Point-of-sale setup, Setup pos (creating products) – Liquid Controls LCR 600 Setup & Op User Manual

Page 41

41

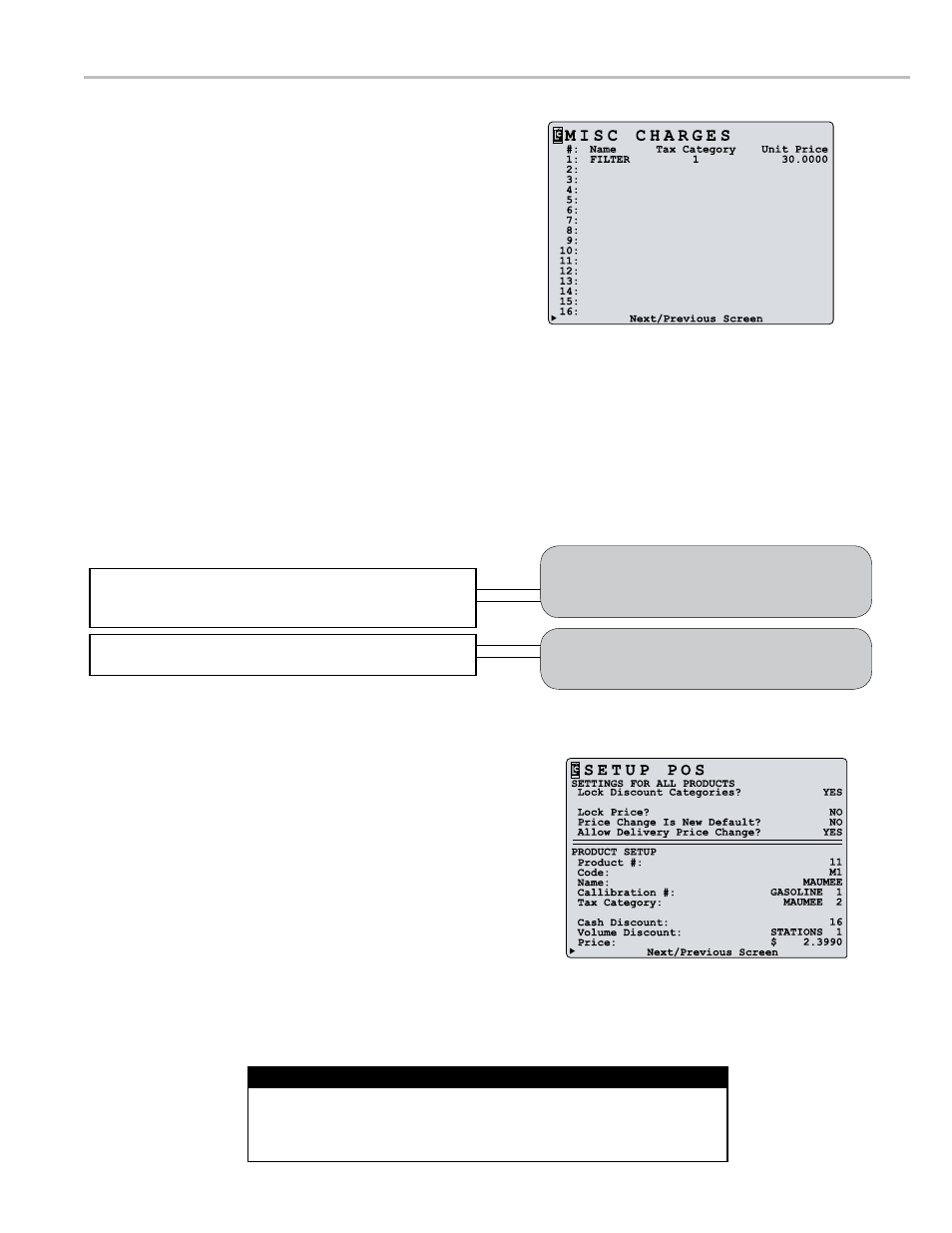

mISc chargeS

Name:

(fE)

c - u

The name or description of the selected cash discount

category.

Tax Category:

(LB)

c - u

The tax category applied to the miscellaneous charge.

Choices include tax categories 1 through 16, no tax, same tax

as product.

1

through

16 • None • Same as Product

Unit Price:

(fE)

c - u

The price per unit of the miscellaneous charge.

Setup poS (creating products)

After the tax structures and discounts are entered, you can begin creating products. A product is a unique combination

of a calibration, a tax structure, a volume discount, a cash discount, and a price. On the setup POS screen, under

PROdUCT SeTUP

, the fields below the double line allow you to name the product and assign a calibration a tax

structure, discounts, and a price. The LCR 600 provides for 100 different products. All 100 products are all available

for selection in the delivery screens.

poInt-of-Sale Setup

To create a product:

1. Move the pointer

to the Product #:

field and press

EntEr. Enter a number between 1-100. Make sure the

number has not been used for a previous product.

2. Move the pointer

to the Code

: field and press EntEr.

Enter a code unique to this product.

3. Move the pointer

to the Name

: field and press EntEr.

Enter a name unique to the product.

4. Move the pointer

to the Calibration #

: field and

press

EntEr. Enter the number of the calibration used to

prove the product.

5. Move the pointer

to the Tax Category

: field and

press

EntEr. Select one of the preset tax categories for

the product.

6. Move the pointer

to the Cash discount

: field and

press

EntEr. Select one of the preset cash discounts for

the product.

7. Move the pointer

to the Volume discount

: field and

press

EntEr. Select one of the preset volume discounts

for the product.

8. Move the pointer

to the Price

: field and press

EntEr. Enter the price of the product.

Be careful.

Product #

s can be overwritten. Don’t

accidentally overwrite a

Product #

currently in

use.

Code #

s are often the same as codes employed

by company’s office records.

If you don’t want to apply a cash discount, volume discount or a tax structures to

a product, select a number that has not been programmed with a discount or a

tax. See Cash Discounting on page 44.

no Discounts?