Casio FX-9750GII User Manual

Page 210

7-15

• For more than one coupon period to redemption

S Annual Yield (YLD)

YLD is calculated using Newton’s Method.

Press

(BOND) from the Financial 2 screen to display the following input screen for Bond

calculation.

(E)(BOND)

d1 .......... purchase date (month, date, year)

d2 .......... redemption date (month, date, year)

RDV

...... redemption price per $100 of face value

CPN

...... coupon rate

PRC

...... price per $100 of face value

YLD

...... annual yield

After configuring the parameters, use one of the function menus noted below to perform the

corresponding calculation.

• {PRC} … {Calculate the bond’s price (PRC), accrued interest (INT), and cost of bond (CST)}

• {YLD} … {Calculate the yield to maturity}

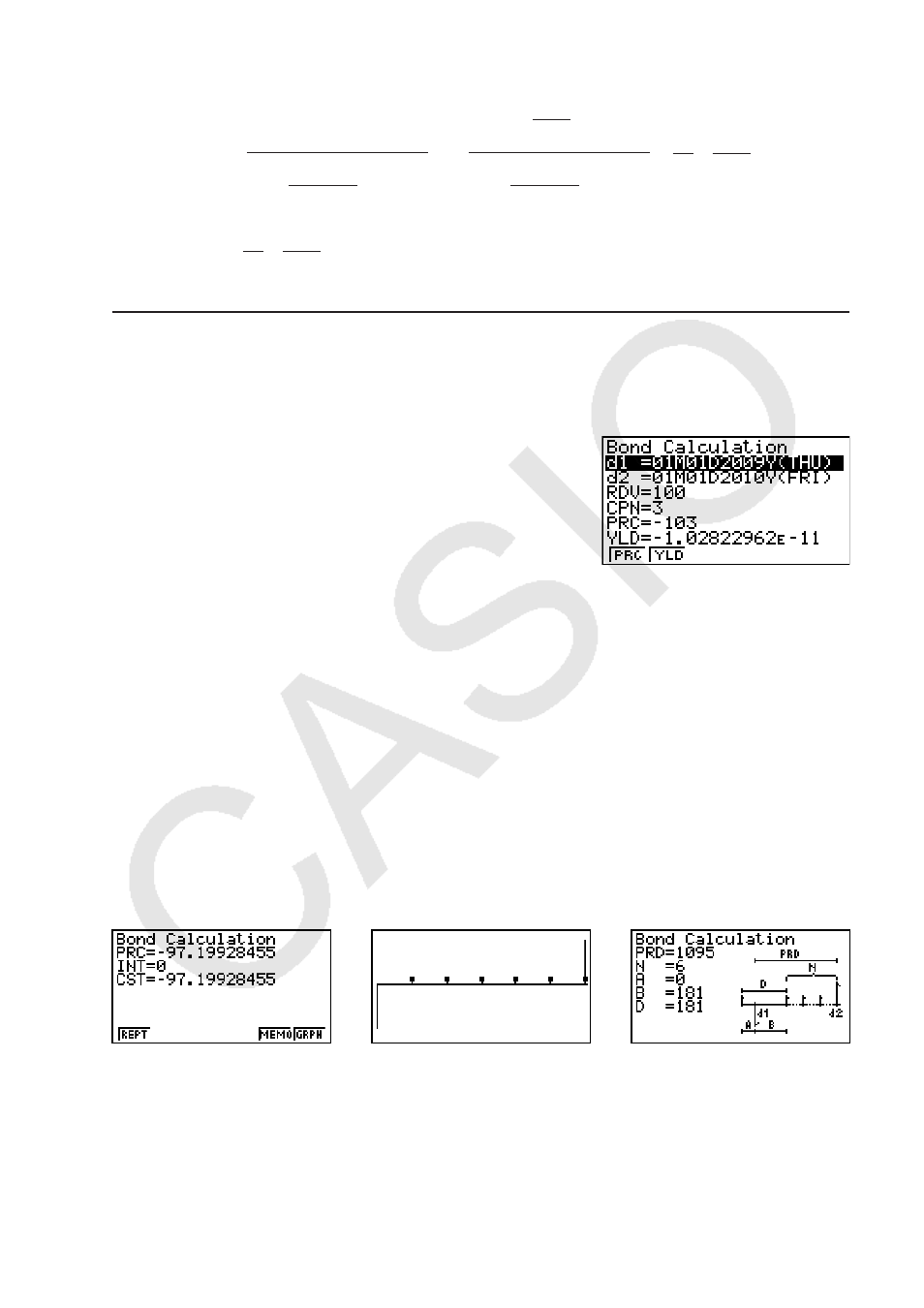

Calculation Result Output Examples

{PRC}

{PRC} − {GRPH}

{PRC} − {MEMO}

An error (Ma ERROR) occurs if parameters are not configured correctly.

Use the following function menu to maneuver between calculation result screens.

• {REPT} … {parameter input screen}

• {GRPH} … {draws graph}

• {MEMO} … {displays numbers of days used in calculations}

s

D

A

0

CPN

,17 –

&67 35&+ ,17

+

s

D

A

0

CPN

PRC =

–

–

RDV

(1+

)

0

YLD/

100

(1+

)

0

YLD/

100

0

CPN

3

N

k

=1

(N–1+B/D )

(k–1+B/D )

s

D

A

0

CPN

,17 –

&67 35&+ ,17

+

s

D

A

0

CPN

PRC =

–

–

RDV

(1+

)

0

YLD/

100

(1+

)

0

YLD/

100

0

CPN

3

N

k

=1

(N–1+B/D )

(k–1+B/D )