Point-of-sale setup, Tax categories – Liquid Controls LCR 600 Setup & Op User Manual

Page 37

37

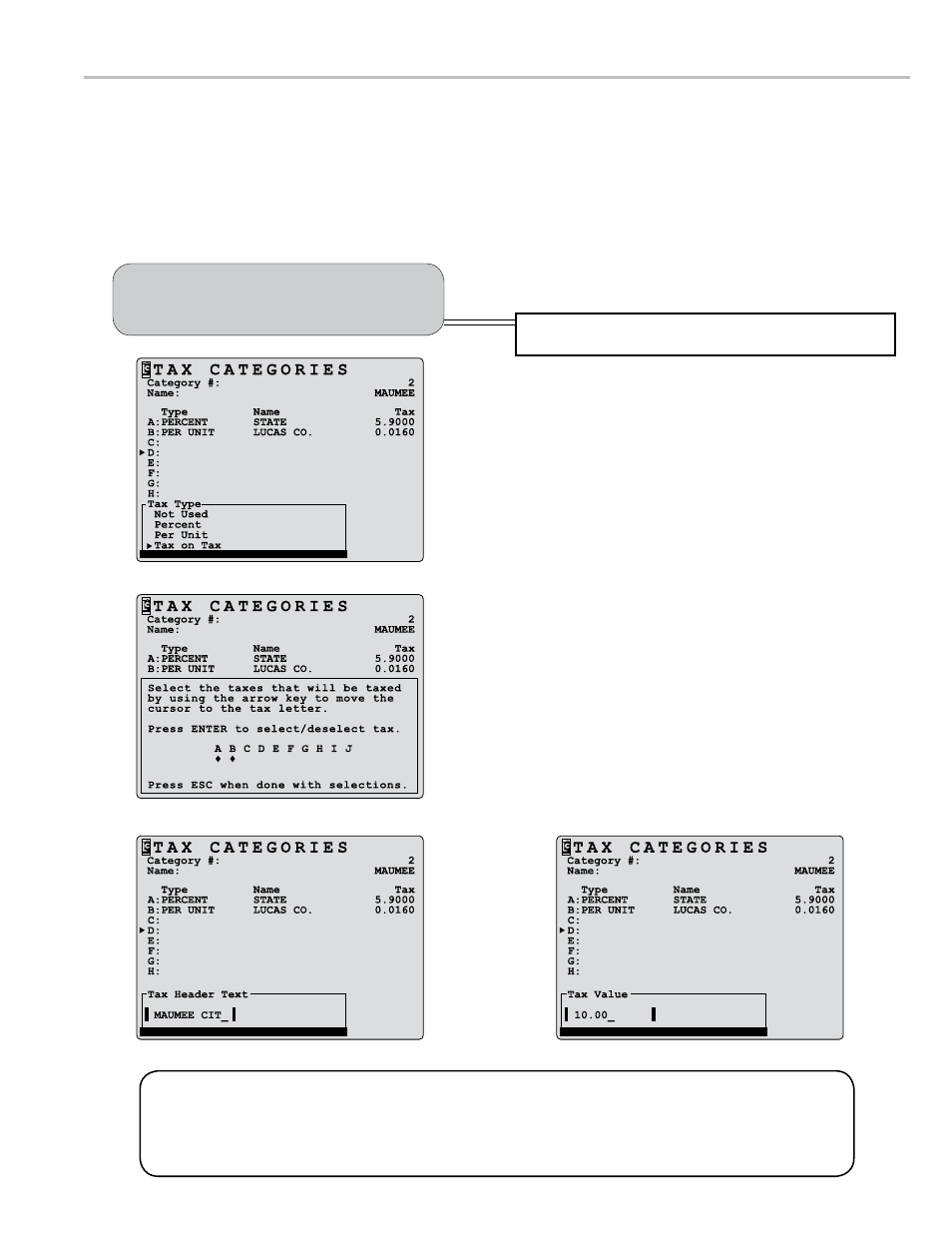

Tax categories

You can setup 16 different tax categories (or tax structures) in the LCR 600 POS. Each tax category has ten blank

lines where you can enter taxes and build a tax structure. The LCR 600 will apply a tax as either a percent of the

delivery total, a numerical quantity applied per unit delivered, or a percent tax on other taxes. When a tax category is

completed, it can be added to a product in the Setup POS screen, and when that product is selected for a delivery,

the LCR 600 will apply the tax category to the delivery total and print a short summary of the taxation on the delivery

ticket.

To setup a tax category:

1. Navigate to the Tax Categories screen in the Setup POS

application.

2. Select a category number (1-16) from the Category #:

field.

3. Enter a name for the category number in the Name

: field.

4. Move the pointer

to A:

field and press enter. The LCR

600 will bring up the Tax Type list box (followed by the

Tax Header Text

field edit box and the Tax Value

field edit box).

5. Select the tax type from the Tax Type list box. The LCR

600 will then bring up the Tax Header Text

field edit

box.

5a. If Tax on Tax is selected from the Tax Type list box,

a window will appear on the screen asking you to select

which taxes should receive the Tax on Tax. The letter

of the fields receiving the will be displayed in the Type

column.

6. Enter a name for the tax type in the Tax Header Text.

The LCR 600 will then bring up the Tax Value

field edit

box.

7. Enter the value of the tax in the Tax Value

field edit

box.

8. Move the pointer

to B: and press enter. Repeat steps

5 to 7.

9. Complete the lettered fields until you have built your

entire tax structure.

tax typeS

Not Used

typically used to erase an existing tax line item.

Percent

a percentage, the Tax Value, of the delivery subtotal added to the total.

Per Unit

a fixed amount, the Tax Value, charged per unit of delivered product.

Tax on Tax

a percentage, the Tax Value, of the delivery subtotal and other selected taxes added to the total.

Be careful.

Category #

s can be overwritten.

Don’t accidentally overwrite a

Category #

currently in use.

poInt-of-Sale Setup

Tax Header Text Field Edit Box

Tax on Tax - Application to Other Taxes

Tax Type List Box

Tax Value List Box