Depreciation, Casio – Casio FX-CG10 User Manual

Page 279

CASIO

7-15

• 360-day Date Mode Calculations

The following describes how calculations are processed when 360 is specified for the Date

Mode item in the Setup screen.

• If d1 and d2 are both the last day of February (day 28 in a normal year, day 29 in a leap

year), d2 is treated as day 30.

• If d1 is the last day of February, d1 is treated as day 30.

• If d2 is day 31 of a month and d1 is day 30 or day 31 of a month, d2 is treated as day 30.

• If d1 is day 31 of a month, d1 is treated as day 30.

9. Depreciation

Depreciation lets you calculate the amount that a business expense can be offset by income

(depreciated) over a given year.

• This calculator supports the following four types of depreciation calculations.

straight-line (

SL

), fixed-percent (

FP

), sum-of-the-years’-digits (

SYD

), or declining-balance

(

DB

).

• Any one of the above methods can be used to calculate depreciation for a specified period.

A table and graph of the depreciated amount and undepreciated amount in year

j

.

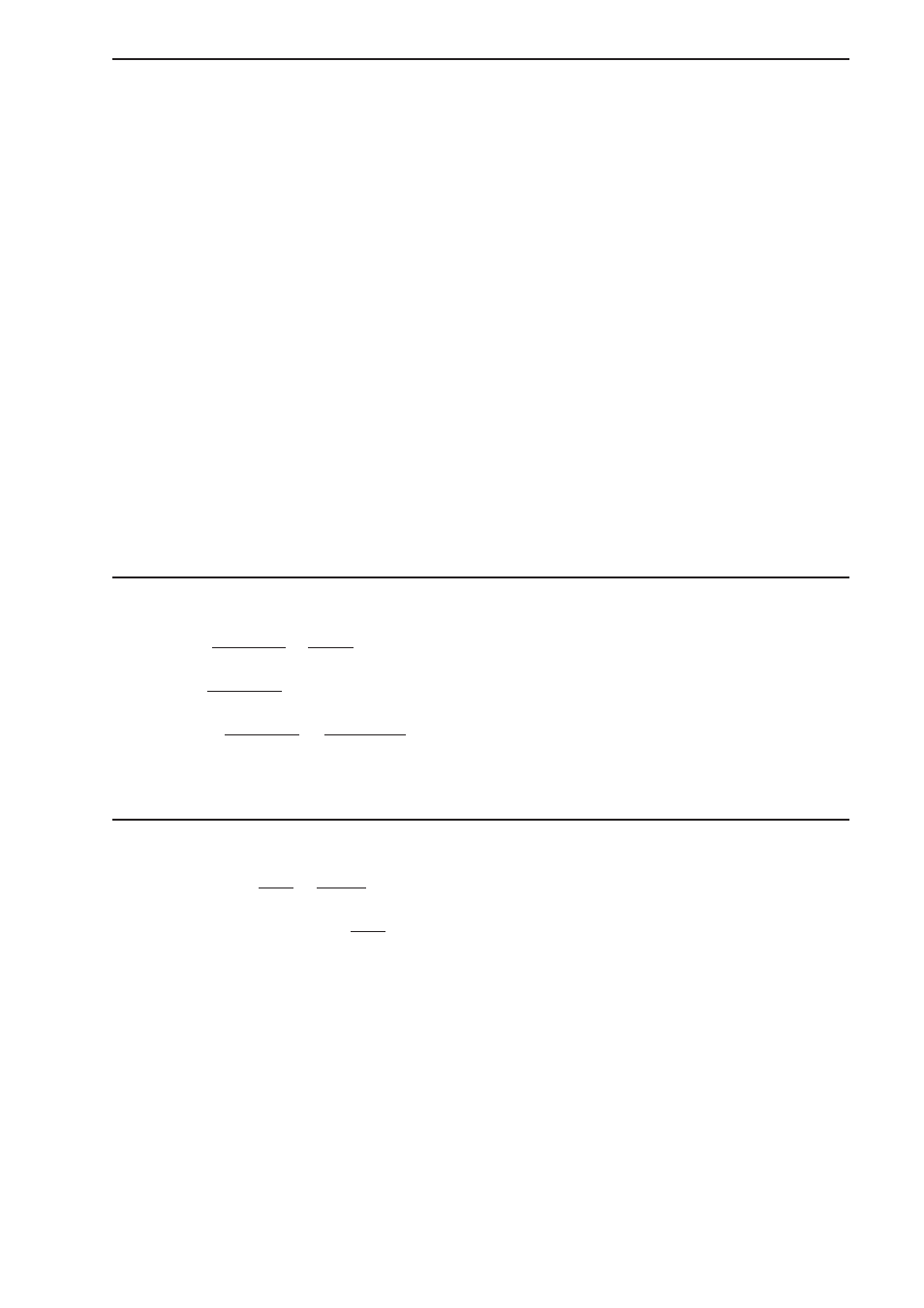

u Straight-Line Method (SL)

SL

j

: depreciation charge for the

j

th year

n

:

useful

life

PV

: original cost (basis)

FV

: residual book value

j

: year for calculation of depreciation

cost

Y

−1 : number of months in the first year

of depreciation

u Fixed-Percent Method (FP)

FP

j

: depreciation charge for the

j

th year

RDV

j

: remaining depreciable value at the

end of

j

th year

I

% :

depreciation

ratio

{Y–1}

(PV–FV )

SL

1

=

n

12

u

(PV–FV )

SL

j

=

n

12–{Y–1}

({Y–1}

≠12)

(PV–FV )

n

12

u

SL

n

+1

=

{Y–1}

(PV–FV )

SL

1

=

n

12

u

(PV–FV )

SL

j

=

n

12–{Y–1}

({Y–1}

≠12)

(PV–FV )

n

12

u

SL

n

+1

=

100

I%

FP

j

= (RDV

j

–1

+ FV

)

×

100

{Y–1}

I%

FP

1

= PV

Ч

12

Ч

FP

n

+1

= RDV

n

({Y–1}

≠12)

RDV

1

= PV – FV – FP

1

RDV

j

= RDV

j

–1

– FP

j

RDV

n

+1

= 0 ({Y–1}

≠12)

100

I%

FP

j

= (RDV

j

–1

+ FV

)

×

100

{Y–1}

I%

FP

1

= PV

Ч

12

Ч

FP

n

+1

= RDV

n

({Y–1}

≠12)

RDV

1

= PV – FV – FP

1

RDV

j

= RDV

j

–1

– FP

j

RDV

n

+1

= 0 ({Y–1}

≠12)