Dd o – Toshiba TEC MA-315-100 User Manual

Page 43

Attention! The text in this document has been recognized automatically. To view the original document, you can use the "Original mode".

E01 -11069

NOTES 1.

2

.

3.

4,

5.

6.

The tax tables of Чах V% Чах 2“, and “GST” should be programmed in

Chapter 43. Tax Table Setting”. Those tax tables will become effective in

”REG”, ”MGR” or “ El” mode for adding the taxes to sale items entered

through a Department Keys only when the Department Key is programmed

with taxable status for the required tax in this operation.

Every time each of the [RTNMDSE], [TXVM}, [TX2IM], [GST/M] and

[FSfM] keys in this operation is pressed, the preset status is reversed. For

example, if a Department Key is already set with Чах 1 Taxable” status

and the [TXIIMJ key is pressed during the setting sequence of that

Department Key, it is now set with Чах 1 Non-taxable” status. If [TX1/M]

is again pressed, Чах 1 Taxable” status is again obtained.

The tax (PST) status obtained (as the result of [TX1/M] and/or [TX2/M]

depressions) can be verified by reading the numeric value displayed in the

rightmost digit of the AMOUNT portion when the individual Department Key

is pressed. Similarly, the Key Type status is displayed in the 2nd digit (next

to the rightmost digit).

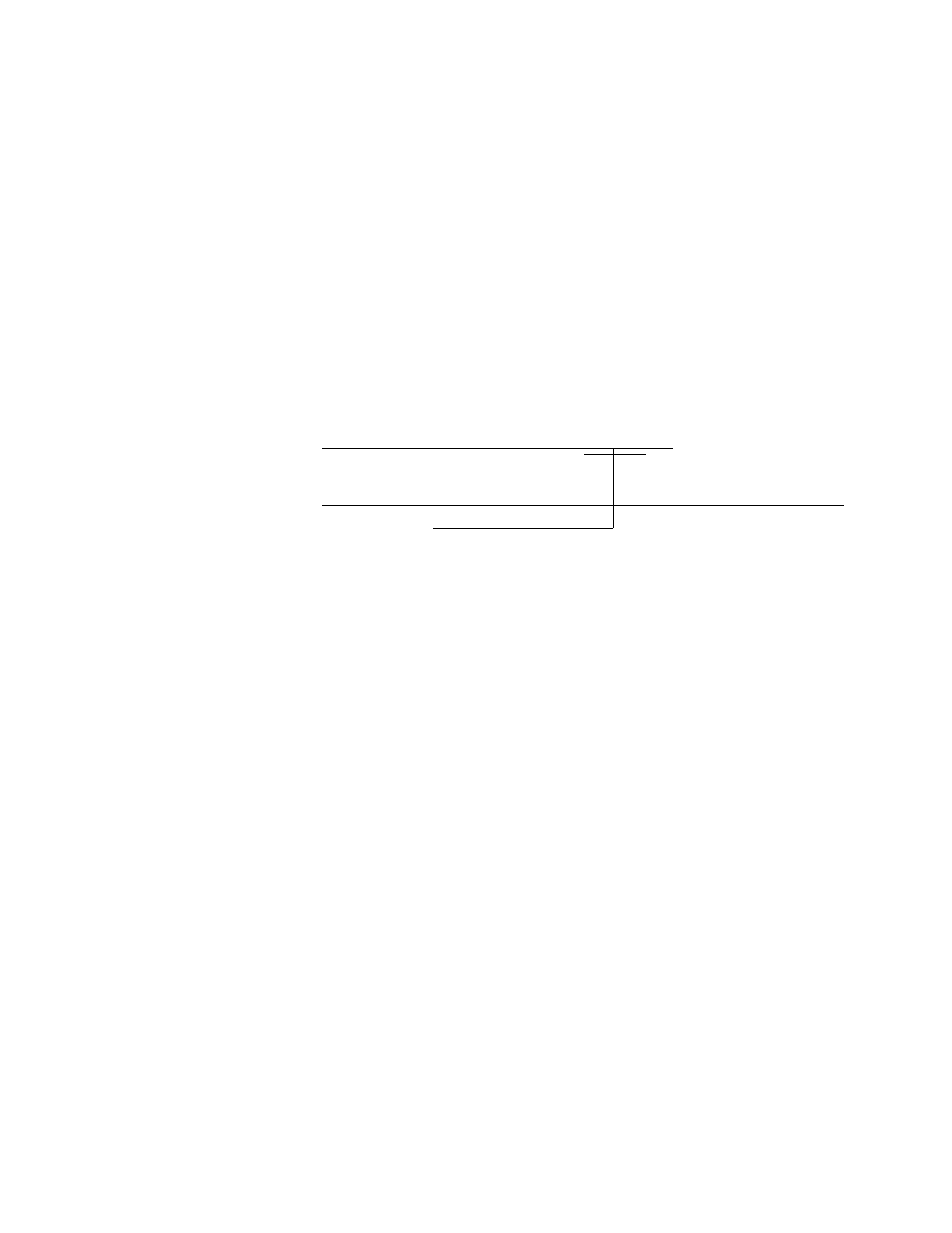

DP

AMOUNT

DD o,[

“Г

I

ni

1 P

or

I

“Ü" fixed

to indicate the

Displays the

1

obtained Tax (PST)

Department

Displays 0, 1, 4, or 5 to

status.

No.:

indicate the Key Type status.

0: Non-taxable

01 to 15

0: Itemized

1: Single-item

4: Other Income

1: Tax 1 Taxable

2: Tax 2 Taxable

3: Both Tax 1 &

5: Single-Item & Other

Income (1 + 4)

Tax 2 Taxable

(These status codes are also printed on the program receipt issued when

the final [AT/TL] key is pressed; refer to the Receipt Format on next page.)

The Negative/Positive status, GST status and Food Stamp status can only

be verified on the program receipt (refer to next page) but not in the display.

If a wrong status has been set, correct it by performing the programming

operation again.

If a Department Key is set with Negative status, an amount entered through

that key is subtracted from the sale total. It may be used for item entries of

coupons, returned bottles, etc.

Key Type Description

Itemized Key:

When a sale item amount is entered through this

key, the sale is not finalized until a media key (such

as [AT/TL]) is operated. Other items can be

entered within one sale receipt sequence.

Single-item Key:

A sale item entry through this key will automatically

finalize the sale as cash outside a sale (i.e. when

no other items have been entered within one receipt

sequence). However, it will hinction just as an

Itemized Key if operated inside a sale.

Other income Key: It is used to enter items which do not directly

become sales for the store, such as lottery,

postage, gift wrapping fee, size adjustment fee,

utility (payment of electricity and gas), and donation.

-41 -