Casio – Casio FX-CG10 User Manual

Page 282

CASIO

7-18

PRC

: price per $100 of face value

CPN

: coupon rate (%)

YLD

: annual yield (%)

A

: accrued days

M

: number of coupon payments per year (1=annual, 2=semi annual)

N

: number of coupon payments between settlement date and maturity date

RDV

: redemption price or call price per $100 of face value

D

: number of days in coupon period where settlement occurs

B

: number of days from settlement date until next coupon payment date = D − A

INT

: accrued interest

CST

: price including interest

• For one or fewer coupon period to redemption

• For more than one coupon period to redemption

u Annual Yield (YLD)

YLD is calculated using Newton’s Method.

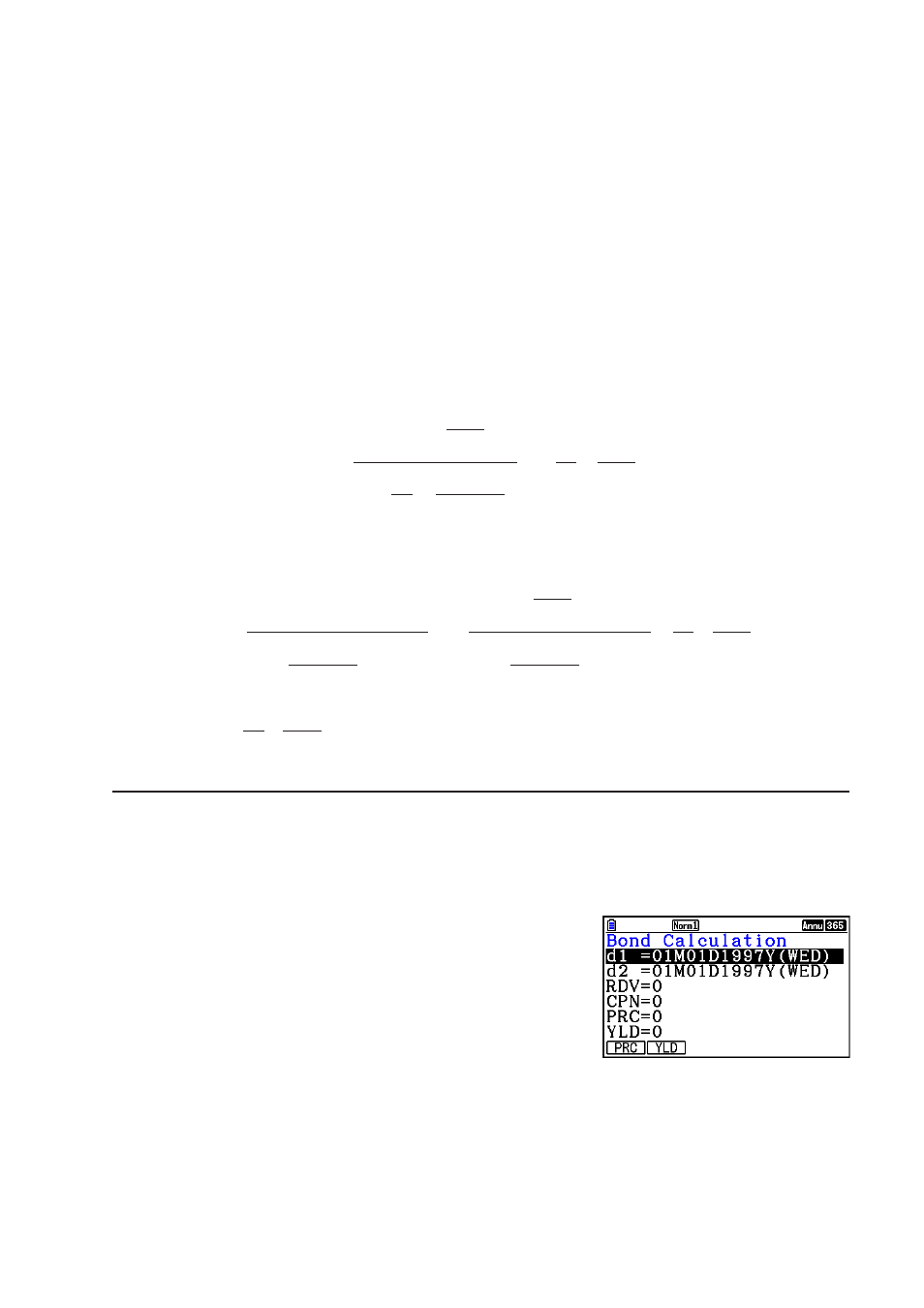

Press

4(BOND) from the Financial 2 screen to display the following input screen for Bond

calculation.

6( g) 4(BOND)

PRC =

+ (

– )

RDV

+

M

CPN

1+ (

×

)

D

B

M

YLD/

100

×

D

A

M

CPN

PRC =

+ (

– )

RDV

+

M

CPN

1+ (

×

)

D

B

M

YLD/

100

×

D

A

M

CPN

×

D

A

M

CPN

INT =

–

CST = PRC

+ INT

+

×

D

A

M

CPN

PRC =

–

–

RDV

(1+

)

M

YLD/

100

(1+

)

M

YLD/

100

M

CPN

Σ

N

k

=1

(N–1+B/D )

(k–1+B/D )

×

D

A

M

CPN

INT =

–

CST = PRC

+ INT

+

×

D

A

M

CPN

PRC =

–

–

RDV

(1+

)

M

YLD/

100

(1+

)

M

YLD/

100

M

CPN

Σ

N

k

=1

(N–1+B/D )

(k–1+B/D )