EdgeWare FastGraph Version 3 User Manual

Page 35

35

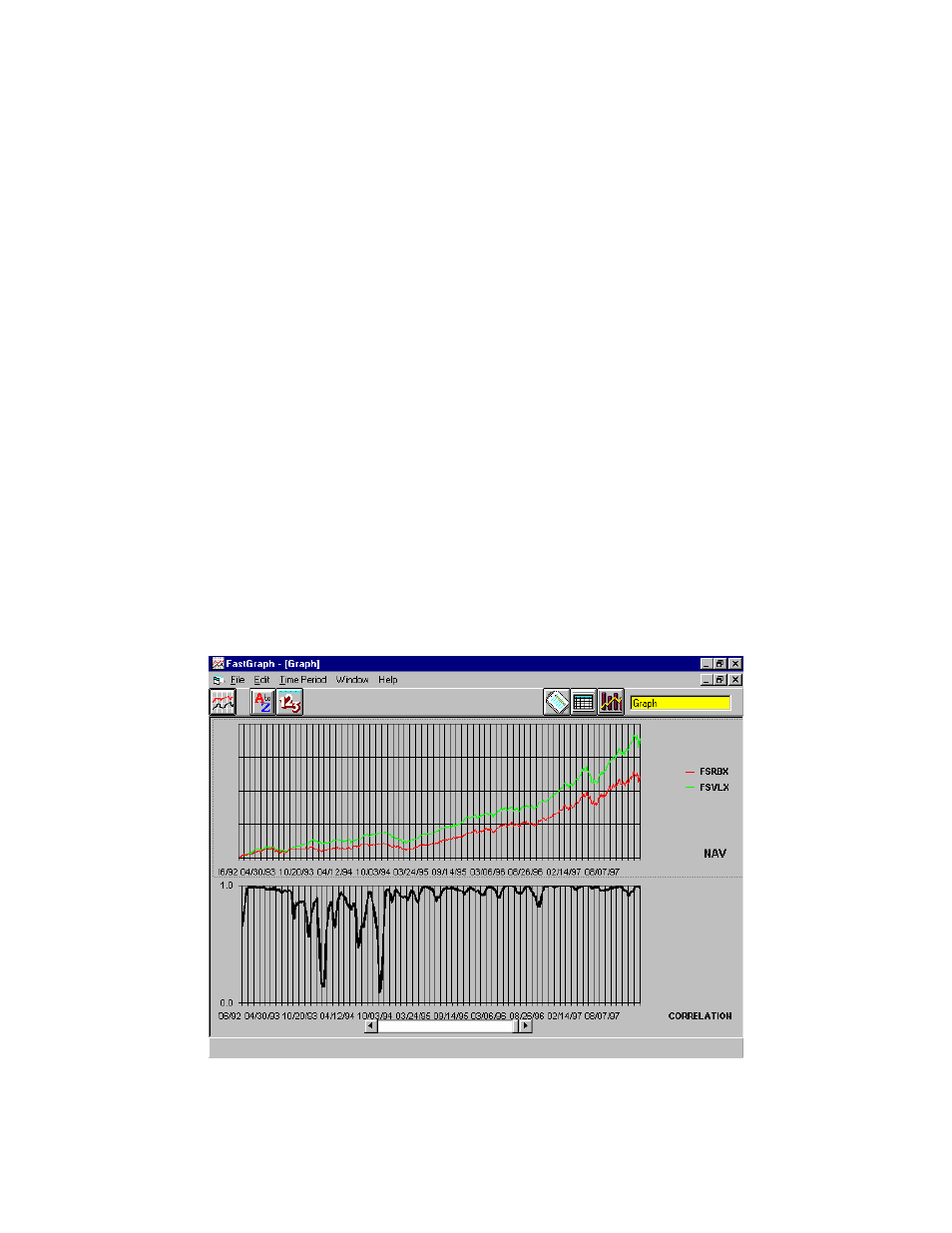

FastTrack Example #7 - Correlation Analysis

Correlation Analysis allows the comparison of funds and indexes to determine how

closely related they may be. FastGraph uses the common Pearson’s correlation to do this

analysis. Maximum correlation has a value of 1.0 and negative correlation has a value of

-1.0

If an investor is trying to be diversified by holding more than one fund it may be a good

idea to hold two funds that have a low correlation. Correlation can also be used for inter-

market analysis.

To display the correlation between two funds, first load a FastTrack family or individual

funds. Next, go to the Data screen and highlight the two funds you want to analyze (only

two funds at a time), go to the main FastGraph screen and select Show Correlation and

enter the number of trading days to use in the calculation, a minimum value of 50 trading

days is recommended. Finally, click the graph icon.

FastGraph shows the NAV of the funds (or indexes) in the upper part of the screen, the

lower part of the screen shows the correlation value.

The following chart shows the correlation is very high between Fidelity Select Regional

Banks and Select Home Finance, as would be expected. However, notice that there are

periods when the correlation does change dramatically. The chart is for a total of five

years.