Tax configuration – Liquid Controls DMS Office User Manual

Page 27

27

Tax Configuration

TAX ConFIgURATIon

There are three tax-related .500 files: CfgTax.500, Tax.500

and TaxCode.500 These files label and structure tax

values from DELLOAD.DAT for use in DMS Delivery.

Any changes to these files must be made before running

LCLoad.

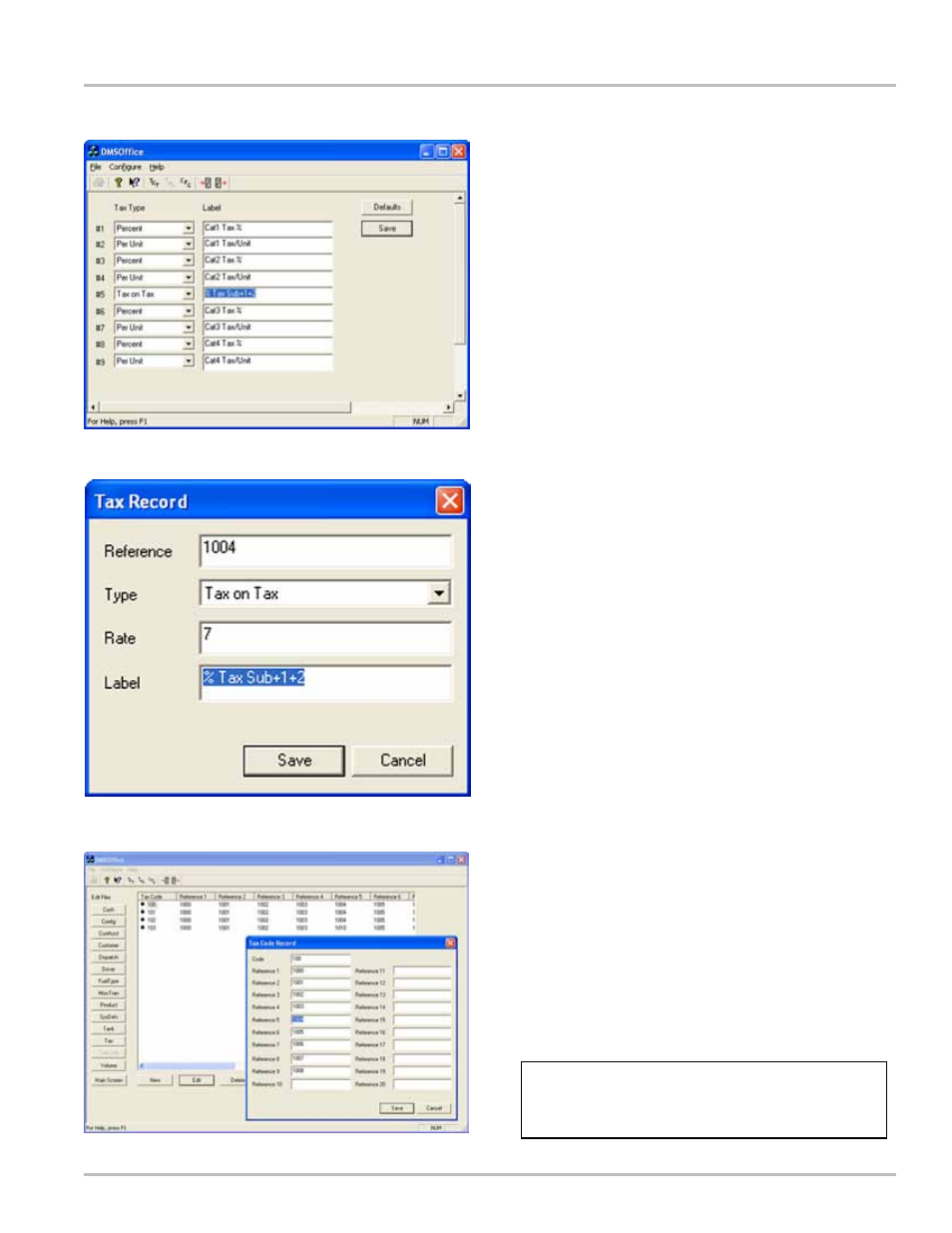

CfgTax.500

Tax.500

TaxCode.500

If CfgTax.500 is configured correctly, after running LCLoad,

Tax.500 and TaxCode.500 will not require editing unless 10

or more individual taxes are needed.

LCLoad and taxes

Tax.500 and TaxCode.500 are created by LCLoad using

data from CfgTax.500 and DELLOAD.DAT field values.

Tax.500 records specify single taxes, and TaxCode.500

records combine single taxes to form tax structures.

Following the highlighted fields in the examples to the

right:

1. The two fields of CfgTax.500

#5 (Tax Type and Label)

and Field 23 of DELLOAD.DAT (

Rate in Tax.500)

combine to create Tax Record #1004 (

Reference

#5 in TaxCode.500). LCLoad creates a Tax Record

for each unique combination of

Type, Rate, and

Label.

2. Tax

Reference #1004 is a single tax used in many

TaxCode.500’s tax structures.

3. A Tax Code is created for every unique combination

of Tax Records in DELLOAD.DAT.