Account information, Price and tax – Liquid Controls DMS Delivery User Manual

Page 24

24

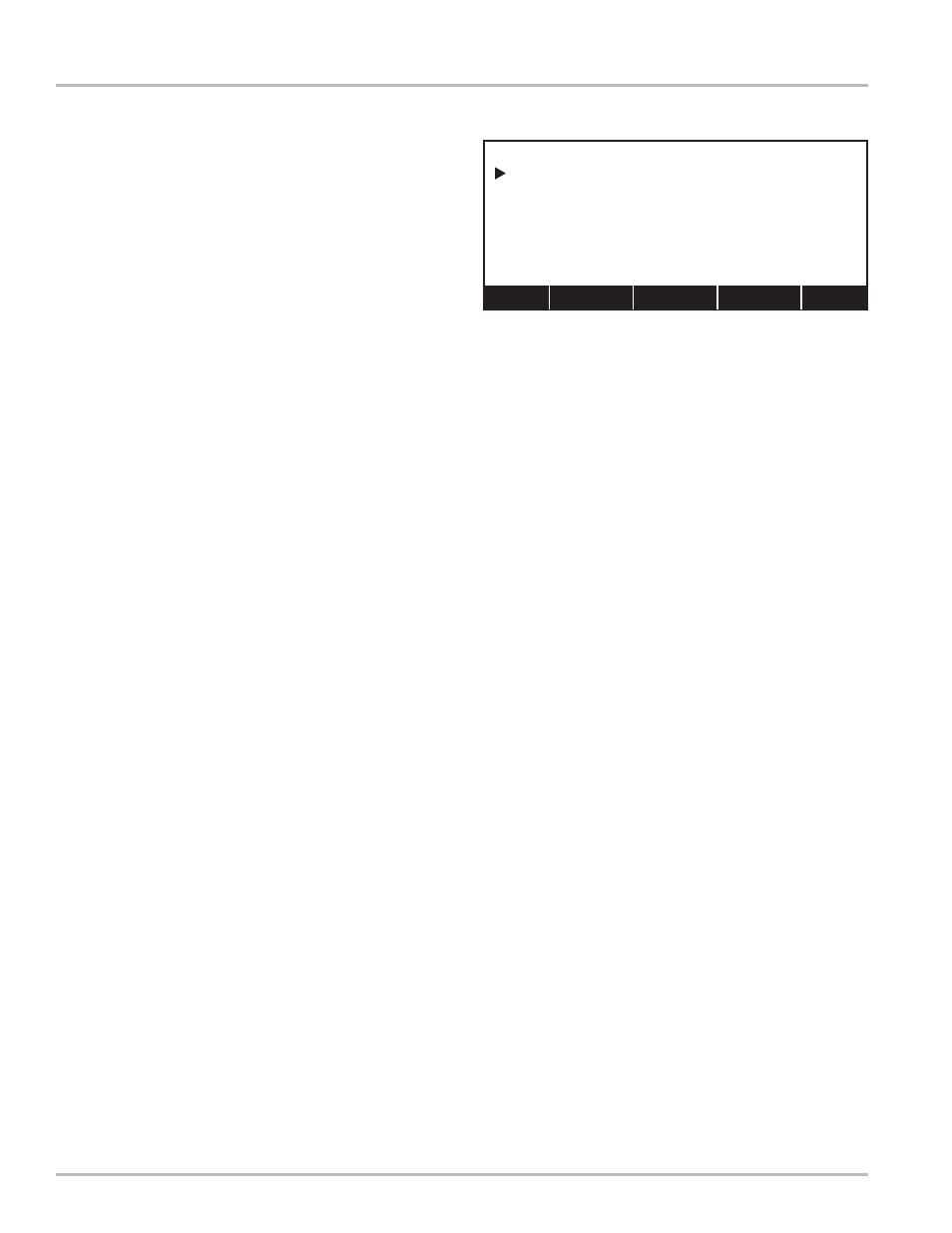

Price and Tax

The Price and Tax screen is used to select the pricing

and tax structure for the next delivery.

PRICE PER GALLON

Opens a field edit window where you can enter a new

(or change the existing) price per gallon for the next

delivery.

TAX CODE

Opens a list box window of available tax codes. A tax

code is a framework of taxes that can be applied to

customers. If no codes are found on the list, the field will

remain blank. New tax codes can only be added by the

DMS Office program.

Existing customers should have a tax code assigned to

their account, and a code can be applied to new

customers using the Tax Code option.

VIEW TAX APPLIED

This field displays one of the individual taxes included in

the selected tax code. The reference number (or name)

of the individual tax is displayed on the right. To scroll

through the individual taxes, use Next (F1) and Prev (F2).

(Type of tax) and (Description of the tax) will change

according to the office computer’s configuration of the

tax.

(TYPE OF TAX)

Contains a type of the tax selected and the value or rate

of that tax. Common types of taxes are: Percent Tax, Per

Unit Tax, Tax on Tax, and Flat Fee.

To change the rate of a tax, select (Type of tax) to open

a field edit window. Rates will return to their defaults after

the next delivery.

(DESCRIPTION OF TAX)

This field displays the description of the individual tax

shown in View Tax Applied. The description is configured

by the office computer, and can not be modified.

Account Information

0.0000

100

1000

0.0000

PRICE AND TAX

Price per gallon:

Tax Code:

View Tax Applied:

(Type of tax)

(Description of the tax)

Next Prev Util Back

Next (F1) scrolls forward through Tax Applied according to selected

Tax Code

Prev (F2) scrolls backwards through Tax Applied according to

selected Tax Code

Util (F3) opens to Utilities menu (pg 27)

Back (F4) returns to Select Customer (pg 15)