Tax configuration, Cfgtax.500, Tax.500 – Liquid Controls DMS Office User Manual

Page 28: Taxcode.500

28

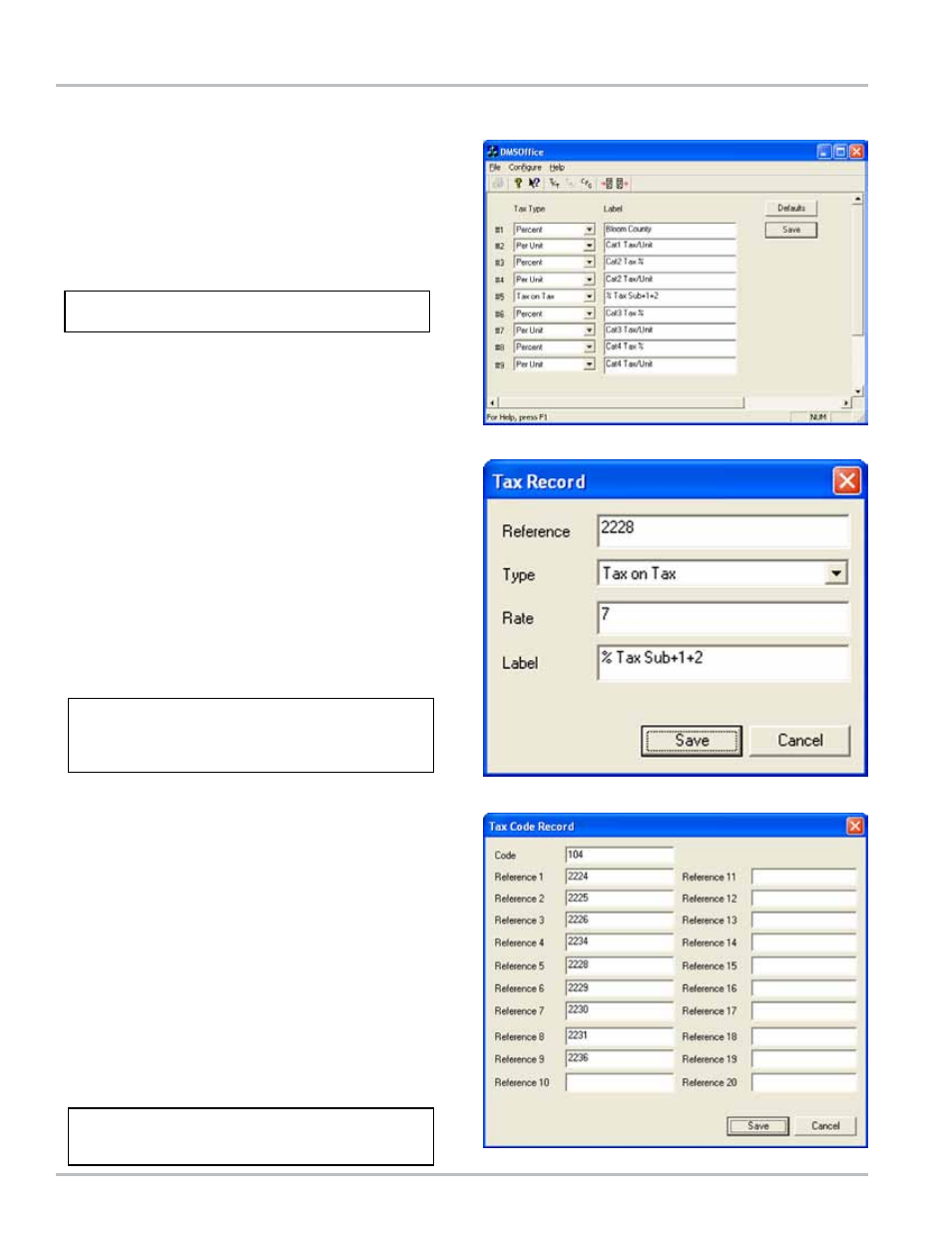

CFgTAX.500

The CfgTax.500 defines and labels the tax fields in

the DELLOAD.DAT records. There are 9 fields in the

CfgTax.500 file that correlate directly to the 9 fields

in DELLOAD.DAT fields (N16 to N24). The

Tax Type

(chosen from a drop down menu) fields and the

Label

(entered as an alpanumeric value) fields can be edited

to suit specific tax structures.

TAX.500

The Tax.500 contains the specifications of each

individual tax: the DELLOAD.DAT value (

Rate), the type

of tax designated by CfgTax.500 (

Type), and the label

designated by CfgTax.500 (

Label). LCLoad populates the

Tax.500 records and assigns them a reference number

which TaxCode.500 uses to set tax structures.

TAXCoDE.500

TaxCode.500 contains tax structures that are applied to

customers and their tanks in DMS delivery. These tax

structures are a sequential group of Tax Records. The

Tax Code for each customer tank is saved in Dispatch.500

along with other delivery and transaction data.

Each DELLOAD.DAT record determines if a tax is active for

that account. If the DELLOAD.dat field is a zero, no tax is

applied.

CfgTax.500

Tax.500

TaxCode.500

Tax Codes can be keyed in by the driver for new deliveries

and miscellaneous transactions.

Tax Configuration

CfgTax.500 must be completed before running LCLoad.

Type

p

ercenT

A percent tax on the subtotal (the

value of the volume delivered times

the price).

p

er

u

niT

A dollar amount charged per unit of

product delivered.

S

urcHarGe

A flat fee not based on volume or price.

T

ax

On

T

ax

A calculation on the running tax total.

Click the

Save button before leaving this window to save

changes.

To return fields to default values click the

Defaults button

and then click the

Save button