Rice Lake TransAct 3.5 User Manual

Page 132

Accounting

Setup and Miscellaneous Rates

Version 3.5

133

When

Prompt Before Applying

is turned on, the user will be prompted before a minimum is applied for

each rate type (e.g.

Material

,

Surcharge

, and

Delivery

).

NOTE:

Be sure to set the

Minimum Charge

for each

Rate Type

in the

Rate Table

.

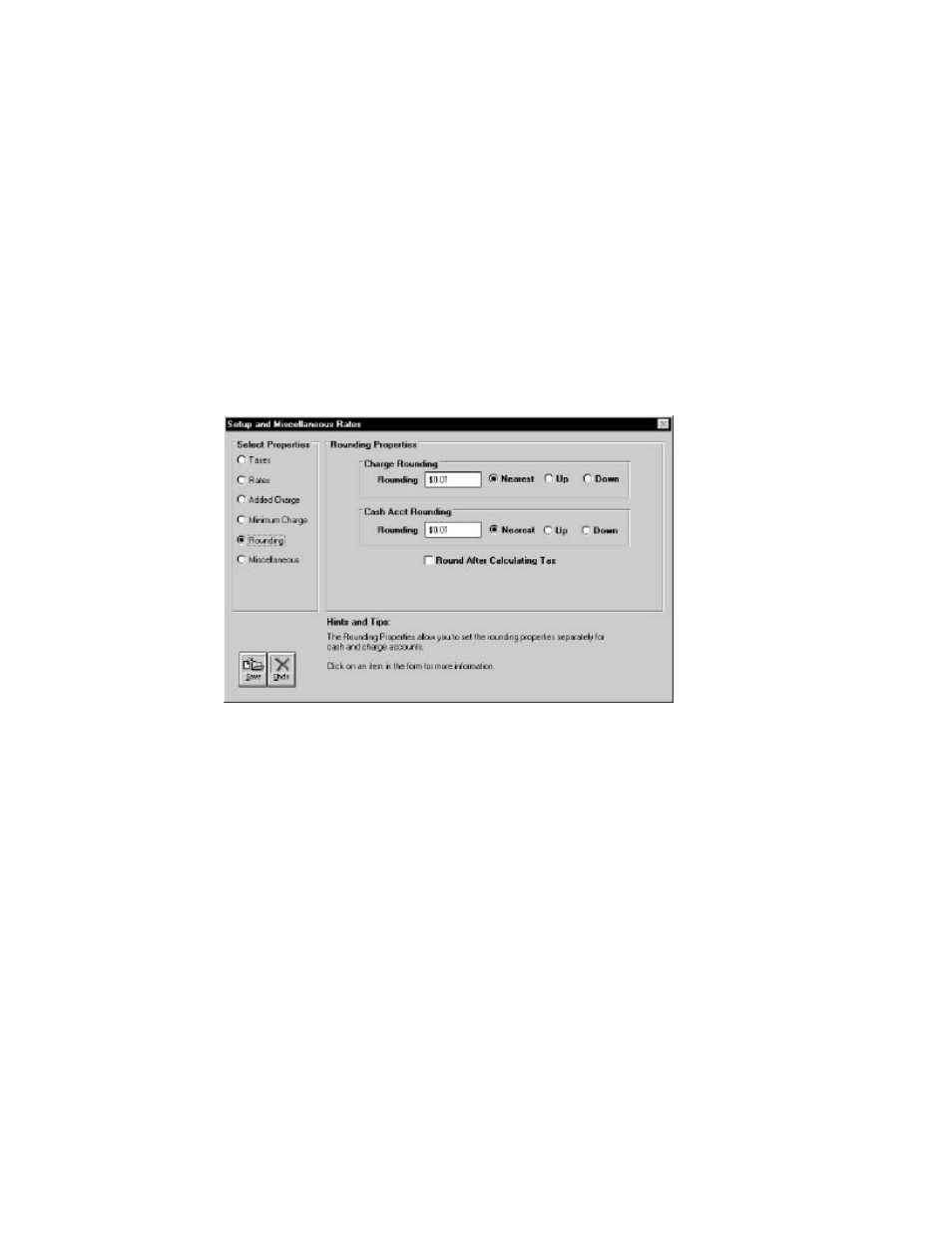

Charge and Cash Rounding Properties

Rounding can be setup to round differently for charge and cash transactions. For example, charge

accounts may be charged to the nearest penny, but cash accounts are rounded to the nearest quarter.

Rounding for

Charge

transactions applies to the base charge only. Sales tax and fixed charges are added

to the rounded base charge. The

Round After Calculating Tax

option is available only for cash

transactions and can only be used with the

Nearest

and

Down

options.

Figure 114. Cash and Charge Rounding

By default, rounding is to the nearest penny. Use this section to modify the rounding parameters. Charges

can be rounded

Up

to the next higher increment,

Down

to the next lower increment, or to the

Nearest

increment of the

Rounding Amount

.

Miscellaneous

Monthly Finance Charge

The

Monthly Finance Charge

must be entered as a percentage. The

Monthly Finance Charge

is applied

during

Statement

processing. A finance charge is applied to any unpaid previous balance when

statements are generated.

NOTE:

If some accounts are charged a monthly finance charge and others are not, enter individual

monthly finance charges for each customer account using the

Discounts and Account

Flags

table. The

Discounts

and Account Flags

table is covered later in this section.