EdgeWare FastGraph Version 3 User Manual

Page 50

50

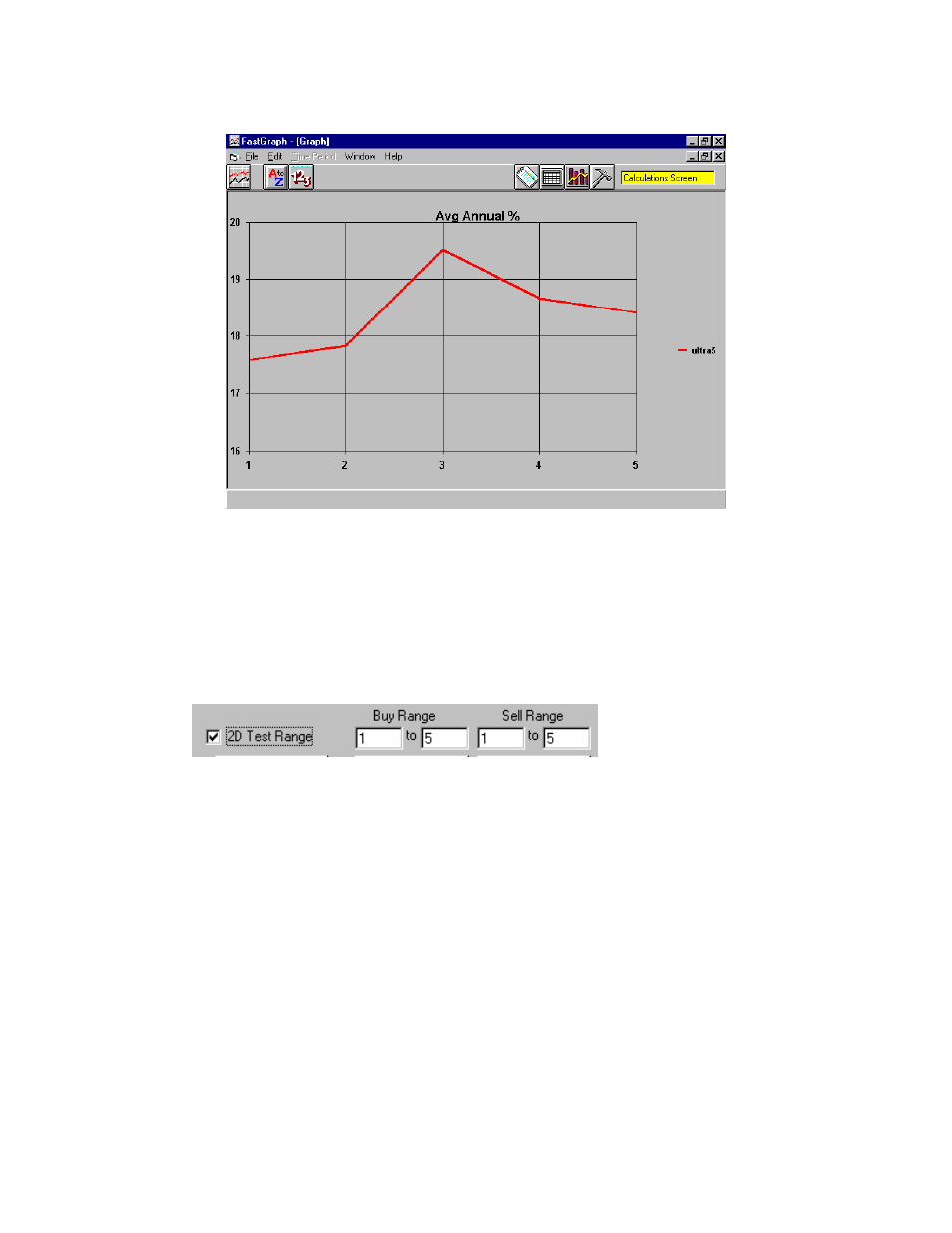

From this graph we see that we get the best annual return when we “Buy” with any three

of the four signals in the market. We would sell if there are less than three separate sig-

nals on a buy.

You can also examine MDD, UI, UPI and switches per year in the same manner if you

select a different Y Parameter.

To make a Two Dimensional analysis (2D) go back to the Calculations Screen. Now,

select:

Notice that we now have separate fields for Buy Range and Sell Range. FastGraph can

now use or have a different number of “buy” signals to go long the market than the num-

ber of “buy” signals to leave the market. For example, a strategy may enter the market

when four of five separate signals are on a buy but not sell until there are only two sig-

nals still on a buy. Note: FastGraph always looks at the direction of the last change in

signals. This will be explained in the following example.

Create a Sig Summary File by clicking the Calc Sig Sum button. When the calculation is

complete go the Main Screen and load the file. Since we have made a 2D run we can use

Contour as the Graph Type. Here are the results: