Sharp EL-9900 User Manual

Page 196

186

Chapter 11: Financial Features

17. Press

E.

Usually C/Y (cumulative

interest per year) is the

same value as P/Y. If not,

enter the value instead.

18. Press

{ 3 times to move the cursor to PMT (payment

amount).

19. Press

@ h.

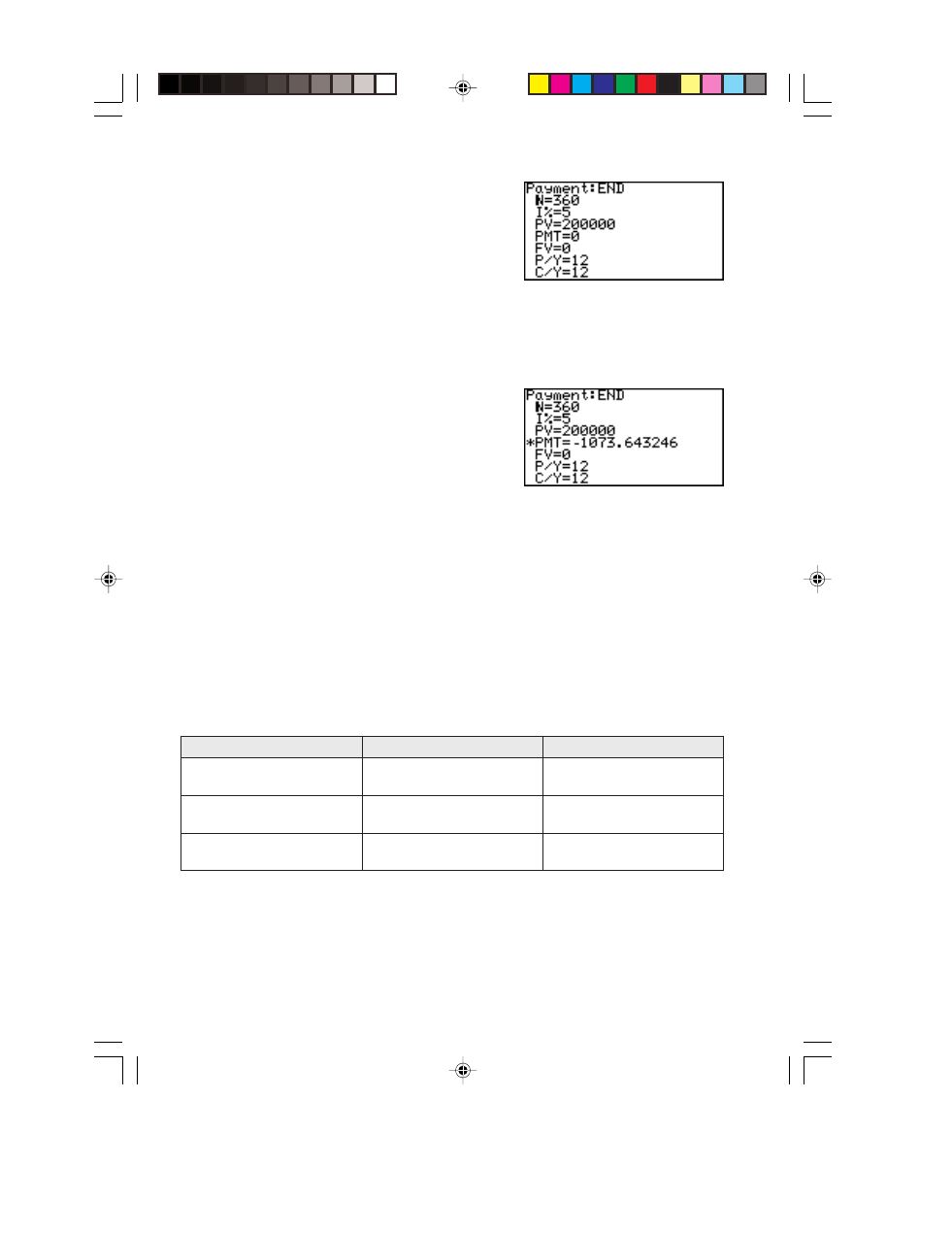

The result will appear as follows.

20. Payment amount per month

PMT =

-

1073.643246

(Negative value indicates

payment.)

The numerical value input

format and display format in

the FINANCE mode comply to that of SETUP.

The above answer is given when the FSE setting in SET UP

menu is set to FloatPT. If you wish to display 2 digit decimal

point format, set TAB to 2 and FSE to FIX.

Answer:

You have to pay $1,073.64 per month for 30 years.

Simple interest and compound interest

There are two ways to calculate interest: simple and compound. In the FINANCE

mode, the calculator can execute compound interest calculations.

Example of depositing $10,000 in a bank for 3 years at an annual interest rate of 3%

Period

Simple interest

Compound interest

First year

Receive $10,000 x 0.03 =

Receive $10,000 x 0.03 =

$300

$300

Second year

Receive $300 (constantly)

Receive $10,300 x 0.03 =

$309

Third year

Receive $300 (constantly)

Receive $10,609 x 0.03 =

$318.27

With compound interest, the amount in the bank is increased by receiving interest on

the interest gained during each calculated period.

183_193_chapter11_en

02.8.23, 2:19 PM

186