Table tax – Sharp UP-600 User Manual

Page 193

193

Table tax

Your POS terminal has an automatic tax calculation feature which allows you to program four tax tables.

Automatic tax calculations require you to program, in addition to the tax table, the tax status of each

pertinent department, PLU, and function key.

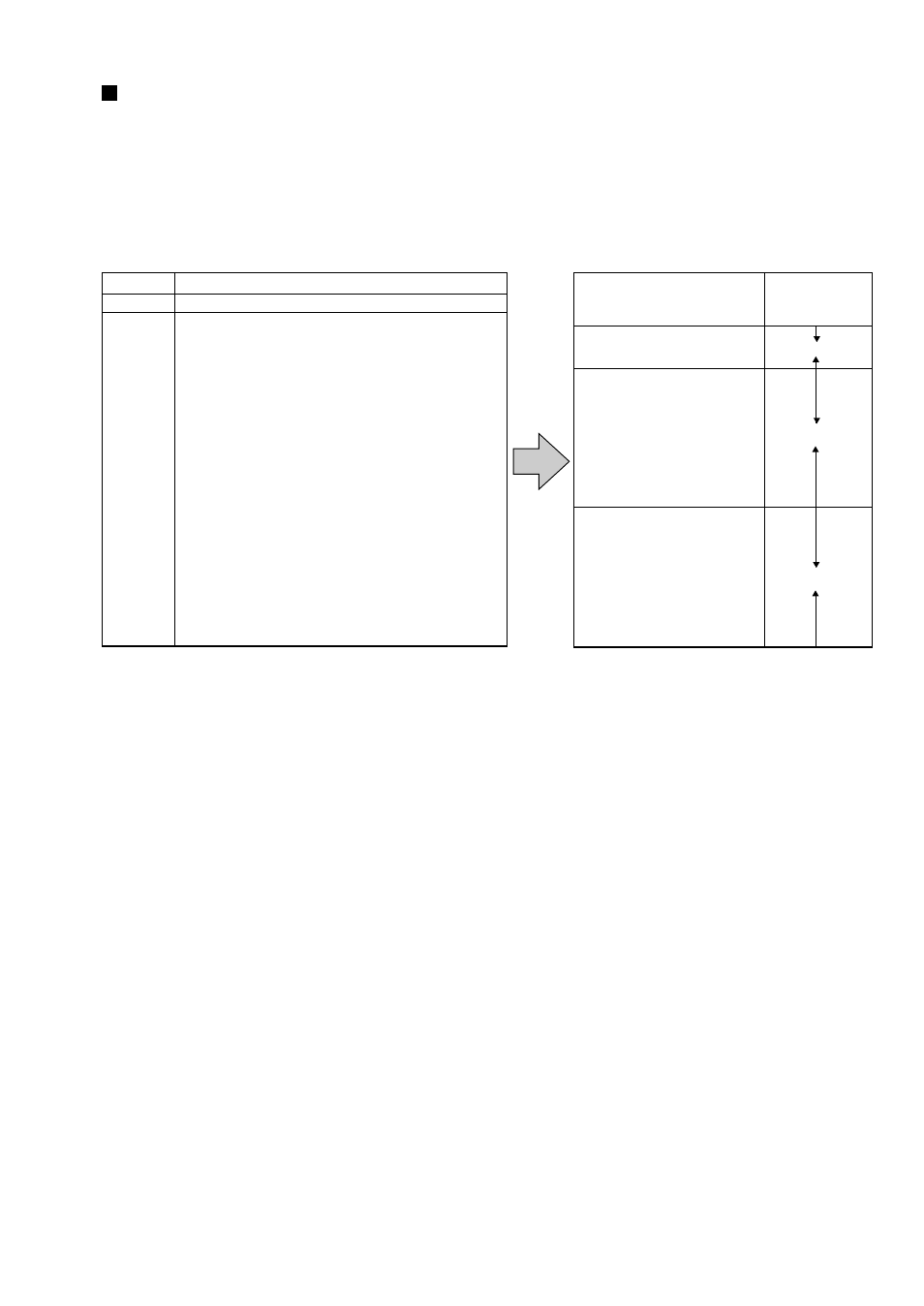

Sample tax table

New Jersey tax table: 6%

To program a tax table, first make a table like the right table shown above.

From the tax table, calculate the differences between a minimum breakpoint and the next one (A). Then,

from the differences, find irregular cycles (B) and regular cycles (C and D). These cycles will show you the

following items necessary to program the tax table:

T:

Tax amount collected on the minimum taxable amount (Q)

Q:

Minimum taxable amount

M1:

Maximum value of the minimum breakpoint on a regular cycle (C).

We call this point “MAX point.”

M2:

Maximum value of the minimum breakpoint on a regular cycle (D).

We call this point “MAX point.”

M:

Range of the minimum breakpoint on a regular cycle: difference between Q and M1 or between M1

and M2

Range of sales amount

Tax

Minimum breakpoint

Maximum breakpoint

.00

0

.01

to

0

.10

.01-T

0

.11-Q

to

0

.22

.02

0

.23

to

0

.38

.03

0

.39

to

0

.56

.04

0

.57

to

0

.72

.05

0

.73

to

0

.88

.06

0

.89

to

1.10

.07

1.11-M1

to

1.22

.08

1.23

to

1.38

.09

1.39

to

1.56

.10

1.57

to

1.72

.11

1.73

to

1.88

.12

1.89

to

2.10

.13

2.11-M2

to

2.22

A: Difference between a

minimum breakpoint and

the next one (¢)

-

10 (0.11 - 0.01)

B: Non-cyclic

12 (0.23 - 0.11)

16 (0.39 - 0.23)

18 (0.57 - 0.39)

C: Cyclic 1

16 (0.73 - 0.57)

16 (0.89 - 0.73)

22 (1.11 - 0.89)

12 (1.23 - 1.11)

16 (1.39 - 1.23)

18 (1.57 - 1.39)

16 (1.73 - 1.57)

D: Cyclic 2

16 (1.89 - 1.73)

22 (2.11 - 1.89)

......

......

.....

.....

......

......

.....

.....

........

........

.....

.....

........

........

.....

.....