Address: q, Address 1 – Toshiba TEC MA-85-100 User Manual

Page 88

Attention! The text in this document has been recognized automatically. To view the original document, you can use the "Original mode".

EOl-11072

Bit 7:

RESET (Receipt-format) ...Each transaction entry will print a sale receipt with the Store

Name stamp printed. The receipt is cut and handed to the

customer. If journal recording is required, you can use 2-ply

paper rolls.

SET (Journal-format) ...The sales data will be printed in a journal format, eliminating

store name stamping, line feeding, etc. When this status is

selected, receipts will not be Issued from the register.

Bit 8:

RESET (Cashier Signing Method) ... A maximum of 4 cashiers can operate the

register. Refer to Chapter 18 for further details.

SET (Nothing) ... The register will operate without any cashier identifying operation.

Address: Q

(Tax Status)

¡Initial SET Bit Nos.i.

Your Selection —

□□□□□□

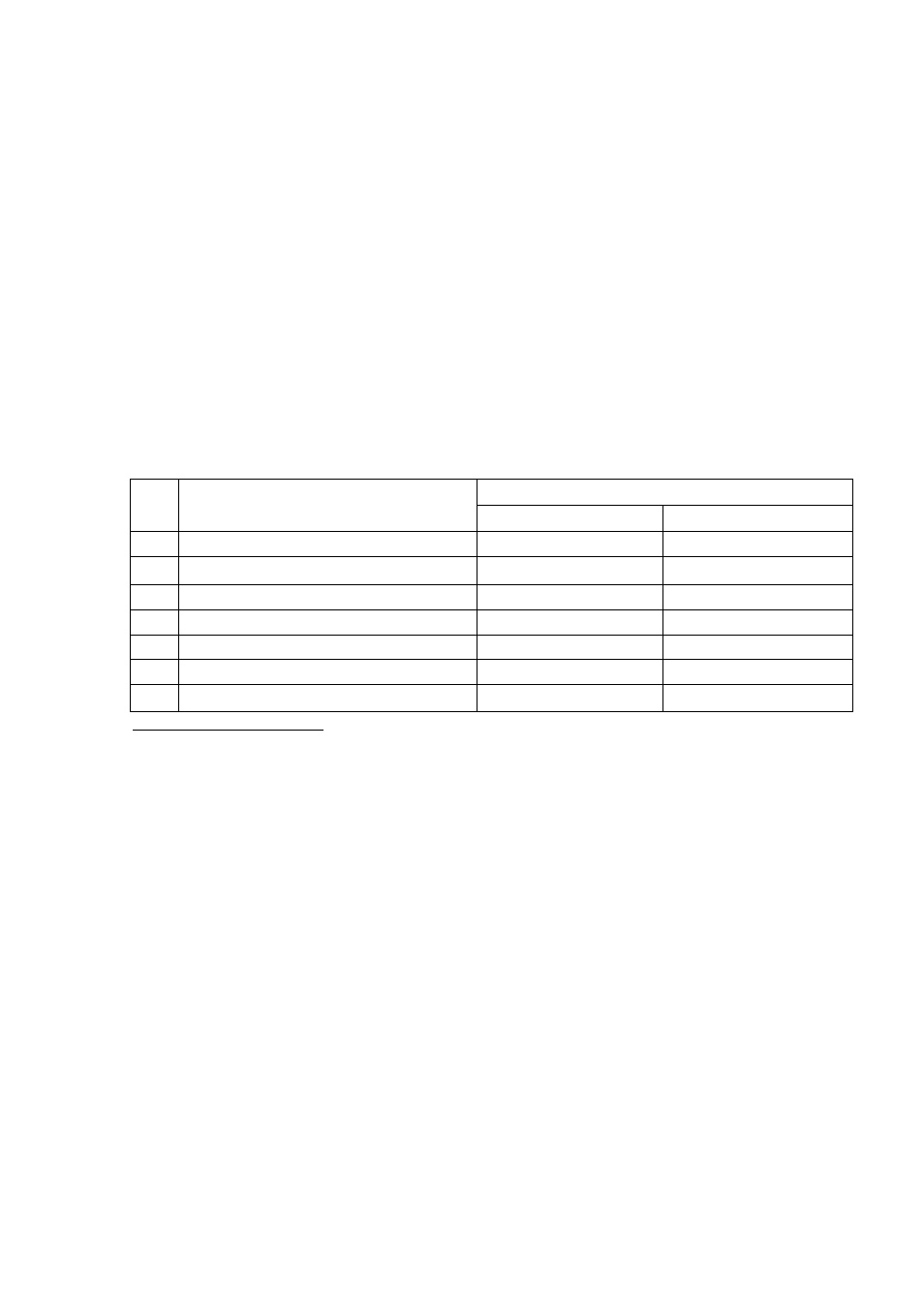

Bit

No.

Content

Selective Status

RESET

SET

1

[% + ] key PST/Tax Status

[ NON-TAXABLE j

TAXABLE

2

[%-] key PST/Tax Status

[ NON-TA^BLE j

TAXABLE

3

[DOLL DISC] key PST/Tax Status

[ NON-TAXABLE j

TAXABLE

4

[% + ] key GST Status

[ GST NON-tAXABLE j

GST TAXABLE

5

[%-] key GST Status

T GST NON-tA)^BLE j

GST TAXABLE

6

[DOLL DISC] key GST Status

T Gist NON-tA)WBLE 2

GST TAXABLE

i t

;

8

•

Supplementary Description:

Bit 1 & Bit 2; RESET status

SET status

Bit 3:

RESET status

SET Status .

The key always operates as Non-taxable.

The key becomes PST/Tax Taxable if they are used after

depressing the [ST] key. If the key is used after entering a

Department or PLU item, the key obeys the Department

PST/Tax status.

The key always operates as Non-taxable

The key always operates as Taxable.

To make status selections of Bits 4 to 6 here, Address 14 - Bit 1 “SET” status must be selected.

Bit 4 & Bit 5:

Bit 6:

RESET status

SET status .

RESET status

SET status .

The keys always operates as GST Non-taxable.

The key becomes GST Taxable if it is used after depressing

the [ST] key. If it is used after entering a Department or PLU

item, it obeys the Department GST status.

The key always operates as GST Non-taxable.

The key always operates as GST Taxable.

- Addresses 4, 5 are vacant -

- 8 8 -