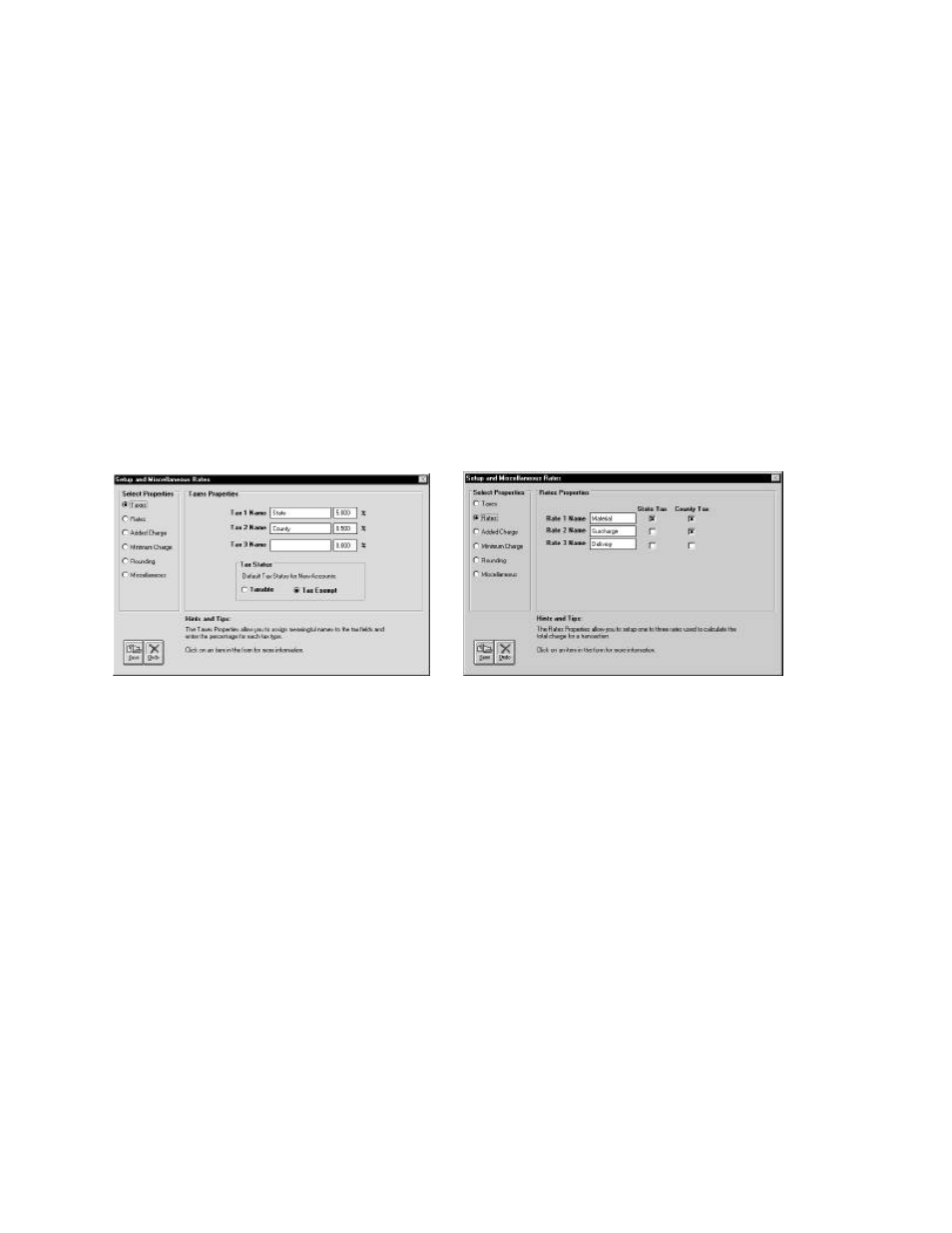

Figure 123. Tax and Rate setup

Material Rate

2.11 Tons

X

Material (Rate 1) $35.00

=

73.85

73.85

X

the State Tax (5%)

=

3.69

73.85

X

the County Tax (0.5%)

=

.37

Rate One total

=

77.91

Surcharge Rate

2.11 Tons

X

Surcharge (Rate 2) $0.00

=

0.00

0.00

X

the County Tax (0.5%)

=

0.00

Rate Two total

=

0.00

Delivery Rate

2.11 Tons

X

Delivery (Rate 3) $40.00

=

40.00

40.00

X

the State Tax (5%)

=

2.00

40.00

X

the County Tax (0.5%)

=

0.20

Rate Three Total

=

42.20