Address: |t, Address, Address 1 – Toshiba TEC MA-305-100 User Manual

Page 97: Address 2, Non-print options 1), Optional functions 1)

Attention! The text in this document has been recognized automatically. To view the original document, you can use the "Original mode".

EOl-11068

Address: |T[

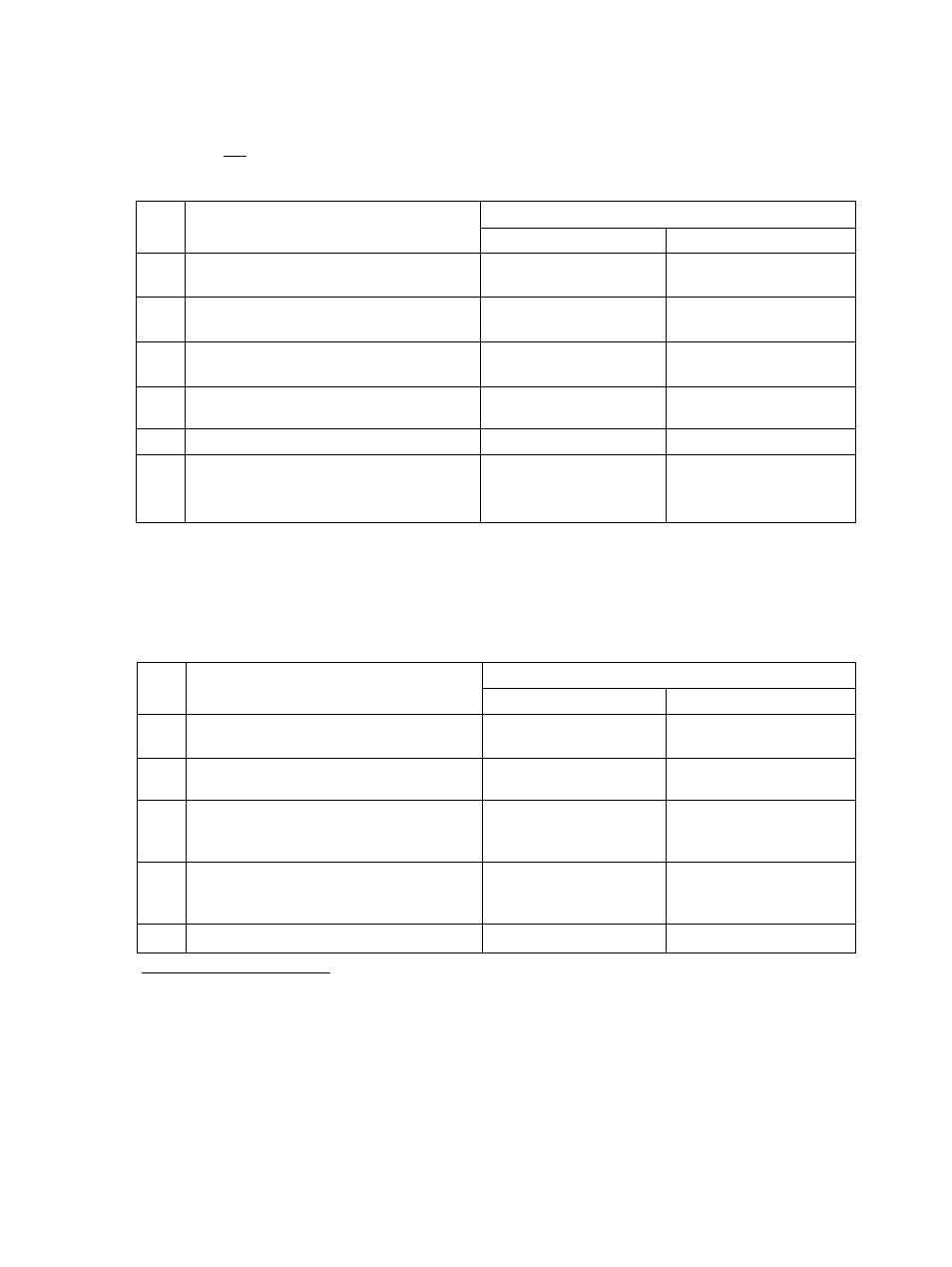

(Non-print Options 1)

Your Selection

►

¡Initial SET Bit Nos.;

►

□□□□□

Bit

No.

Content

Selective Status

RESET

SET

1

Time on Journal and Every Receipt in

REG, X, Z, SET modes

r PRINT 1

i__________ . --------- . -J

NON-PRINT

2

Purchased Item Count on Sale Receipts

in REG mode

r NON-PRINT 1

3

Manual Subtotal on Sale Receipts in

REG mode

r PRINT i

NON-PRINT

4

GT (Grand Total) on Financial Reports

(in X and Z modes)

r PRINT 1

NON-PRINT

iiB

6

"r, e 'I

Sum of Negative Department Data on

Financial Reports (in X and Z-.modes) -

.

..............

.

...............................

.

....

.

..............

.

! NON-PRINT i

..........................................'pr

Address:

(Optional Functions 1)

¡Initial SET Bit Nos. ¡'

^

Your Selection ---------------^

□□□□

0

Bit

No.

Content

Selective Status

RESET

SET

1

Fraction Rounding Process on Quantity

Extension or % Calculations

I Round OFF I

ROUND UP

2

Fraction Rounding Process on Quantity

Extension or % Calculations

! Follow Bit 1 status, j

ROUND DOWN

3

Credit Balance (over-subtraction of the

sale by [DOLL DISC] or [VOID] keys)

in REG mode

1

PROHIBITED

1

1 1

ALLOWED

4

Obtaining Taxable Total (sale total

including taxes) by [TXBL TL] or [ST]

key before finalizing each sale

1 NOT COMPULSORY 1

i I

COMPULSORY

i

SuDDlementarv Description:

Bit 1 & Bit 2:

If both RESET, ROUND OFF status is obtained.

If both SET, Bit 2 status prevails, i.e., ROUND DOWN.

(Fraction Rounding Process on tax/PST calculations is fixed to ROUND UP, out

of the application of the process selected here. As for GST, see Address 14 -

Bits 2 & 3)

Bit 3:

The [RTN MDSE] key is operable to turn the sale into negative regardless of this bit

status selection.

- 95 -